Although the major benefit of debt financing is easy to observethe tax shield-many of the indirect costs of debt financing can be quite subtle and difficult to observe. Describe some of these costs. Select from the drop-down menus.) O A. Overinvestment: Highly leveraged firms run the risk of bankruptcy and so cannot write long tem employment contracts and offer job security. O B. Overinvestment: Not investing in positive NPV projects OC. Overinvestment: Investing in negative NPV projects. O D. Overinvestment: Paying out dividends instead of investing in positive NPV projects. Select from the drop-down menus.) O A. Underinvestment: Not investing in positive NPV projects O B. Underinvestment: Paying out dividends instead f investing positive NPV projects. OC. Underinvestment: Highly leveraged firms run the risk of bankruptcy and so cannot write long term employment contracts and offer job security. O D. Underinvestment: Investing in negative NPV projects. Select from the drop-down menus.) O A. Cashing out: Highly leveraged firms run the risk of bankruptcy and so cannot write long tem employment contracts and offer job security. OR Cochinn r

Although the major benefit of debt financing is easy to observethe tax shield-many of the indirect costs of debt financing can be quite subtle and difficult to observe. Describe some of these costs. Select from the drop-down menus.) O A. Overinvestment: Highly leveraged firms run the risk of bankruptcy and so cannot write long tem employment contracts and offer job security. O B. Overinvestment: Not investing in positive NPV projects OC. Overinvestment: Investing in negative NPV projects. O D. Overinvestment: Paying out dividends instead of investing in positive NPV projects. Select from the drop-down menus.) O A. Underinvestment: Not investing in positive NPV projects O B. Underinvestment: Paying out dividends instead f investing positive NPV projects. OC. Underinvestment: Highly leveraged firms run the risk of bankruptcy and so cannot write long term employment contracts and offer job security. O D. Underinvestment: Investing in negative NPV projects. Select from the drop-down menus.) O A. Cashing out: Highly leveraged firms run the risk of bankruptcy and so cannot write long tem employment contracts and offer job security. OR Cochinn r

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 3MC: David Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing....

Related questions

Question

2

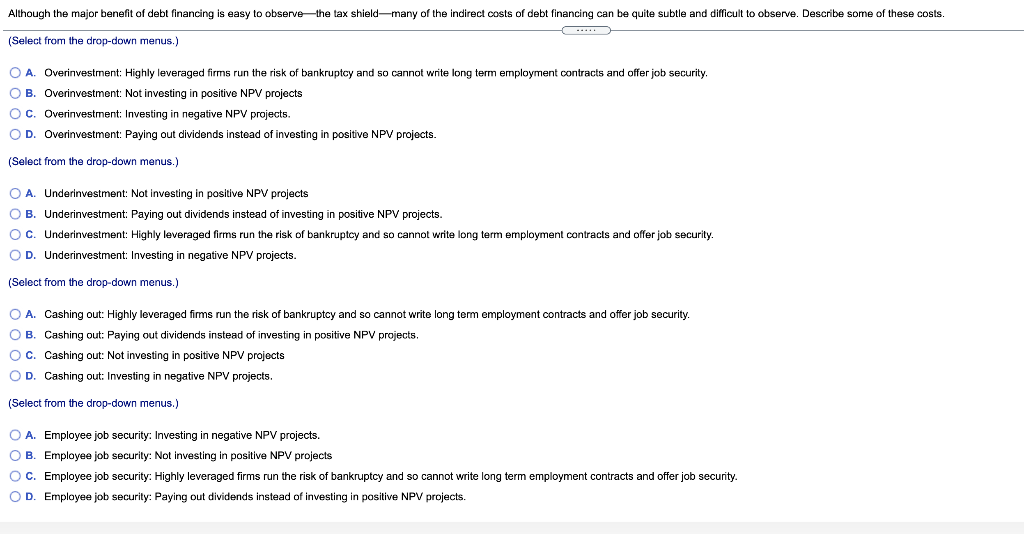

Transcribed Image Text:Although the major benefit of debt financing is easy to observe-the tax shield-many of the indirect costs of debt financing can be quite subtle and difficult to observe. Describe some of these costs.

...

(Select from the drop-down menus.)

O A. Overinvestment: Highly leveraged firms run the risk of bankruptcy and so cannot write long term employment contracts and offer job security.

O B. Overinvestment: Not investing in positive NPV projects

Oc. Overinvestment: Investing in negative NPV projects.

O D. Overinvestment: Paying out dividends instead of investing in positive NPV projects.

(Select from the drop-down menus.)

O A. Underinvestment: Not investing in positive NPV projects

O B. Underinvestment: Paying out dividends instead of investing in positive NPV projects.

Oc. Underinvestment: Highly leveraged firms run the risk of bankruptcy and so cannot write long term employment contracts and offer job security.

OD.

Underinvestment: Investing in negative NPV projects.

(Select from the drop-down menus.)

O A. Cashing out: Highly leveraged firms run the risk of bankruptcy and so cannot write long term employment contracts and offer job security.

O B. Cashing out: Paying out dividends instead of investing in positive NPV projects.

Oc. Cashing out: Not investing in positive NPV projects

O D. Cashing out: Investing in negative NPV projects.

(Select from the drop-down menus.)

O A. Employee job security: Investing in negative NPV projects.

O B. Employee job security: Not investing in positive NPV projects

O C. Employee job security: Highly leveraged firms run the risk of bankruptcy and so cannot write long term employment contracts and offer job security.

O D. Employee job security: Paying out dividends instead of investing in positive NPV projects.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage