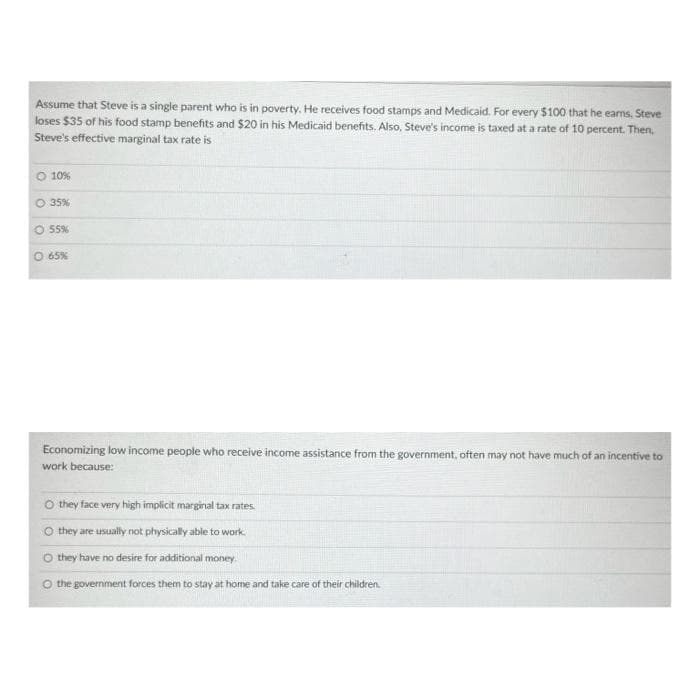

Assume that Steve is a single parent who is in poverty. He receives food stamps and Medicaid. For every $100 that he earns, Steve loses $35 of his food stamp benefits and $20 in his Medicaid benefits. Also, Steve's income is taxed at a rate of 10 percent. Then, Steve's effective marginal tax rate is O 10% O 35% O 55% O 65%

Q: Excise taxes are levied on a) individual income. O b) specific goods or commodities. c) corporate…

A: The answer is as follows:-

Q:

A: The budget constraint of the individual can be written as follows:

Q: c. Does the tax-spending system in the United States redistribute resources from higher-income…

A: A progressive tax refers to a tax in which the tax rate increases as the taxable amount rises, thus…

Q: Suppose the tax rate on the first $10,000 income is 0; 10 percent on the next $20,000; 20 percent on…

A: Tax rate:For first 10,000=0%10000-30000=10%30000-50000=20%50000-80000=30%80000 and above=40%

Q: P P=7 lo=7 On the following diagram, if there is a $3 tax imposed on buyers, what is the tax burden…

A: In the given figure, the initial equilibrium is achieved at price of $7 and quantity of 7 units.

Q: Co=100 lo=90 Go=330 To=240 b=0,75 t=0,2 . What is the equilibrium level of income ? . What is the…

A: The equilibrium level of income is the point at which a business is able to sell all of the goods it…

Q: 2. Given: C = 250 + 0.8 Y I= 150 G = 300 TR = 100 (3+3+3+4+3+3+4=23) NX = 100 t =0.25 i) Find the…

A: Hi, Thank you for the question. According to our policy, we can only answer up to 3 sub-parts per…

Q: Federal payroll taxes to fund the EI program are levied at a combined rate of 1.58 percent up to an…

A: There are usually three kinds of taxes that are levied by the state Progressive tax - This is the…

Q: 4. Suppose that there are two households in the economy, A and B, that they face the same wage rate…

A: Proportional Tax is defined as an income tax system, also known as a flat tax system that levies the…

Q: Suppose in Fiscalville there is a O percent tax on the first $10,000 of income, but there is a 20…

A: a. The first $10,000 is tax-free in the economy and the next $10,000 has a 20 percent tax, the next…

Q: Generational Imbalance is the division of between the current and future generations, assuming that…

A: When talking about generational imbalances, it is the economic concept to describe a situation when…

Q: A household with income that is two-thirds of the poverty threshold has ratio of income to poverty…

A: I=2/3 of Poverty

Q: three reasons why tax expenditures are politically favorable over cash government spending

A: Tax expenditures are the credits or refunds in tax given to the people in some specific areas.

Q: Archanges sared 1. Suppose your total taxable income this year is $75,000. You are taxed at a rate…

A: Taxes are the compulsory payments levied on individuals and organizations by the government to…

Q: 4.7) Consider a national income tax that is structured as follows: Income Marginal tax rate…

A:

Q: Kelly’s taxable income is $110,000. Approximately what percent of her taxable income is her tax?…

A: Kelly's Taxable Income is $110,000 Kelly's Taxable Income is between 43,650 or 112,650 where tax is…

Q: How much federal income tax will you owe? Instructions: Enter your answer rounded to 2 decimal…

A: Answer e) Federal Tax owed= 1st slab tax rate X $19400 + 2nd slab rate X excess of taxable income…

Q: Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on…

A:

Q: (Last Word) The combined cost of Social Security and Medicare programs was what percent of U.S. GDP…

A: The year 2007-2008 would be the year of great economic recession which had been caused by a bubble…

Q: Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on…

A: From $0 to $10,000 the tax rate is 0%. So, the tax payment can be calculated as follows: Thus, the…

Q: Below is a tax table. Assume I earn $150 a year. My tax bracket is ;my marginal tax rate is my…

A: Meaning of Progressive Tax: The term progressive tax refers to the situation under which tax rate…

Q: he following table shows tax payments made for various incomes. According to the information in the…

A: The following problem has been answered as follows:

Q: Barry can work 3120 hours in a (non-leap) year. He has the opportunity to work for $20 per hour.…

A: Since the question you have posted consists of multiple parts, we will answer the first three parts…

Q: Kathy works full time during the day as an economist and faces a 90 percent marginal tax rate. If…

A: Given, Marginal tax rate = 90% Local business salary = 10,000

Q: Suppose you are a typical person in the U.S. economy.You pay 4 percent of your income in a state…

A: State income tax amount can be calculated as follows. Thus, state income tax will be $1,200.

Q: Suppose George made $20,000 last year and that he lives in the country of Harmony. The way Harmony…

A: Each citizen must pay 10% in taxes on their first $10000 in earnings and then 50 % in taxes on…

Q: Suppose in Fiscalville there is a O percent tax on the first $10,000 of income, but there is a 20…

A: Given information:

Q: Suppose in Fiscalville there is a 5 percent tax on the first $10,000 of income, but there is a 15…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts…

Q: Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on…

A: The above country is following a progressive tax structure.

Q: Suppose the wage is 80 per hour and that the consumer has 100 hours H to work with. Suppose that the…

A: Wage (w) = 80 per hour of workTotal hours available (H) = 100l is the leisure (*l is small L and not…

Q: 5. LO 4 Suppose, as in the federal income tax code for the United States, that the representative…

A: Case 1In the first case when consumers do not pay taxes earlier, a reduction in tax deduction can…

Q: Identify whether each of the following taxes is progressive or regressive and indicate in each case…

A: 1. The Federal Personal Income tax is” progressive, and the incident is on the taxpayer” As income…

Q: Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on…

A: 0−10,000 = No tax 10,000 − 20,000 = 20% 20,000 − 30,000 = 30 % > 30,000 = 40%

Q: Suppose in Fiscalville there is a 5 percent tax on the first $10,000 of income, but there is a 15…

A: The average tax rate is the total amount of tax divided by total income.

Q: Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on…

A: Tax is a compulsory payment that is imposed by the government either directly or indirectly on the…

Q: If the poverty guideline for a family of four is $25,750, what is the income deficit if household…

A: Poverty guideline for a family of four = $25,750 Household's income = $16,500

Q: In Taxland, the first $10,000 earned per year is exempt from taxation. Between $10,000.01 and…

A: Given:- First $10,000- ExemptB/W $10,000.01 and $30,000- 25% tax rateB/W $30,000.01 and $50,000- 30%…

Q: 7). Spending promises made by govemments that are effectively a debt despite the fact that they are…

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the…

Q: Suppose you are a typical person in the U.S. economy. You pay 4 percent of yourincome in a state…

A: Taxes are referred to as mandatory contributions which are levied on individuals or businesses by…

Q: 8. LO 4 Show that the consumer is better off with a lump-sum tax rather than a proportional tax on…

A: To show that the consumer is better off with a lump-sum tax rather than a proportional tax on wage…

Q: The government will have flexibility in implementing countercyclical fiscal policy when the…

A: Countercyclical fiscal policy refers to the one that works in the opposite direction to the business…

Q: Answer questions 17 and 18 based on the following information: As you know, Flabovia has adopted a…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: The country of Aquilonia has a tax system identical to that of Canada. Suppose an Aquilonian bought…

A: Inflation: It the measurement of the rise in the general price level of goods and services during a…

Q: The Food Stamp Program (FSP) was officially established by the 1964 Food Stamp Act to provide…

A: Jessica’s income per month is given to be $250.Also, prices of food and non-food consumption is $1…

Q: 4.7) Consider a national income tax that is structured as follows: Income Marginal tax rate…

A: d.The tax is the unilateral payment that the individuals should make to the government for various…

Q: Suppose in Fiscalville there is a 5 percent tax on the first $10,000 of income, but there is a 15…

A:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Wealth, earnings, and disposable income are just three of several ways of looking at inequality. Imagine a household that earns $80,000 per year from labor. In that year, it also receives an income of $3,000 from investments, pays $12,000 in tax, and receives $7,000 in transfers from the state. Which of the following is its market income and its disposable income? O $83,000; $71,000. O $83,000 $78,000. O $80,000; $68,000. O $80,000; $75,000. JJana has the opportunity to buy the boat of her dreams but needs to determine the best way to fund the purchase. The cost of the boat is $22,000, and she’s considering taking on a second job at which she can earn this amount or selling some investments to generate the cash. However, she realizes that she will also have to pay taxes on any amount she receives. If Jana is in the 35 percent marginal tax bracket and earns $22,000 from a second job, by how much will her end-of-year tax liability increase? What if she elects to sell some investments that she’s held for several years at a gain of $22,000? How would your answer change if she had held the investments for just 6 months?Suppose the wage is 80 per hour and that the consumer has 100 hours H to work with. Suppose that the MRS is given by c/(l−10) . What will the consumer’s choices of c and l be. Repeat with an upper bound of 10 hours. Repeat both parts with a 10% tax rate for all income levels. Suppose that the tax rate has two brackets so that income from hours above (1/5)H is taxed at 20 percent. How does the solution change? Suppose that consumers must instead pay a lump sum tax that raises the same tax revenues as the one listed above. How will outcomes change?

- Suppose George made $20,000 last year and that he lives in the country of Harmony. The way Harmony levies income taxes, each citizen must pay 10 percent in taxes on their first $10,000 in earnings and then 50 percent in taxes on anything else they might earn. So given that George earned $20,000 last year, his marginal tax rate on the last dollar he earns will be __________ and his average tax rate for his entire income will be _________________. a. 50 percent; 50 percent. b. 50 percent; less than 50 percent. c. 10 percent; 50 percent. d. 10 percent; less than 50 percent.Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on earnings between $10,000 and $20,000 and a 30 percent tax on income between $20,000 and $30,000. Any income above $30,000 is taxed at 40 percent. If your income is $50,000, how much will you pay in taxes? Determine your marginal and average tax rates. Is this a progressive tax?Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on earnings between $10,001 and $20,000 and a 30 percent tax on income between $20,001 and $30,000. Any income above $30,000 is taxed at 40 percent. If your income is $50,000, how much will you pay in taxes? Determine your marginal and average tax rates. Is this a progressive tax? Explain.

- Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on earnings between $10,001 and $20,000 and a 30 percent tax on income between $20,001 and $30,000. Any income above $30,000 is taxed at 40 percent. If your income is $50,000, how much will you pay in taxes4. Suppose that there are two households in the economy, A and B, that they face the same wage rate w, and that the government initially uses a proportional income tax according to which each household must pay a fraction t of its labor income as income tax. Assume that given this tax scheme household A chooses to work full time while household B chooses to work part time. Now suppose that the government is interesting in studying the impact of changing the tax system to a progressive tax system where the household work- ing full time would pay a tax rate th >t while the household working part time would pay a rate ti < t. (a) Draw a graph of the impact of this change on the budget constraint that households face with the two different tax systems. (b) What would such a change in the tax system imply for the optimal choice of the two households?Song earns $148,000 taxable income as an interior designer and is taxed at an average rate of 20 percent (i.e., $29,600 of tax). Answer the questions below assuming that Congress increases the income tax rate such that Song's average tax rate increases from 20 percent to 25 percent. Required: What will happen to the government's tax revenues if Song chooses to spend more time pursuing her other passions besides work in response to the tax rate change and therefore earns only $111,000 in taxable income? What is the term that describes this type of reaction to a tax rate increase? What types of taxpayers are likely to respond in this manner?

- A5. Suppose that the initial rural distribution of income is (1, 2, 3, 4) while the initial urban distribution is (3, 4). The poverty line is 2, so the overall poverty rate (headcount index) is 1/3. Now imagine that all of the rural poor move to urban areas and each of them gains 20% in real income. Verify that the overall poverty rate falls to 1/6, yet the urban poverty rate rises from zero to 1/4.Thelma's current income is $100,000 and she currently pays $30,000 in income tax.w Any income she earns above $100,000 is taxed at 40 percent. Which following correctly calculates her tax burden? the her average tax rate is 30 percent her marginal tax rate is 40 percent her average tax rate is 40 percent her marginal tax rate is 30 percent.d. Holding Donald's income and Pd constant at $120 and $1 respectively, what is Donald's demand curve for carrots? e. Suppose that a tax of $1 per unit is levied on donuts. How will this alter Donald's utility maximizing market basket of goods? f. Suppose that, instead of the per unit tax in (e), a lump sum tax of the same dollar amount is levied on Donald. What is Donald's utility maximizing market basket? g. The taxes in (e) and (f) both collect exactly the same amount of revenue for the government, which of the two taxes would Donald prefer? Show your answer numerically and explain why Donald prefers the per unit tax over the lump sum tax, or vice versa, or why he is indifferent between the two taxes.