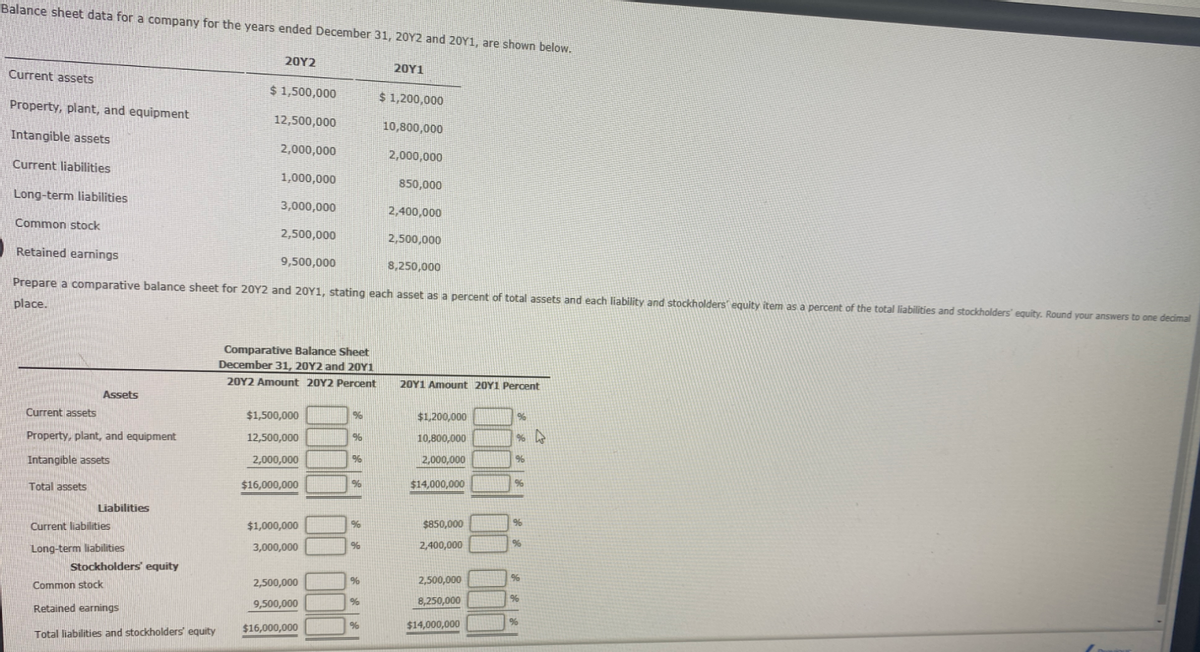

Balance sheet data for a company for the years ended December 31, 20Y2 and 20Y1, are shown below. 20Υ2 20Υ1 Current assets $ 1,500,000 $ 1,200,000 Property, plant, and equipment 12,500,000 10,800,000 Intangible assets 2,000,000 2,000,000 Current liabilities 1,000,000 850,000 Long-term liabilities 3,000,000 2,400,000 Common stock 2,500,000 2,500,000 Retained earnings 9,500,000 8,250,000 Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. Round your answers to one decimal place. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 Amount 20Y2 Percent 20Y1 Amount 20Y1 Percent Assets Current assets $1,500,000 $1,200,000 Property, plant, and equipment 12,500,000 10,800,000 Intangible assets 2,000,000 2,000,000 Total assets $16,000,000 $14,000,000 Liabilities Current liabilities $1,000,000 $850,000 Long-term liabilities 3,000,000 2,400,000 Stockholders' equity Common stock 2,500,000 2,500,000 9,500,000 8,250,000 Retained earnings $16,000,000 % $14,000,000 Total liabilities and stockholders' equity

Balance sheet data for a company for the years ended December 31, 20Y2 and 20Y1, are shown below. 20Υ2 20Υ1 Current assets $ 1,500,000 $ 1,200,000 Property, plant, and equipment 12,500,000 10,800,000 Intangible assets 2,000,000 2,000,000 Current liabilities 1,000,000 850,000 Long-term liabilities 3,000,000 2,400,000 Common stock 2,500,000 2,500,000 Retained earnings 9,500,000 8,250,000 Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. Round your answers to one decimal place. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 Amount 20Y2 Percent 20Y1 Amount 20Y1 Percent Assets Current assets $1,500,000 $1,200,000 Property, plant, and equipment 12,500,000 10,800,000 Intangible assets 2,000,000 2,000,000 Total assets $16,000,000 $14,000,000 Liabilities Current liabilities $1,000,000 $850,000 Long-term liabilities 3,000,000 2,400,000 Stockholders' equity Common stock 2,500,000 2,500,000 9,500,000 8,250,000 Retained earnings $16,000,000 % $14,000,000 Total liabilities and stockholders' equity

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 19P

Related questions

Question

Transcribed Image Text:Balance sheet data for a company for the years ended December 31, 20Y2 and 20Y1, are shown below.

20Υ2

20Υ1

Current assets

$ 1,500,000

$ 1,200,000

Property, plant, and equipment

12,500,000

10,800,000

Intangible assets

2,000,000

2,000,000

Current liabilities

1,000,000

850,000

Long-term liabilities

3,000,000

2,400,000

Common stock

2,500,000

2,500,000

Retained earnings

9,500,000

8,250,000

Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. Round your answers to one decimal

place.

Comparative Balance Sheet

December 31, 20Y2 and 20Y1

20Y2 Amount 20Y2 Percent

20Y1 Amount 20Y1 Percent

Assets

Current assets

$1,500,000

$1,200,000

Property, plant, and equipment

12,500,000

10,800,000

Intangible assets

2,000,000

2,000,000

Total assets

$16,000,000

$14,000,000

Liabilities

Current liabilities

$1,000,000

$850,000

Long-term liabilities

3,000,000

2,400,000

Stockholders' equity

Common stock

2,500,000

2,500,000

9,500,000

8,250,000

Retained earnings

$16,000,000

%

$14,000,000

Total liabilities and stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning