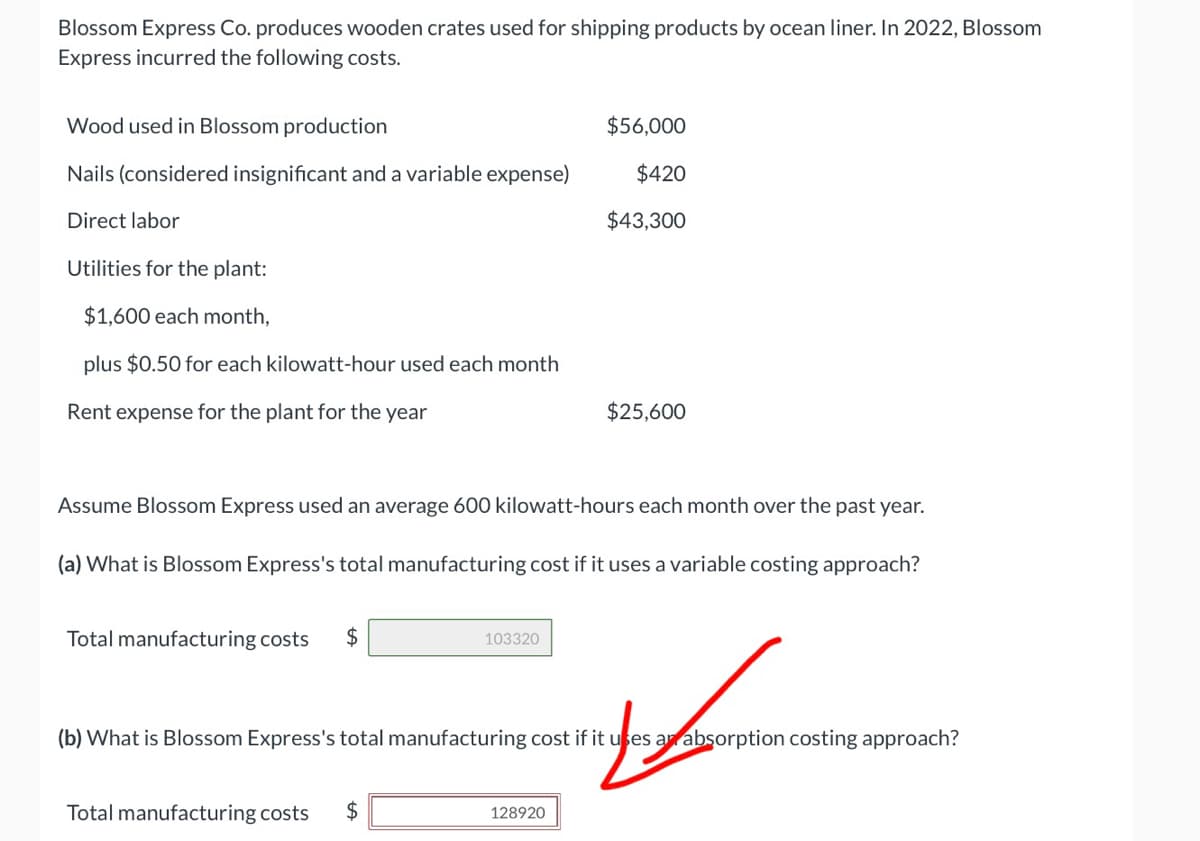

Blossom Express Co. produces wooden crates used for shipping products by ocean liner. In 2022, Blossom Express incurred the following costs. Wood used in Blossom production $56,000 Nails (considered insignificant and a variable expense) $420 Direct labor $43,300 Utilities for the plant: $1,600 each month, plus $0.50 for each kilowatt-hour used each month Rent expense for the plant for the year $25,600 Assume Blossom Express used an average 600 kilowatt-hours each month over the past year. (a) What is Blossom Express's total manufacturing cost if it uses a variable costing approach? Total manufacturing costs 2$ 103320 (b) What is Blossom Express's total manufacturing cost if it uses ar absorption costing approach? Total manufacturing costs 2$ 128920

Blossom Express Co. produces wooden crates used for shipping products by ocean liner. In 2022, Blossom Express incurred the following costs. Wood used in Blossom production $56,000 Nails (considered insignificant and a variable expense) $420 Direct labor $43,300 Utilities for the plant: $1,600 each month, plus $0.50 for each kilowatt-hour used each month Rent expense for the plant for the year $25,600 Assume Blossom Express used an average 600 kilowatt-hours each month over the past year. (a) What is Blossom Express's total manufacturing cost if it uses a variable costing approach? Total manufacturing costs 2$ 103320 (b) What is Blossom Express's total manufacturing cost if it uses ar absorption costing approach? Total manufacturing costs 2$ 128920

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 6PB: Regal Executive, Inc., produces executive motor coaches and currently manufactures the cent awnings...

Related questions

Question

Transcribed Image Text:Blossom Express Co. produces wooden crates used for shipping products by ocean liner. In 2022, Blossom

Express incurred the following costs.

Wood used in Blossom production

$56,000

Nails (considered insignificant and a variable expense)

$420

Direct labor

$43,300

Utilities for the plant:

$1,600 each month,

plus $0.50 for each kilowatt-hour used each month

Rent expense for the plant for the year

$25,600

Assume Blossom Express used an average 600 kilowatt-hours each month over the past year.

(a) What is Blossom Express's total manufacturing cost if it uses a variable costing approach?

Total manufacturing costs

2$

103320

(b) What is Blossom Express's total manufacturing cost if it uses ar absorption costing approach?

Total manufacturing costs

2$

128920

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning