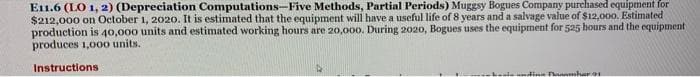

Calculate the depreciation expense for the entire life of the asset assuming the asset was purchased on October 1 2020 using the SUM OF THE YEARS DIGITS METHOD of depreciation.

Q: Alles Company uses a job costing system that applies factory overhead on the basis of direct labor…

A: Predetermined overhead rate = Overhead applied to G15/Direct labor cost of G15

Q: net cash provided by operating activities

A: Cash flows from operating activities: It is a section of Statement of cash flow that explains the…

Q: The founder of Alchemy Products Incorporated discovered a way to turn gold into lead and patented…

A: Given, Investment value = $ 2,400,000 Selling price = $ 75,000,000 Number of shares = 2,000,000

Q: Query Company is considering an investment in machinery with the following information. Initial…

A: Net present value is difference between present value of annual cash inflow less present value of…

Q: Provide with explanations of the other services a Chartered Accountancy firm provides outside the…

A: A Chartered Accountancy firm refers to a professional services firm that is composed of Chartered…

Q: The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4,…

A: The format of Form 8949 is attached herewith. As, the household property was purchased in year 1993…

Q: Compute payroll An employee earns $16 per hour and 1.5 times that rate for all hours in excess of 40…

A: Lets understand the basics. Gross pay for an employee means a pay which is totalling normal pay plus…

Q: ACCT 203 produces and sells lighting fixtures. An entry light has a total cost of $180 per unit, of…

A: A product cost is a sum of certain costs that are incurred directly while making the product…

Q: Exercise 6-36 (Algo) Process Costing (LO 6-1) Bremen Fitness Products produces a sports drink. On…

A: EQUIVALENT UNITS OF PRODUCTION Equivalent Production is represents the production of a process in…

Q: he Hub Store at a university in eastern Canada is considering purchasing a self-serve checkout…

A: Before-tax net annual cost savings=Savings in annual part time wages-Total costs of operating Annual…

Q: If the value of an item can be measured and reasonably determined, this item can be recognized in…

A: An item can be recognized in the financial statement if it satisfies certain specified condition.…

Q: Challenger Factory produces two similar products: regular widgets and deluxe widgets. The total…

A: Predetermined overhead rate is calculated on the basis of estimated cost and estimated hours,…

Q: Jacob is a member of WCC (an LLC taxed as a partnership). Jacob was allocated $80,000 of business…

A: Qualified business income means the deduction of tax which is allowed to small business and…

Q: Here is Flounder Company's portfolio of long-term stock investments at December 31, 2021, the end of…

A: According to the question, we need to prepare the journal entries in the books of Flounder Company.…

Q: Prepare a Year 1 income statement, capital statement (statement of changes in equity), balance…

A: Income Statement- An income statement is one of the three significant financial statements used…

Q: Required: (Consider each case independently): 1. What is the revised net operating income if unit…

A: CVP stands for Cost Volume Profit analysis, under which we ascertain the effect of change in the…

Q: What is the difference between 'Neutrality' and 'Prudence'? Please explain/provide an example for…

A: In accounting, the concepts of "neutrality" and "prudence" play important roles in ensuring the…

Q: Current Liabilities Bon Nebo Co. sold 14,000 annual subscriptions of Bjorn for $46 during December…

A: Liabilities: A liability is a legal obligation to pay other entities as a result of past…

Q: What is the net cash provided by operating activities during the current year? What is the net cash…

A: It is important for the business entity to prepare the Cash flow statement which can determine the…

Q: The income statement for Crane, Inc. is as follows: CRANE, INC. Income Statement For the Year Ended…

A: Earnings per share :— It is calculated by dividing income available to common stockholders equity by…

Q: Kingbird Corporation incurred the following costs during 2022. Direct materials used in product…

A: The manufacturing cost includes the cost that is incurred to manufacture the product. It means the…

Q: Alan Weatherspoon, a super salesman contemplating retirement on his fifty-fifth birthday, decides to…

A: Given, Withdraw amount = $ 23,230 Cumulative PV factor at 11% for 4 periods (calculated) = 3.10245

Q: Ratios Analyzing Long-Term Firm Solvency The following information is available for Percy Company:…

A: Debt to equity ratio :— It is calculated by dividing total liabilities by total stockholders'…

Q: Coronado Company has sales of $506000, variable costs of $417450, and fixed costs of $21000.…

A: Contribution is the difference between the sales and variable cost and contribution margin formula…

Q: The following information was extracted from the financial records including the asset register for…

A: Depreciation is the reduction in the value of asset due to normal wear and tear Effluxion of time.…

Q: ganya manufacturer of hand sanitizers, intends to produce 40.000 units in the thed quarter and…

A: Lets understand the basics. Budget is an estimation of future profit and loss of the business in…

Q: Type here to search View Policies Current Attempt in Progress The following credit sales are…

A: Cash collection :— It is the amount of receivable that are collected from customer during the…

Q: Salvatori, Incorporated, manufactures and sells two products Product A4 and Product Q5. Data…

A: Using activity-based costing, the overhead is applied to the production on the basis of different…

Q: The following information is available for Sheffield Corp.. Current assets Total assets Current…

A: Ratio analysis is the process of comparing different financial account line items for a corporation.…

Q: On January 1, 20X1, Weislin Company borrowed $24,000 to purchase equipment. The loan is to be repaid…

A: Interest refers to the expense that is being charged on the borrowed amount by the borrower to the…

Q: Dax is responsible for preparing financial statements for his employer. Each statement is reviewed…

A: GAAP means generally accepted accounting principles. It is the collection of the various rules and…

Q: Fixed costs: Allocated portion of receptionist's salary Dentist salary Equipment depreciation.…

A: REVENUE & SPENDING VARIANCE In Case of Sales & Net Operating Income ; if Budgeted Sales is…

Q: Tandy Teck manufactures an electronic component for a high-end computer. The company currently sells…

A: Incremental analysis is a decision-making tool. It is based on the relevant costing approach. Under…

Q: Exercise 9-29 (Algo) Plantwide versus Department Allocation (LO 9-2, 3) West State Furniture (WSF)…

A: The overhead is applied to the production on the basis of a pre-determined overhead rate. The profit…

Q: A portion of the stockholders' equity section from the balance sheet of Walland Corporation appears…

A: Dividend is the amount of return paid to the shareholders of the entity. It is paid to both…

Q: Pretty Pictures Co. has a monthly target operating income of $7,400. Variable expenses are 80% of…

A: Contribution margin ratio :— It is calculated by deducting variable to sales ratio and 100%.…

Q: what do you think of the increasing amount of reliance on electronic interactions? Some banks now…

A: The move toward electronic financial transactions has both positive and negative repercussions. Here…

Q: On June 1, 2021, Sarasota Corp. was formed. Its assets, liabilities, share capital, revenues,…

A: The net income or loss is calculated as difference between revenue and expenses. The retained…

Q: The following are some transactions of Ivanhoe Company for 2024. Ivanhoe Company uses straight-line…

A: Depreciation is nothing but a reduction in the value of an asset over time due to normal wear and…

Q: Chaz Corporation has taxable income in 2022 of $312,200 for purposes of computing the §179 expense…

A: Business organizations are required to charge the depreciation expense so that the assets are shown…

Q: 26 Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2021, Lacy…

A: Pension expense is the amount that a business charges to expense in relation to its liabilities for…

Q: With the following transactions, determine the Cost of Good Sold for a Manufacturing plant. A $7000…

A: Total manufacturing costs :— It is the total cost incurred in the manufacturing of product during…

Q: Bond Company had the following amounts in equity before issuing its annual dividend. Ordinary share…

A: Lets understand the basics. Dividend is declared by the entity in order to provide return on their…

Q: Discount Amortization On the first day of the fiscal year, a company issues a $3,000,000, 11%,…

A: Bond :— It is one of the type of securities that pays fixed periodic interest and face value amount…

Q: Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% x…

A: Pension expenditure is the sum that a corporation deducts from revenue in order to cover its…

Q: hermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The…

A: Customer margin means the amount of profit made by selling the goods the customer. It is the margin…

Q: Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar…

A: Income Statement - An income Statement is a financial statement that includes revenue earned and…

Q: XYZ Company had total assets of $500,000, total liabilities of $200,000, and equity of $300,000.…

A: Debt to equity ratio :— It is calculated by dividing total liabilities by total equity. Debt to…

Q: On January 1, 2020, Jet Air Inc. contracted with Systems Plus Inc. to manufacture heavy equipment.…

A: Equipment recorded value = Present value of face value of note + Present value of interest payments…

Please do not give solution in image format thanku

Step by step

Solved in 3 steps

- Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.

- On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?At the end of 2020, Magenta Manufacturing Company discovered that construction cost had been capitalized as a cost of the factory building in 2015 when it should have been treated as a cost of production equipment installation costs. As a result of the misclassification, the depreciation through 2018 was understated by 110,000, and depreciation for 2019 was understated by 90,000. What would be the consequences of correcting for the misclassification of the property cost? a. The taxpayer uses the FIFO inventory method, and 25% of goods produced during the period were included in the ending inventory. b. The taxpayer uses the LIFO inventory method, and no new LIFO layer was added during 2019.

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.