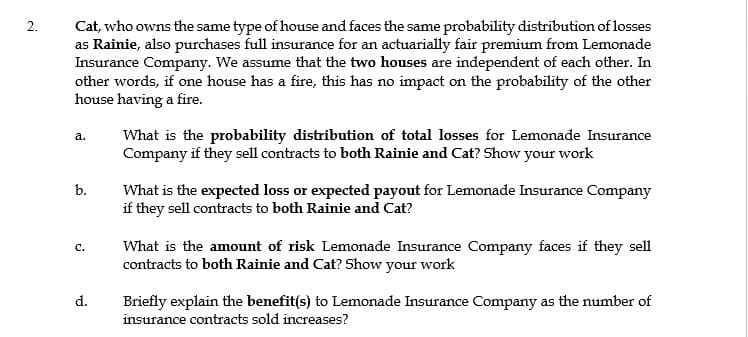

Cat, who owns the same type of house and faces the same probability distribution of losses as Rainie, also purchases full insurance for an actuarially fair premium from Lemonade Insurance Company. We assume that the two houses are independent of each other. In other words, if one house has a fire, this has no impact on the probability of the other house having a fire. What is the probability distribution of total losses for Lemonade Insurance Company if they sell contracts to both Rainie and Cat? Show your work a. b. What is the expected loss or expected payout for Lemonade Insurance Company if they sell contracts to both Rainie and Cat? What is the amount of risk Lemonade Insurance Company faces if they sell contracts to both Rainie and Cat? Show your work с. Briefly explain the benefit(s) to Lemonade Insurance Company as the number of insurance contracts sold increases? d.

Cat, who owns the same type of house and faces the same probability distribution of losses as Rainie, also purchases full insurance for an actuarially fair premium from Lemonade Insurance Company. We assume that the two houses are independent of each other. In other words, if one house has a fire, this has no impact on the probability of the other house having a fire. What is the probability distribution of total losses for Lemonade Insurance Company if they sell contracts to both Rainie and Cat? Show your work a. b. What is the expected loss or expected payout for Lemonade Insurance Company if they sell contracts to both Rainie and Cat? What is the amount of risk Lemonade Insurance Company faces if they sell contracts to both Rainie and Cat? Show your work с. Briefly explain the benefit(s) to Lemonade Insurance Company as the number of insurance contracts sold increases? d.

Chapter18: Asymmetric Information

Section: Chapter Questions

Problem 18.5P

Related questions

Question

Transcribed Image Text:Cat, who owns the same type of house and faces the same probability distribution of losses

as Rainie, also purchases full insurance for an actuarially fair premium from Lemonade

Insurance Company. We assume that the two houses are independent of each other. In

other words, if one house has a fire, this has no impact on the probability of the other

house having a fire.

2.

What is the probability distribution of total losses for Lemonade Insurance

Company if they sell contracts to both Rainie and Cat? Show your work

a.

b.

What is the expected loss or expected payout for Lemonade Insurance Company

if they sell contracts to both Rainie and Cat?

What is the amount of risk Lemonade Insurance Company faces if they sell

contracts to both Rainie and Cat? Show your work

с.

d.

Briefly explain the benefit(s) to Lemonade Insurance Company as the number of

insurance contracts sold increases?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning