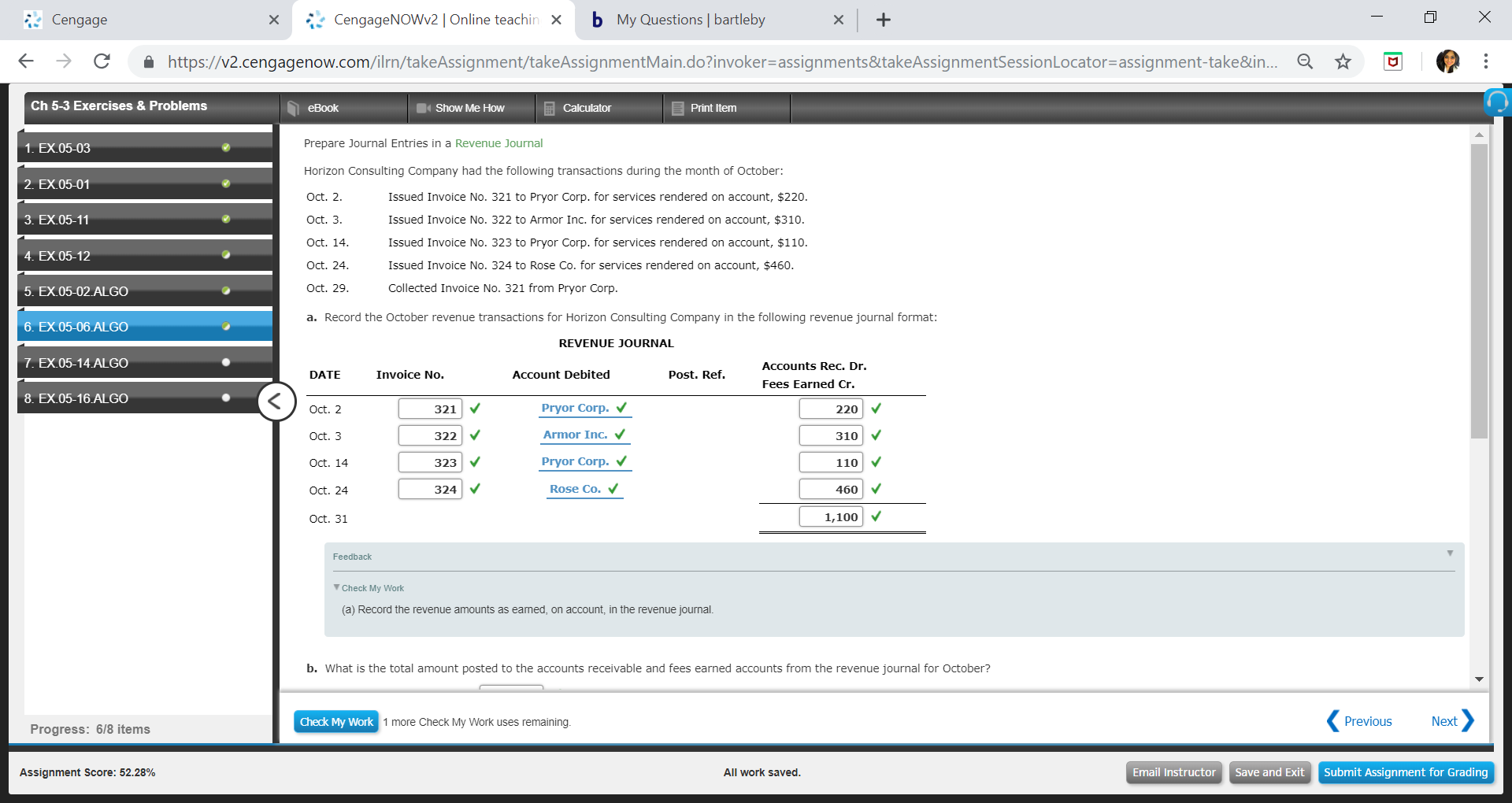

Cengage xCengageNOWv2 | Online teachin Xb My Questions | bartleby ← → С â https://v2.cengagenow.com/rn/takeAssignment takeAssignmentMain doinvoker-assignments&takeAssignmentSessionLocator-assignment take&n ☆ Ch 5-3 Exercises & Problems eBook Show Me How Print Item Prepare Journal Entries in a Revenue Journal Horizon Consulting Company had the following transactions during the month of October: Oct. 2 Oct. 3 Oct. 14 Oct. 24 Oct. 29 a. Record the October revenue transactions for Horizon Consulting Company in the following revenue journal format 1. EX.05-03 2. EX.05-01 Issued Invoice No. 321 to Pryor Corp. for services rendered on account, $220 Issued Invoice No. 322 to Armor Inc. for services rendered on account, $310 Issued Invoice No. 323 to Pryor Corp. for services rendered on account, $110 Issued Invoice No. 324 to Rose Co. for services rendered on account, $460 Collected Invoice No. 321 from Pryor Corp 3. EX.05-11 4. EX.05-12 5. EX.05-02 ALGO 6. EX.05-06 ALGO REVENUE JOURNAL 7. EX.05-14 ALGO Accounts Rec. Dr. DATE Invoice No. Account Debited Post. Ref. Fees Earned Cr. 8. EX.05-16 ALGO Pryor Corp. V Armor Inc. Pryor Corp. V 220 V 310 110 460 321 Oct. 2 Oct. 3 Oct. 14 Oct. 24 Oct. 31 322 323 324 Rose Co. 1,100 Feedback Check My Work (a) Record the revenue amounts as earned, on account, in the revenue journal b. What is the total amount posted to the accounts receivable and fees earned accounts from the revenue journal for October? Check My ork 1 more Check My Work uses remaining Previous Next ProgresS: 618 items Assignment Score: 52.28% All work saved Email InstructorSave and Exit Submit Assignment for Grading

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Hi for this question, the last part states "c. What is the October 31 balance of the Pryor Corp. customer account assuming a zero balance on October 1?" I put $330 assuming it was the total of the two transactions from Pryor Corp of $220 and $110 but it said it was incorrect. The 'check my work' feedback says "(c) Include all the transactions for Pryor Corp." But I thought that does include all transactions? Can you please help? I have attached a picture of the original question. Thanks!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images