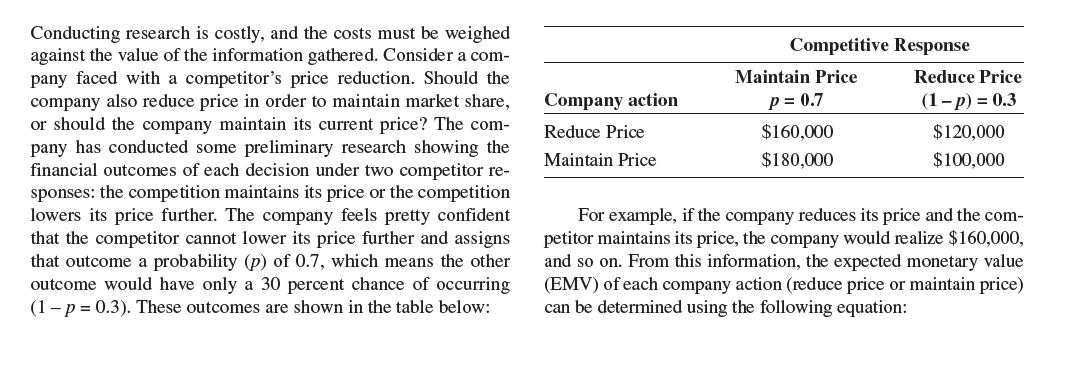

Conducting research is costly, and the costs must be weighed against the value of the information gathered. Consider a com- pany faced with a competitor's price reduction. Should the company also reduce price in order to maintain market share, or should the company maintain its current price? The com- pany has conducted some preliminary research showing the financial outcomes of each decision under two competitor re- sponses: the competition maintains its price or the competition lowers its price further. The company feels pretty confident that the competitor cannot lower its price further and assigns that outcome a probability (p) of 0.7, which means the other outcome would have only a 30 percent chance of occurring (1– p = 0.3). These outcomes are shown in the table below: Competitive Response Maintain Price Reduce Price Company action p = 0.7 (1-p) = 0.3 Reduce Price $160,000 $120,000 Maintain Price $180,000 $100,000 For example, if the company reduces its price and the com- petitor maintains its price, the company would realize $160,000, and so on. From this information, the expected monetary value (EMV) of each company action (reduce price or maintain price) can be determined using the following equation: EMV = (p)(financial outome,) If the value of perfect information is more than the cost + (1 – p)(financial outcome(1 -p) of conducting the research, then the research should be under- taken (that is, EMVP> cost of research). However, if the value of the additional information is less than the cost of obtaining The company would select the action expected to deliver the greatest EMV. More information might be desirable, but is it worth the cost of acquiring it? One way to assess the value of ad- ditional information is to determine the expected value of perfect information (EMVpj), calculated using the following equation: more information, the research should not be conducted. EMVPI = EMVcertainty - EMVpest alternative where = (p) (highest financial outcome,) + (1 – p) (highest financial outcome(1 -p) EMV, Vcertainty

Conducting research is costly, and the costs must be weighed against the value of the information gathered. Consider a com- pany faced with a competitor's price reduction. Should the company also reduce price in order to maintain market share, or should the company maintain its current price? The com- pany has conducted some preliminary research showing the financial outcomes of each decision under two competitor re- sponses: the competition maintains its price or the competition lowers its price further. The company feels pretty confident that the competitor cannot lower its price further and assigns that outcome a probability (p) of 0.7, which means the other outcome would have only a 30 percent chance of occurring (1– p = 0.3). These outcomes are shown in the table below: Competitive Response Maintain Price Reduce Price Company action p = 0.7 (1-p) = 0.3 Reduce Price $160,000 $120,000 Maintain Price $180,000 $100,000 For example, if the company reduces its price and the com- petitor maintains its price, the company would realize $160,000, and so on. From this information, the expected monetary value (EMV) of each company action (reduce price or maintain price) can be determined using the following equation: EMV = (p)(financial outome,) If the value of perfect information is more than the cost + (1 – p)(financial outcome(1 -p) of conducting the research, then the research should be under- taken (that is, EMVP> cost of research). However, if the value of the additional information is less than the cost of obtaining The company would select the action expected to deliver the greatest EMV. More information might be desirable, but is it worth the cost of acquiring it? One way to assess the value of ad- ditional information is to determine the expected value of perfect information (EMVpj), calculated using the following equation: more information, the research should not be conducted. EMVPI = EMVcertainty - EMVpest alternative where = (p) (highest financial outcome,) + (1 – p) (highest financial outcome(1 -p) EMV, Vcertainty

Chapter18: Asymmetric Information

Section: Chapter Questions

Problem 18.6P

Related questions

Question

Calculate the expected monetary value (EMV) of both company actions. Which action should the company take?

Transcribed Image Text:Conducting research is costly, and the costs must be weighed

against the value of the information gathered. Consider a com-

pany faced with a competitor's price reduction. Should the

company also reduce price in order to maintain market share,

or should the company maintain its current price? The com-

pany has conducted some preliminary research showing the

financial outcomes of each decision under two competitor re-

sponses: the competition maintains its price or the competition

lowers its price further. The company feels pretty confident

that the competitor cannot lower its price further and assigns

that outcome a probability (p) of 0.7, which means the other

outcome would have only a 30 percent chance of occurring

(1– p = 0.3). These outcomes are shown in the table below:

Competitive Response

Maintain Price

Reduce Price

Company action

p = 0.7

(1-p) = 0.3

Reduce Price

$160,000

$120,000

Maintain Price

$180,000

$100,000

For example, if the company reduces its price and the com-

petitor maintains its price, the company would realize $160,000,

and so on. From this information, the expected monetary value

(EMV) of each company action (reduce price or maintain price)

can be determined using the following equation:

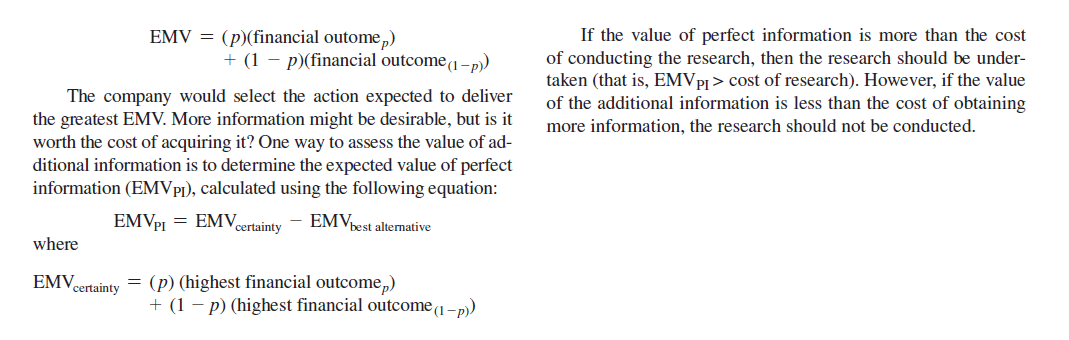

Transcribed Image Text:EMV = (p)(financial outome,)

If the value of perfect information is more than the cost

+ (1 – p)(financial outcome(1 -p)

of conducting the research, then the research should be under-

taken (that is, EMVP> cost of research). However, if the value

of the additional information is less than the cost of obtaining

The company would select the action expected to deliver

the greatest EMV. More information might be desirable, but is it

worth the cost of acquiring it? One way to assess the value of ad-

ditional information is to determine the expected value of perfect

information (EMVpj), calculated using the following equation:

more information, the research should not be conducted.

EMVPI = EMVcertainty

- EMVpest alternative

where

= (p) (highest financial outcome,)

+ (1 – p) (highest financial outcome(1 -p)

EMV,

Vcertainty

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning