(ou are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the ocal university. Over 90 percent of your clientele consists of college students. College Computers is not the only firm that builds computers to meet this university's specifications; indeed, it competes with many manufacturers online and through traditional retail outlets. To attract its large student clientele, College Computers runs a weekly ad in the student paper advertising its "free service after he sale" policy in an attempt to differentiate itself from the competition. The weekly demand for computers produced by College Computers is given by Q= 1,400 – 4P, and its weekly cost of producing computers is qQ) = 1,600 + 2Q?. f other firms in the industry sell PCs at $300, what quantity and price of computers should you produce to maximize your firm's profits? nstructions: Round your response to the nearest whole number. Quantity: ( ] computers nstructions: Round your response to the nearest penny (two decimal places). Price: $ What long-run adjustments should you anticipate? O Exit by other firms, increasing your profits. O Entry by other firms, reducing your profits. O Exit by other firms along with decreased profits. O Entry by other firms along with increased profits.

(ou are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the ocal university. Over 90 percent of your clientele consists of college students. College Computers is not the only firm that builds computers to meet this university's specifications; indeed, it competes with many manufacturers online and through traditional retail outlets. To attract its large student clientele, College Computers runs a weekly ad in the student paper advertising its "free service after he sale" policy in an attempt to differentiate itself from the competition. The weekly demand for computers produced by College Computers is given by Q= 1,400 – 4P, and its weekly cost of producing computers is qQ) = 1,600 + 2Q?. f other firms in the industry sell PCs at $300, what quantity and price of computers should you produce to maximize your firm's profits? nstructions: Round your response to the nearest whole number. Quantity: ( ] computers nstructions: Round your response to the nearest penny (two decimal places). Price: $ What long-run adjustments should you anticipate? O Exit by other firms, increasing your profits. O Entry by other firms, reducing your profits. O Exit by other firms along with decreased profits. O Entry by other firms along with increased profits.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter23: Managing Vertical Relationships

Section: Chapter Questions

Problem 1MC

Related questions

Question

1

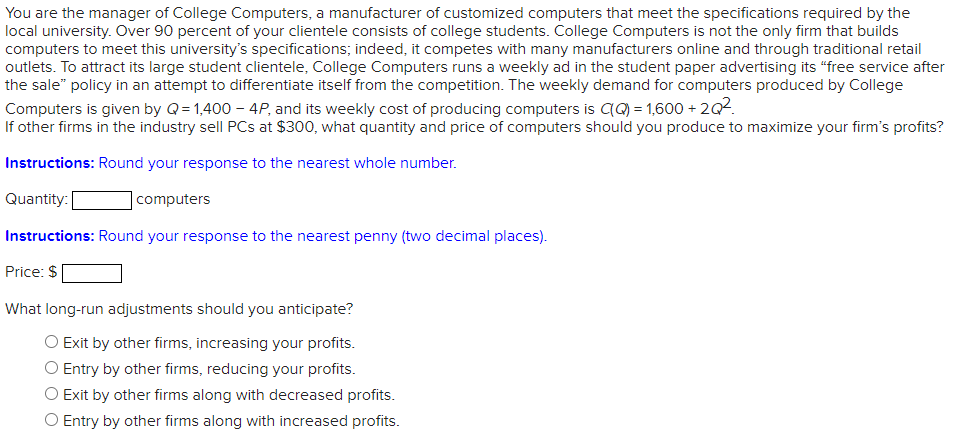

Transcribed Image Text:You are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the

local university. Over 90 percent of your clientele consists of college students. College Computers is not the only firm that builds

computers to meet this university's specifications; indeed, it competes with many manufacturers online and through traditional retail

outlets. To attract its large student clientele, College Computers runs a weekly ad in the student paper advertising its "free service after

the sale" policy in an attempt to differentiate itself from the competition. The weekly demand for computers produced by College

Computers is given by Q= 1,400 – 4P, and its weekly cost of producing computers is CQ) = 1,600 + 2Q2.

If other firms in the industry sell PCs at $300, what quantity and price of computers should you produce to maximize your firm's profits?

Instructions: Round your response to the nearest whole number.

Quantity:|

|computers

Instructions: Round your response to the nearest penny (two decimal places).

Price: $

What long-run adjustments should you anticipate?

O Exit by other firms, increasing your profits.

O Entry by other firms, reducing your profits.

Exit by other firms along with decreased profits.

O Entry by other firms along with increased profits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning