Portfolio analysis You have been given the expected return data shown in the first table on three assets-F, G, and H-over the period 2016-2019: Using these assets, you have isolated the three investment alternatives shown in the following table: a. Calculate the average return over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives. d. On the basis of your findings, which of the three investment alternatives do you think performed better over this period? Why? a. The expected return over the 4-year period for alternative 1 is %. (Round to two decimal place.) i Data Table - X - X Data Table (Click on the icon here O in order to copy the contents of the data table below into a spreadsheet.) Alternative Investment Expected Return Asset G 21% 1 100% of assetF Year Asset F Asset H 2 50% of asset F and 50% of asset G 50% of asset F and 50% of asset H 2016 2017 20% 18% 3 21% 22% 20% 19% 19% 2018 20% 2019 23% 18% 21% Print Done Print Done

Portfolio analysis You have been given the expected return data shown in the first table on three assets-F, G, and H-over the period 2016-2019: Using these assets, you have isolated the three investment alternatives shown in the following table: a. Calculate the average return over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives. d. On the basis of your findings, which of the three investment alternatives do you think performed better over this period? Why? a. The expected return over the 4-year period for alternative 1 is %. (Round to two decimal place.) i Data Table - X - X Data Table (Click on the icon here O in order to copy the contents of the data table below into a spreadsheet.) Alternative Investment Expected Return Asset G 21% 1 100% of assetF Year Asset F Asset H 2 50% of asset F and 50% of asset G 50% of asset F and 50% of asset H 2016 2017 20% 18% 3 21% 22% 20% 19% 19% 2018 20% 2019 23% 18% 21% Print Done Print Done

Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 5EP

Related questions

Question

please do A-D

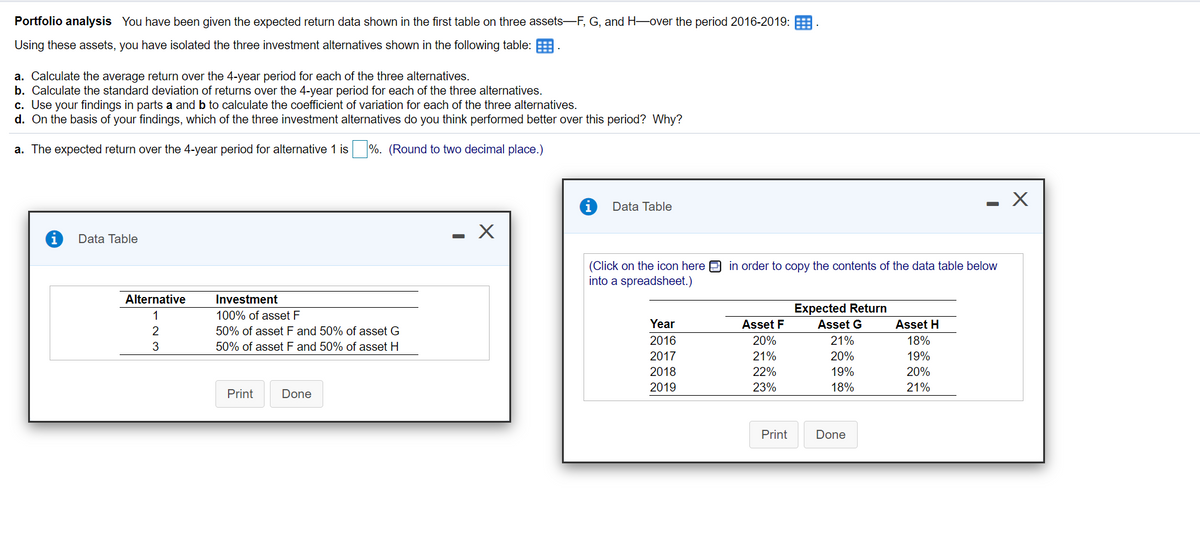

Transcribed Image Text:Portfolio analysis You have been given the expected return data shown in the first table on three assets-F, G, and H-over the period 2016-2019: E

Using these assets, you have isolated the three investment alternatives shown in the following table:

a. Calculate the average return over the 4-year period for each of the three alternatives.

b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives.

c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives.

d. On the basis of your findings, which of the three investment alternatives do you think performed better over this period? Why?

a. The expected return over the 4-year period for alternative 1 is

%. (Round to two decimal place.)

- X

Data Table

- X

Data Table

(Click on the icon here 9 in order to copy the contents of the data table below

into a spreadsheet.)

Alternative

Investment

Expected Return

1

100% of asset F

Year

Asset F

Asset G

Asset H

2

50% of asset F and 50% of asset G

2016

20%

21%

18%

3

50% of asset F and 50% of asset H

2017

21%

20%

19%

2018

22%

19%

20%

2019

23%

18%

21%

Print

Done

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you