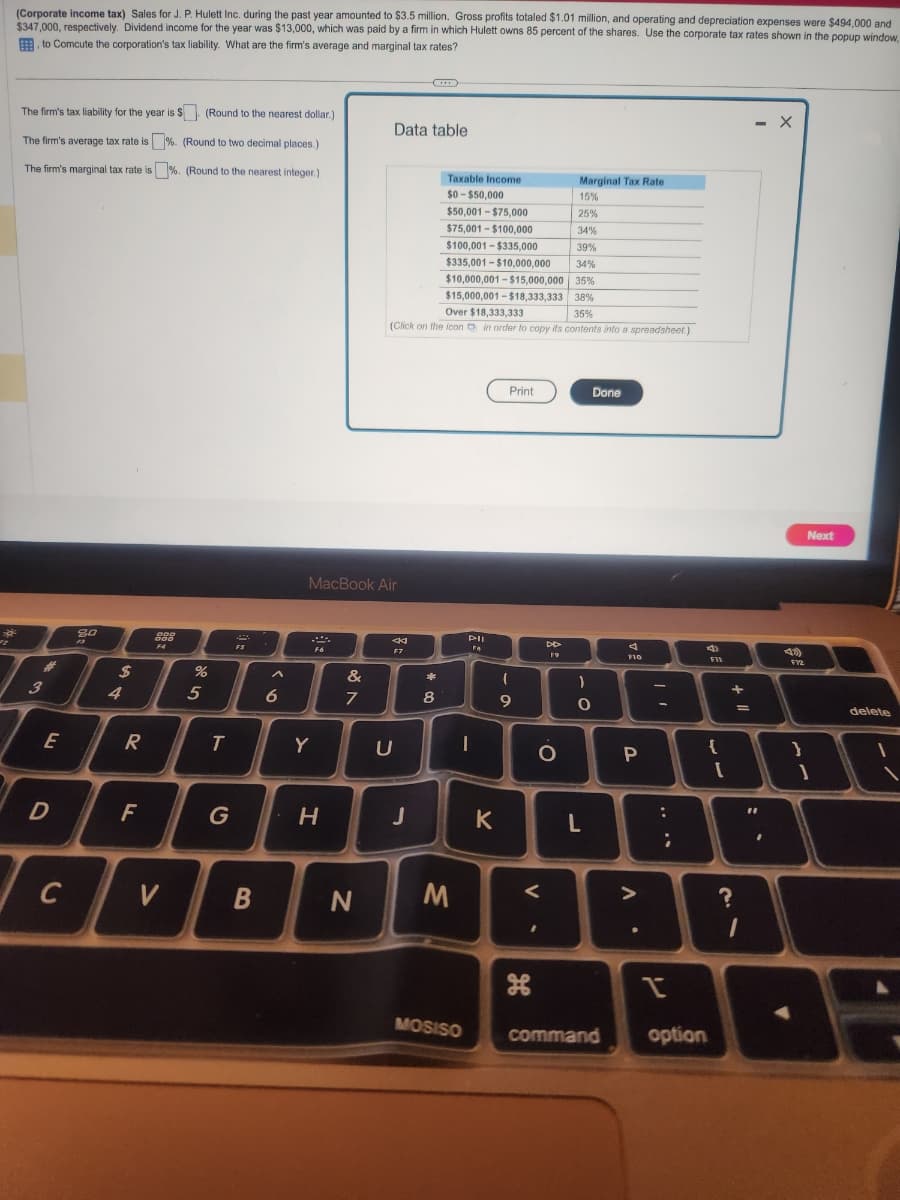

(Corporate income tax) Sales for J. P. Hulett Inc. during the past year amounted to $3.5 million. Gross profits totaled $1.01 million, and operating and depreciation expenses were $494,000 and $347,000, respectively. Dividend income for the year was $13,000, which was paid by a firm in which Hulett owns 85 percent of the shares. Use the corporate tax rates shown in the popup window to Comcute the corporation's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is S (Round to the nearest dollar.) The firm's average tax rate is%. (Round to two decimal places.) The firm's marginal tax rate is%. (Round to the nearest integer.) Data table Taxable Income $0-$50,000 $50,001-$75,000 Marginal Tax Rate 15% 25% $75,001-$100,000 34% $100,001-$335,000 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15.000.00 - B - X

(Corporate income tax) Sales for J. P. Hulett Inc. during the past year amounted to $3.5 million. Gross profits totaled $1.01 million, and operating and depreciation expenses were $494,000 and $347,000, respectively. Dividend income for the year was $13,000, which was paid by a firm in which Hulett owns 85 percent of the shares. Use the corporate tax rates shown in the popup window to Comcute the corporation's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is S (Round to the nearest dollar.) The firm's average tax rate is%. (Round to two decimal places.) The firm's marginal tax rate is%. (Round to the nearest integer.) Data table Taxable Income $0-$50,000 $50,001-$75,000 Marginal Tax Rate 15% 25% $75,001-$100,000 34% $100,001-$335,000 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15.000.00 - B - X

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter6: Accounting For Financial Management

Section: Chapter Questions

Problem 7P

Related questions

Question

100%

Transcribed Image Text:(Corporate income tax) Sales for J. P. Hulett Inc. during the past year amounted to $3.5 million. Gross profits totaled $1.01 million, and operating and depreciation expenses were $494,000 and

$347,000, respectively. Dividend income for the year was $13,000, which was paid by a firm in which Hulett owns 85 percent of the shares. Use the corporate tax rates shown in the popup window,

to Comcute the corporation's tax liability. What are the firm's average and marginal tax rates?

The firm's tax liability for the year is $. (Round to the nearest dollar.)

The firm's average tax rate is%. (Round to two decimal places.)

The firm's marginal tax rate is %. (Round to the nearest integer.)

3

E

D

C

80

$

4

R

F

DOD

000

F4

V

%

5

T

FS

B

A

6

Y

MacBook Air

F6

H

&

7

N

Data table

Marginal Tax Rate

15%

25%

34%

39%

$335,001-$10,000,000 34%

$10,000,001-$15,000,000 35%

$15,000,001-$18,333,333 38%

Over $18,333,333

35%

(Click on the icon in order to copy its contents into a spreadsheet.)

44

F7

D

J

*

8

Taxable Income

$0-$50,000

$50,001-$75,000

$75,001-$100,000

$100,001-$335,000

M

MOSISO

Pil

FA

-

K

Print

- o

(

9

<

H

DD

19

O

)

. C

Done

O

L

4

F10

P

>

-

:

;

4

I

command option

F11

{

[

+

?

=

1

- X

"1

.

F12

}

Next

1

delete

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning