Cost of sales 800,000 Additional information and data for adjustments follow: 1) The company sells at a markup of 20%based on sales. All customers are within a four-day delivery area. 2) On December 27,2021, dean authorized a customer to return, for full credit, goods shipped and billed at P30,000 on December 14,2021. The retumed goods were received by dean on January 4,2022, and a P30,000 credit memo was issued on the same date. The goods were not included in the ending of inventory. 3) A P40,000 shipment of goods to a customer on December 31,2021, terms FOB shipping point, 2/10, n/30 was not recorded as a sale in 2021. The goods were excluded in the ending inventory in 2021. 4) A P50,000 shipment of goods to a customer on December 30,2021, terms FOB destination, 5/10, n/30 was recorded as a sale in 2021. The goods were not included in the ending inventory in 2021 5) A P20,000 shipment of goods to a customer on December 29,2021, terms FOB shipping point, 3/10, n/30, was recorded as a sale in 2021. The goods were not included in the ending inventory in 2021. 6) Based on the aging of the accounts receivable, the allowance for doubtful accounts would be P15,000. Based on the above data, compute for the following: 1. Adjusted balance of accounts receivable as of December 31,2021. a. P350,000 b. P260,000 2. Merchandise inventory as of December 31,2021 c. P289,000 d. P290,000 a. P376,000 c. P408,000 b. P432,000 d. P440,000 3. Net sales for the year 2021 a. P990,000 c. P1,010,000 b. P960,000 d. P910,000

Cost of sales 800,000 Additional information and data for adjustments follow: 1) The company sells at a markup of 20%based on sales. All customers are within a four-day delivery area. 2) On December 27,2021, dean authorized a customer to return, for full credit, goods shipped and billed at P30,000 on December 14,2021. The retumed goods were received by dean on January 4,2022, and a P30,000 credit memo was issued on the same date. The goods were not included in the ending of inventory. 3) A P40,000 shipment of goods to a customer on December 31,2021, terms FOB shipping point, 2/10, n/30 was not recorded as a sale in 2021. The goods were excluded in the ending inventory in 2021. 4) A P50,000 shipment of goods to a customer on December 30,2021, terms FOB destination, 5/10, n/30 was recorded as a sale in 2021. The goods were not included in the ending inventory in 2021 5) A P20,000 shipment of goods to a customer on December 29,2021, terms FOB shipping point, 3/10, n/30, was recorded as a sale in 2021. The goods were not included in the ending inventory in 2021. 6) Based on the aging of the accounts receivable, the allowance for doubtful accounts would be P15,000. Based on the above data, compute for the following: 1. Adjusted balance of accounts receivable as of December 31,2021. a. P350,000 b. P260,000 2. Merchandise inventory as of December 31,2021 c. P289,000 d. P290,000 a. P376,000 c. P408,000 b. P432,000 d. P440,000 3. Net sales for the year 2021 a. P990,000 c. P1,010,000 b. P960,000 d. P910,000

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PA: On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as...

Related questions

Question

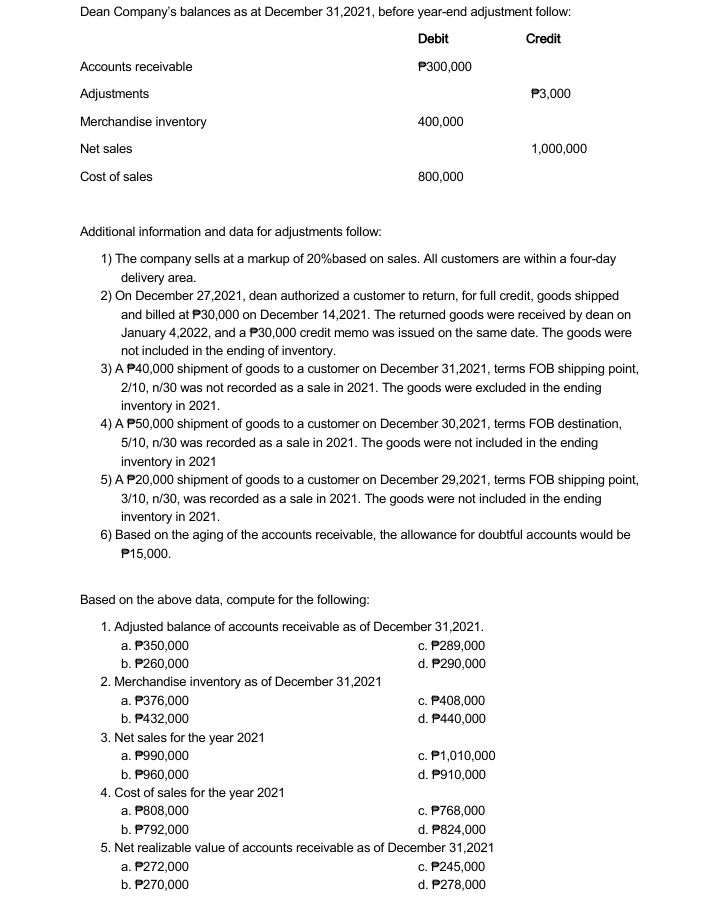

Transcribed Image Text:Dean Company's balances as at December 31,2021, before year-end adjustment follow:

Debit

Credit

Accounts receivable

P300,000

Adjustments

P3,000

Merchandise inventory

400,000

Net sales

1,000,000

Cost of sales

800,000

Additional information and data for adjustments follow:

1) The company sells at a markup of 20%based on sales. All customers are within a four-day

delivery area.

2) On December 27,2021, dean authorized a customer to return, for full credit, goods shipped

and billed at P30,000 on December 14,2021. The returned goods were received by dean on

January 4,2022, and a P30,000 credit memo was issued on the same date. The goods were

not included in the ending of inventory.

3) A P40,000 shipment of goods to a customer on December 31,2021, terms FOB shipping point,

2/10, n/30 was not recorded as a sale in 2021. The goods were excluded in the ending

inventory in 2021.

4) A P50,000 shipment of goods to a customer on December 30,2021, terms FOB destination,

5/10, n/30 was recorded as a sale in 2021. The goods were not included in the ending

inventory in 2021

5) A P20,000 shipment of goods to a customer on December 29,2021, terms FOB shipping point,

3/10, n/30, was recorded as a sale in 2021. The goods were not included in the ending

inventory in 2021.

6) Based on the aging of the accounts receivable, the allowance for doubtful accounts would be

P15,000.

Based on the above data, compute for the following:

1. Adjusted balance of accounts receivable as of December 31,2021.

c. P289,000

a. P350,000

b. P260,000

d. P290,000

2. Merchandise inventory as of December 31,2021

a. P376,000

c. P408,000

b. P432,000

d. P440,000

3. Net sales for the year 2021

a. P990,000

c. P1,010,000

b. P960,000

d. P910,000

4. Cost of sales for the year 2021

a. P808,000

c. P768,000

b. P792,000

d. P824,000

5. Net realizable value of accounts receivable as of December 31,2021

c. P245,000

d. P278,000

a. P272,000

b. P270,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,