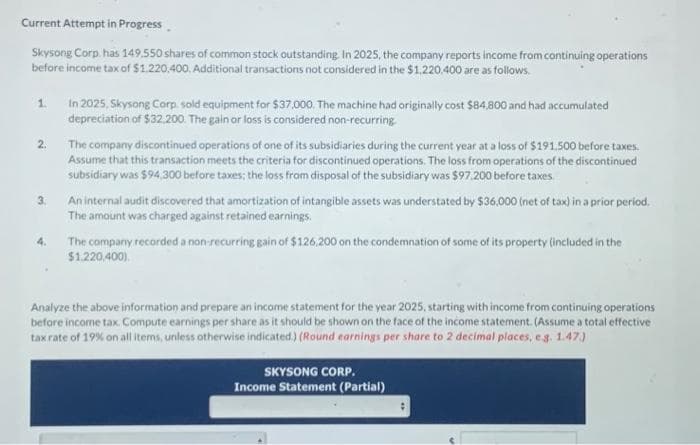

Current Attempt in Progress Skysong Corp. has 149.550 shares of common stock outstanding In 2025, the company reports income from continuing operations before income tax of $1.220,400. Additional transactions not considered in the $1,220,400 are as follows. 1. 2. 3. 4. In 2025, Skysong Corp. sold equipment for $37,000. The machine had originally cost $84,800 and had accumulated depreciation of $32,200. The gain or loss is considered non-recurring. The company discontinued operations of one of its subsidiaries during the current year at a loss of $191,500 before taxes. Assume that this transaction meets the criteria for discontinued operations. The loss from operations of the discontinued subsidiary was $94,300 before taxes; the loss from disposal of the subsidiary was $97.200 before taxes. An internal audit discovered that amortization of intangible assets was understated by $36,000 (net of tax) in a prior period. The amount was charged against retained earnings. The company recorded a non-recurring gain of $126,200 on the condemnation of some of its property (included in the $1.220,400) Analyze the above information and prepare an income statement for the year 2025, starting with income from continuing operations before income tax. Compute earnings per share as it should be shown on the face of the income statement. (Assume a total effective tax rate of 19% on all items, unless otherwise indicated.) (Round earnings per share to 2 decimal places, e.g. 1.47.) SKYSONG CORP. Income Statement (Partial)

Current Attempt in Progress Skysong Corp. has 149.550 shares of common stock outstanding In 2025, the company reports income from continuing operations before income tax of $1.220,400. Additional transactions not considered in the $1,220,400 are as follows. 1. 2. 3. 4. In 2025, Skysong Corp. sold equipment for $37,000. The machine had originally cost $84,800 and had accumulated depreciation of $32,200. The gain or loss is considered non-recurring. The company discontinued operations of one of its subsidiaries during the current year at a loss of $191,500 before taxes. Assume that this transaction meets the criteria for discontinued operations. The loss from operations of the discontinued subsidiary was $94,300 before taxes; the loss from disposal of the subsidiary was $97.200 before taxes. An internal audit discovered that amortization of intangible assets was understated by $36,000 (net of tax) in a prior period. The amount was charged against retained earnings. The company recorded a non-recurring gain of $126,200 on the condemnation of some of its property (included in the $1.220,400) Analyze the above information and prepare an income statement for the year 2025, starting with income from continuing operations before income tax. Compute earnings per share as it should be shown on the face of the income statement. (Assume a total effective tax rate of 19% on all items, unless otherwise indicated.) (Round earnings per share to 2 decimal places, e.g. 1.47.) SKYSONG CORP. Income Statement (Partial)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 23E

Related questions

Question

Transcribed Image Text:Current Attempt in Progress

Skysong Corp. has 149.550 shares of common stock outstanding In 2025, the company reports income from continuing operations

before income tax of $1.220,400. Additional transactions not considered in the $1,220,400 are as follows.

1.

2.

3.

4.

In 2025, Skysong Corp. sold equipment for $37,000. The machine had originally cost $84,800 and had accumulated

depreciation of $32.200. The gain or loss is considered non-recurring.

The company discontinued operations of one of its subsidiaries during the current year at a loss of $191,500 before taxes.

Assume that this transaction meets the criteria for discontinued operations. The loss from operations of the discontinued

subsidiary was $94,300 before taxes; the loss from disposal of the subsidiary was $97.200 before taxes

An internal audit discovered that amortization of intangible assets was understated by $36,000 (net of tax) in a prior period.

The amount was charged against retained earnings.

The company recorded a non-recurring gain of $126,200 on the condemnation of some of its property (included in the

$1.220,400).

Analyze the above information and prepare an income statement for the year 2025, starting with income from continuing operations

before income tax. Compute earnings per share as it should be shown on the face of the income statement. (Assume a total effective

tax rate of 19% on all items, unless otherwise indicated.) (Round earnings per share to 2 decimal places, e.g. 1.47.)

SKYSONG CORP.

Income Statement (Partial)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub