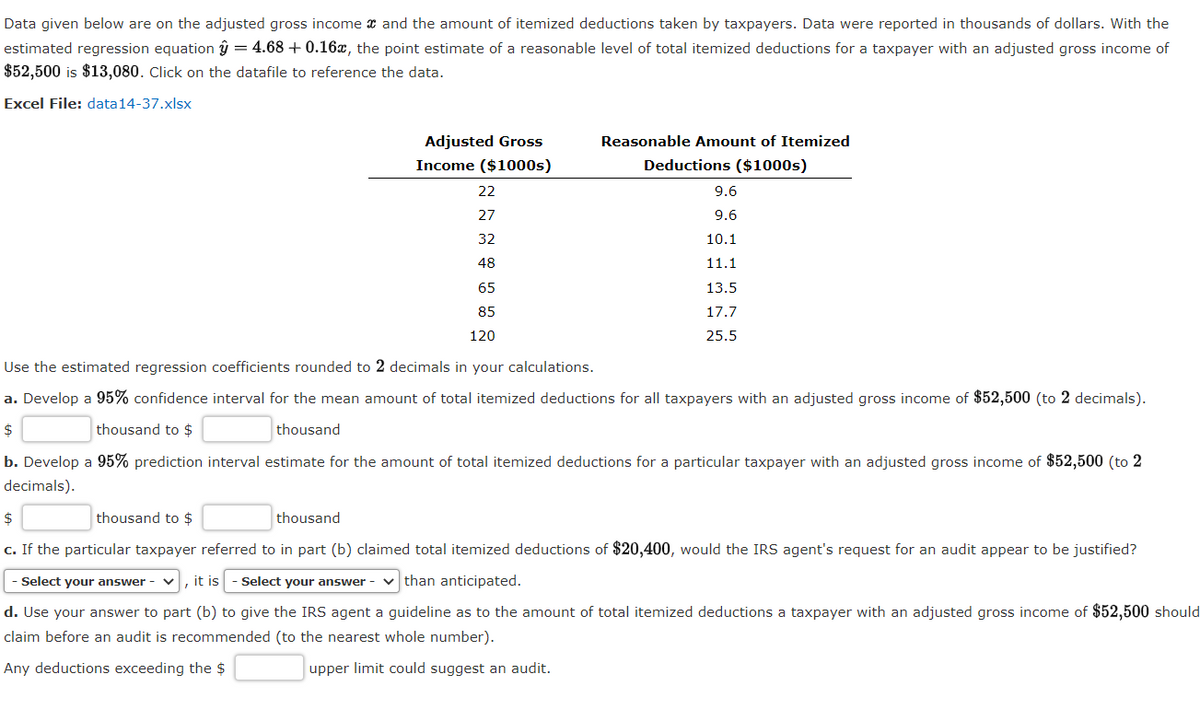

Data given below are on the adjusted gross income x and the amount of itemized deductions taken by taxpayers. Data were reported in thousands of dollars. With the estimated regression equation y=4.68+0.16x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $52,500 is $13,080

Data given below are on the adjusted gross income x and the amount of itemized deductions taken by taxpayers. Data were reported in thousands of dollars. With the estimated regression equation y=4.68+0.16x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $52,500 is $13,080

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter3: Straight Lines And Linear Functions

Section3.CR: Chapter Review Exercises

Problem 16CR: XYZ Corporation Stock Prices The following table shows the average stock price, in dollars, of XYZ...

Related questions

Question

|

Data given below are on the adjusted gross income x and the amount of itemized deductions taken by taxpayers. Data were reported in thousands of dollars. With the estimated regression equation y=4.68+0.16x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $52,500 is $13,080 |

Transcribed Image Text:Data given below are on the adjusted gross income x and the amount of itemized deductions taken by taxpayers. Data were reported in thousands of dollars. With the

estimated regression equation ŷ = 4.68 + 0.16x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of

$52,500 is $13,080. Click on the datafile to reference the data.

Excel File: data14-37.xlsx

Adjusted Gross

Reasonable Amount of Itemized

Income ($1000s)

Deductions ($1000s)

22

9.6

27

9.6

32

10.1

48

11.1

65

13.5

85

17.7

120

25.5

Use the estimated regression coefficients rounded to 2 decimals in your calculations.

a. Develop a 95% confidence interval for the mean amount of total itemized deductions for all taxpayers with an adjusted gross income of $52,500 (to 2 decimals).

$

thousand to $

thousand

b. Develop a 95% prediction interval estimate for the amount of total itemized deductions for a particular taxpayer with an adjusted gross income of $52,500 (to 2

decimals).

$

thousand to $

thousand

c. If the particular taxpayer referred to in part (b) claimed total itemized deductions of $20,400, would the IRS agent's request for an audit appear to be justified?

Select your answer - v

it is - Select your answer - v than anticipated.

d. Use your answer to part (b) to give the IRS agent a guideline as to the amount of total itemized deductions a taxpayer with an adjusted gross income of $52,500 should

claim before an audit is recommended (to the nearest whole number).

Any deductions exceeding the $

upper limit could suggest an audit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill