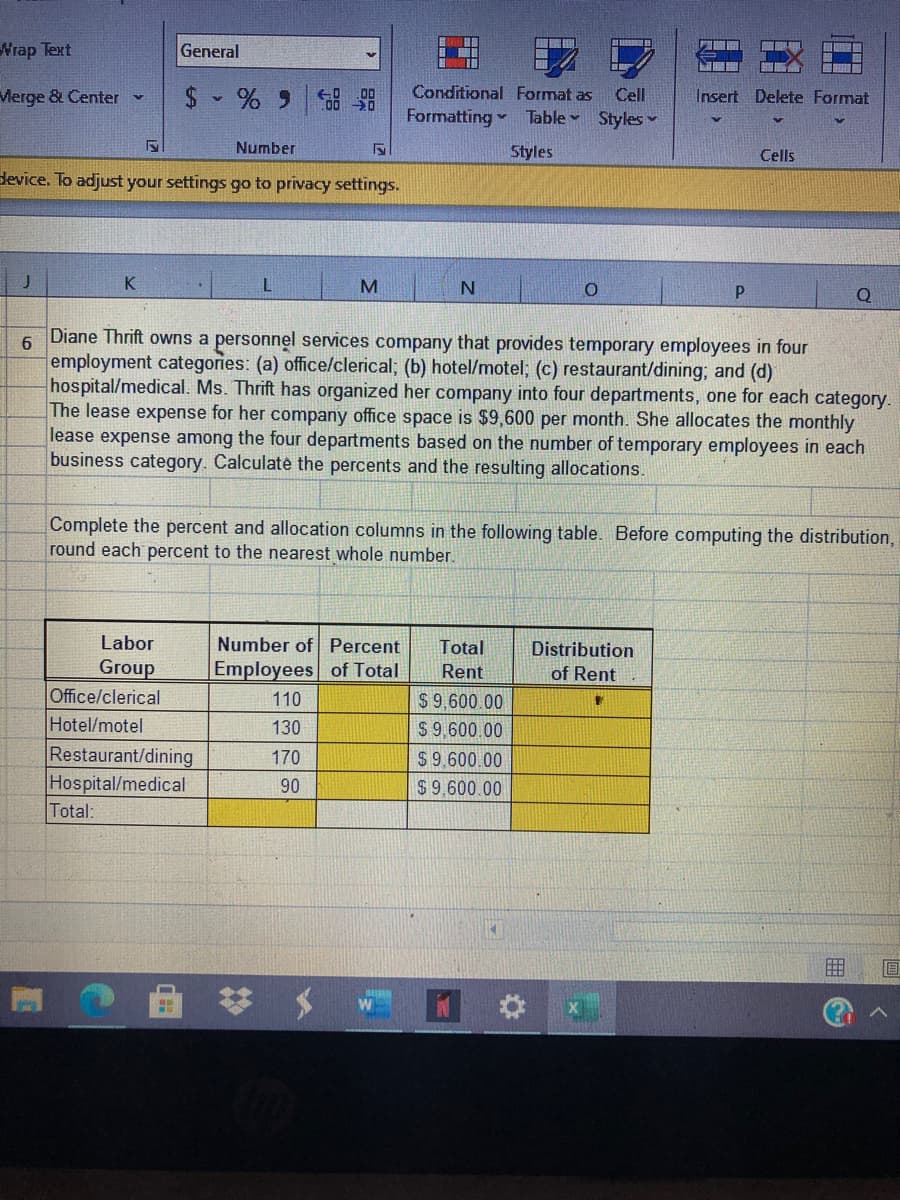

Diane Thrift owns a personnel services company that provides temporary employees in four employment categories: (a) office/clerical; (b) hotel/motel; (c) restaurant/dining; and (d) hospital/medical. Ms. Thrift has organized her company into four departments, one for each category. The lease expense for her company office space is $9,600 per month. She allocates the monthly lease expense among the four departments based on the number of temporary employees in each business category. Calculate the percents and the resulting allocations. Complete the percent and allocation columns in the following table. Before computing the distribution, round each percent to the nearest whole number. Labor Number of Percent Total Distribution Group Office/clerical Hotel/motel Restaurant/dining Hospital/medical Total: Employees of Total Rent of Rent $ 9,600.00 $ 9,600.00 110 130 170 $9,600.00 90 $9,600.00

Diane Thrift owns a personnel services company that provides temporary employees in four employment categories: (a) office/clerical; (b) hotel/motel; (c) restaurant/dining; and (d) hospital/medical. Ms. Thrift has organized her company into four departments, one for each category. The lease expense for her company office space is $9,600 per month. She allocates the monthly lease expense among the four departments based on the number of temporary employees in each business category. Calculate the percents and the resulting allocations. Complete the percent and allocation columns in the following table. Before computing the distribution, round each percent to the nearest whole number. Labor Number of Percent Total Distribution Group Office/clerical Hotel/motel Restaurant/dining Hospital/medical Total: Employees of Total Rent of Rent $ 9,600.00 $ 9,600.00 110 130 170 $9,600.00 90 $9,600.00

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 4.1C

Related questions

Question

Transcribed Image Text:Nrap Text

General

$- % 9 8 8

Merge & Center

Conditional Format as

Cell

Insert Delete Format

Formatting Table Styles

Number

Styles

Cells

device. To adjust your settings go to privacy settings.

K

Diane Thrift owns a personnel services company that provides temporary employees in four

6

employment categories: (a) office/clerical; (b) hotel/motel; (c) restaurant/dining; and (d)

hospital/medical. Ms. Thrift has organized her company into four departments, one for each category.

The lease expense for her company office space is $9,600 per month. She allocates the monthly

lease expense among the four departments based on the number of temporary employees in each

business category. Calculate the percents and the resulting allocations.

Complete the percent and allocation columns in the following table. Before computing the distribution,

round each percent to the nearest whole number.

Labor

Number of Percent

Total

Distribution

Group

Office/clerical

Employees of Total

Rent

of Rent

110

$9.600.00

Hotel/motel

130

$ 9,600.00

Restaurant/dining

Hospital/medical

Total:

170

$9.600.00

90

$9.600.00

囲

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage