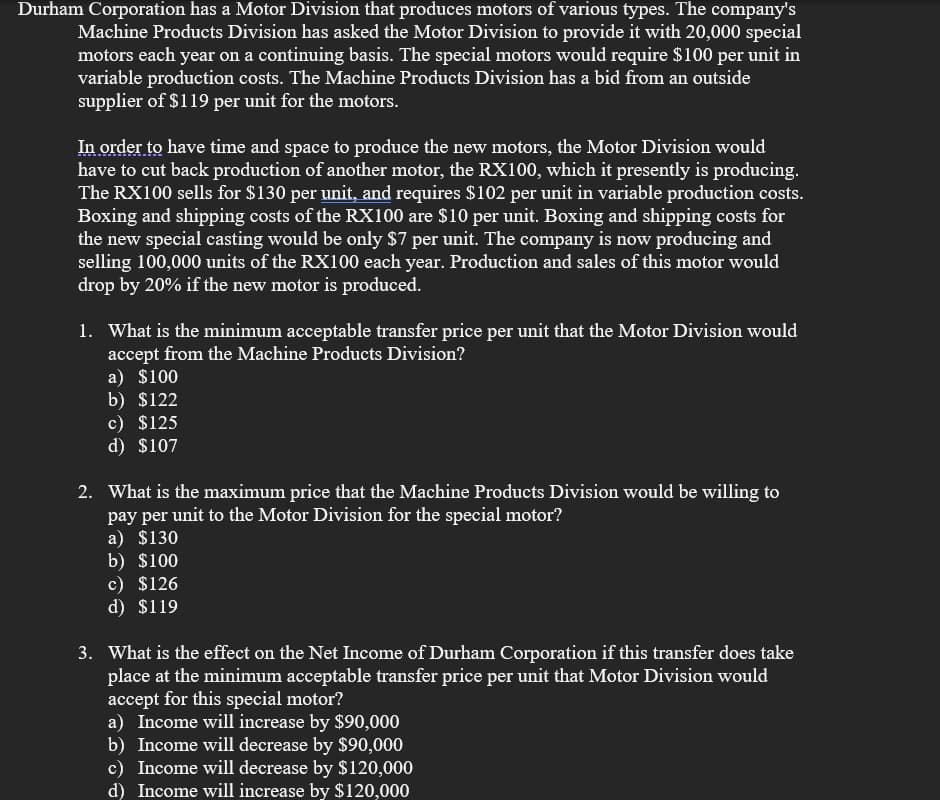

Durham Corporation has a Motor Division that produces motors of various types. The company's Machine Products Division has asked the Motor Division to provide it with 20,000 special motors each year on a continuing basis. The special motors would require $100 per unit in variable production costs. The Machine Products Division has a bid from an outside supplier of $119 per unit for the motors. In order to have time and space to produce the new motors, the Motor Division would have to cut back production of another motor, the RX100, which it presently is producing. The RX100 sells for $130 per unit, and requires $102 per unit in variable production costs. Boxing and shipping costs of the RX100 are $10 per unit. Boxing and shipping costs for the new special casting would be only $7 per unit. The company is now producing and selling 100,000 units of the RX100 each year. Production and sales of this motor would drop by 20% if the new motor is produced. 1. What is the minimum acceptable transfer price per unit that the Motor Division would accept from the Machine Products Division? a) $100 b) $122 c) $125 d) $107 2. What is the maximum price that the Machine Products Division would be willing to pay per unit to the Motor Division for the special motor? a) $130 b) $100 c) $126 d) $119 3. What is the effect on the Net Income of Durham Corporation if this transfer does take place at the minimum acceptable transfer price per unit that Motor Division would accept for this special motor? a) Income will increase by $90,000 b) Income will decrease by $90,000 c) Income will decrease by $120,000 d) Income will increase by $120,000

Durham Corporation has a Motor Division that produces motors of various types. The company's Machine Products Division has asked the Motor Division to provide it with 20,000 special motors each year on a continuing basis. The special motors would require $100 per unit in variable production costs. The Machine Products Division has a bid from an outside supplier of $119 per unit for the motors. In order to have time and space to produce the new motors, the Motor Division would have to cut back production of another motor, the RX100, which it presently is producing. The RX100 sells for $130 per unit, and requires $102 per unit in variable production costs. Boxing and shipping costs of the RX100 are $10 per unit. Boxing and shipping costs for the new special casting would be only $7 per unit. The company is now producing and selling 100,000 units of the RX100 each year. Production and sales of this motor would drop by 20% if the new motor is produced. 1. What is the minimum acceptable transfer price per unit that the Motor Division would accept from the Machine Products Division? a) $100 b) $122 c) $125 d) $107 2. What is the maximum price that the Machine Products Division would be willing to pay per unit to the Motor Division for the special motor? a) $130 b) $100 c) $126 d) $119 3. What is the effect on the Net Income of Durham Corporation if this transfer does take place at the minimum acceptable transfer price per unit that Motor Division would accept for this special motor? a) Income will increase by $90,000 b) Income will decrease by $90,000 c) Income will decrease by $120,000 d) Income will increase by $120,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 4CE

Related questions

Question

100%

Transcribed Image Text:Durham Corporation has a Motor Division that produces motors of various types. The company's

Machine Products Division has asked the Motor Division to provide it with 20,000 special

motors each year on a continuing basis. The special motors would require $100 per unit in

variable production costs. The Machine Products Division has a bid from an outside

supplier of $119 per unit for the motors.

In order to have time and space to produce the new motors, the Motor Division would

have to cut back production of another motor, the RX100, which it presently is producing.

The RX100 sells for $130 per unit, and requires $102 per unit in variable production costs.

Boxing and shipping costs of the RX100 are $10 per unit. Boxing and shipping costs for

the new special casting would be only $7 per unit. The company is now producing and

selling 100,000 units of the RX100 each year. Production and sales of this motor would

drop by 20% if the new motor is produced.

1. What is the minimum acceptable transfer price per unit that the Motor Division would

accept from the Machine Products Division?

a) $100

b) $122

c) $125

d) $107

2. What is the maximum price that the Machine Products Division would be willing to

pay per unit to the Motor Division for the special motor?

a) $130

b) $100

c) $126

d) $119

3. What is the effect on the Net Income of Durham Corporation if this transfer does take

place at the minimum acceptable transfer price per unit that Motor Division would

accept for this special motor?

a) Income will increase by $90,000

b) Income will decrease by $90,000

c) Income will decrease by $120,000

d) Income will increase by $120,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning