EXERCISE 8-2. CLASSIFICATION OF INCOME. REQUIREMENTS: I Classify the following income into (A) Self-Employment (B) Passive subject to final withholding tax (C) Compensation, It On the following income, write (Y) if the taxpayer can avail of the 8% income tax rate, and (N) if the taxpayer cannot avail of the 8% income tax rate 1 Rent income of apartment 2 Gain on sale of a commercial building 3. Gain on sale of residential house 4. Income as street vendor 5 Income of a junk shop owner 6 Interest on peso deposit with Bank of the Philippine Islands 7. Royalty as book author

EXERCISE 8-2. CLASSIFICATION OF INCOME. REQUIREMENTS: I Classify the following income into (A) Self-Employment (B) Passive subject to final withholding tax (C) Compensation, It On the following income, write (Y) if the taxpayer can avail of the 8% income tax rate, and (N) if the taxpayer cannot avail of the 8% income tax rate 1 Rent income of apartment 2 Gain on sale of a commercial building 3. Gain on sale of residential house 4. Income as street vendor 5 Income of a junk shop owner 6 Interest on peso deposit with Bank of the Philippine Islands 7. Royalty as book author

Chapter1: An Introducti On To Taxation And Understa Nding The Federal Tax Law

Section: Chapter Questions

Problem 48DQ

Related questions

Question

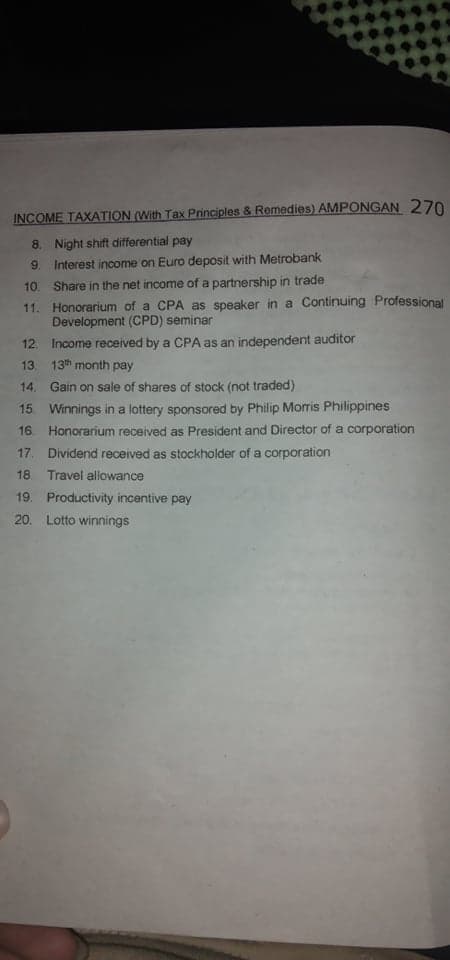

Transcribed Image Text:INCOME TAXATION (With Tax Principles & Remedies) AMPONGAN 270

8. Night shift differential pay

9.

Interest income on Euro deposit with Metrobank

10. Share in the net income of a partnership in trade

11.

Honorarium of a CPA as speaker in a Continuing Professional

Development (CPD) seminar

Income received by a CPA as an independent auditor

13. 13th month pay

12

14. Gain on sale of shares of stock (not traded)

15. Winnings in a lottery sponsored by Philip Morris Philippines

16. Honorarium received as President and Director of a corporation

17. Dividend received as stockholder of a corporation

18

Travel allowance

19. Productivity incentive pay

20. Lotto winnings

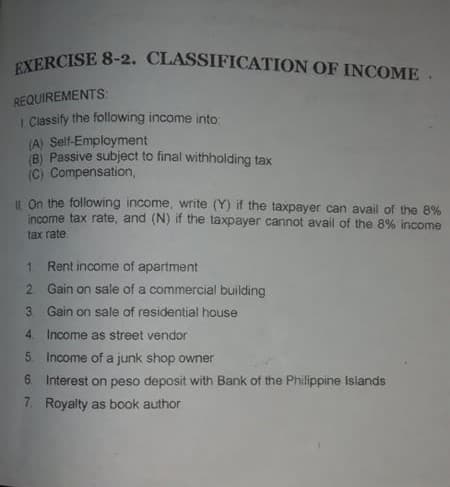

Transcribed Image Text:EXERCISE 8-2. CLASSIFICATION OF INCOME.

REQUIREMENTS:

I Classify the following income into

(A) Self-Employment

B) Passive subject to final withholding tax

(C) Compensation,

IL On the following income, write (Y) if the taxpayer can avail of the 8%

income tax rate, and (N) if the taxpayer cannot avail of the 8% income

tax rate

1.

Rent income of apartment

2 Gain on sale of a commercial building

3 Gain on sale of residential house

4. Income as street vendor

5 Income of a junk shop owner

6. Interest on peso deposit with Bank of the Philippine Islands

7. Royalty as book author

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT