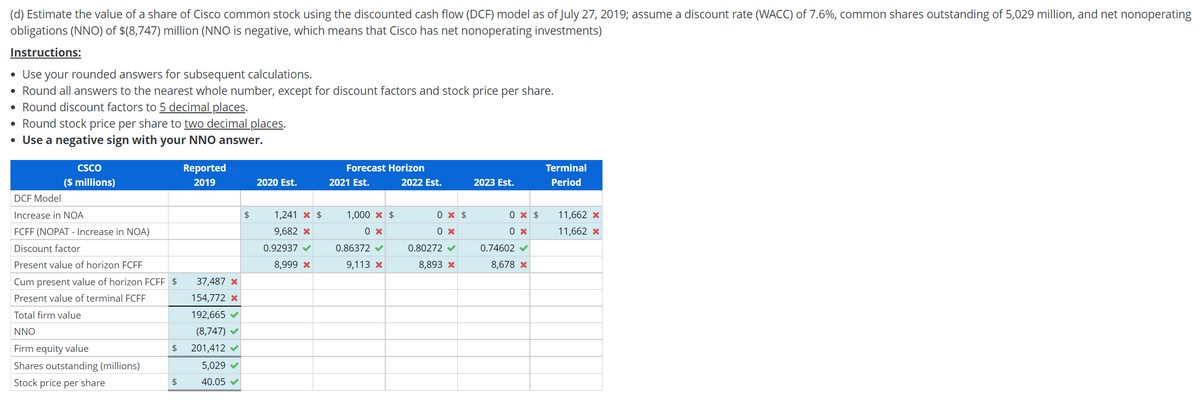

(d) Estimate the value of a share of Cisco common stock using the discounted cash flow (DCF) model as of July 27, 2019; assume a discount rate (WACC) of 7.6%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(8,747) million (NNO is negative, which means that Cisco has net nonoperating investments) Instructions: • Use your rounded answers for subsequent calculations. • Round all answers to the nearest whole number, except for discount factors and stock price per share. • Round discount factors to 5 decimal places. Round stock price per share to two decimal places. • Use a negative sign with your NNO answer. CSCO Reported Forecast Horizon Terminal ($ millions) 2019 2020 Est. 2021 Est. 2022 Est. 2023 Est. Period DCF Model Increase in NOA $ 1,241 x $ 1,000 x $ 0 x $ 0 x $ 11,662 x FCFF (NOPAT - Increase in NOA) 9,682 x 0 x 0 x 11,662 x Discount factor 0.92937 V 0.86372 v 0.80272 v 0.74602 v Present value of horizon FCFF 8,999 x 9,113 * 8,893 * 8,678 x Cum present value of horizon FCFF $ 37,487 * Present value of terminal FCFF 154,772 * Total firm value 192,665 v NNO (8,747) V Firm equity value 2$ 201,412 v Shares outstanding (millions) 5,029 v Stock price per share 40.05 V

(d) Estimate the value of a share of Cisco common stock using the discounted cash flow (DCF) model as of July 27, 2019; assume a discount rate (WACC) of 7.6%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(8,747) million (NNO is negative, which means that Cisco has net nonoperating investments) Instructions: • Use your rounded answers for subsequent calculations. • Round all answers to the nearest whole number, except for discount factors and stock price per share. • Round discount factors to 5 decimal places. Round stock price per share to two decimal places. • Use a negative sign with your NNO answer. CSCO Reported Forecast Horizon Terminal ($ millions) 2019 2020 Est. 2021 Est. 2022 Est. 2023 Est. Period DCF Model Increase in NOA $ 1,241 x $ 1,000 x $ 0 x $ 0 x $ 11,662 x FCFF (NOPAT - Increase in NOA) 9,682 x 0 x 0 x 11,662 x Discount factor 0.92937 V 0.86372 v 0.80272 v 0.74602 v Present value of horizon FCFF 8,999 x 9,113 * 8,893 * 8,678 x Cum present value of horizon FCFF $ 37,487 * Present value of terminal FCFF 154,772 * Total firm value 192,665 v NNO (8,747) V Firm equity value 2$ 201,412 v Shares outstanding (millions) 5,029 v Stock price per share 40.05 V

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Please answer this question

Transcribed Image Text:(d) Estimate the value of a share of Cisco common stock using the discounted cash flow (DCF) model as of July 27, 2019; assume a discount rate (WACC) of 7.6%, common shares outstanding of 5,029 million, and net nonoperating

obligations (NNO) of $(8,747) million (NNO is negative, which means that Cisco has net nonoperating investments)

Instructions:

• Use your rounded answers for subsequent calculations.

• Round all answers to the nearest whole number, except for discount factors and stock price per share.

• Round discount factors to 5 decimal places.

Round stock price per share to two decimal places.

• Use a negative sign with your NNO answer.

CSCO

Reported

Forecast Horizon

Terminal

($ millions)

2019

2020 Est.

2021 Est.

2022 Est.

2023 Est.

Period

DCF Model

Increase in NOA

$

1,241 x $

1,000 x $

0 x $

0 x $

11,662 x

FCFF (NOPAT - Increase in NOA)

9,682 x

0 x

0 x

11,662 x

Discount factor

0.92937 V

0.86372 v

0.80272 v

0.74602 v

Present value of horizon FCFF

8,999 x

9,113 *

8,893 *

8,678 x

Cum present value of horizon FCFF $

37,487 *

Present value of terminal FCFF

154,772 *

Total firm value

192,665 v

NNO

(8,747) V

Firm equity value

2$

201,412 v

Shares outstanding (millions)

5,029 v

Stock price per share

40.05 V

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman