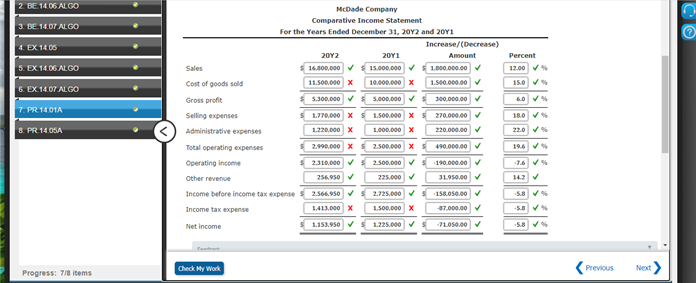

For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparative income statement: McDade Company Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 16,800,000 $ 15,000,000 Cost of goods sold (11,500,000) (10,000,000) Gross profit $ 5,300,000 $ 5,000,000 Selling expenses $ (1,770,000) $ (1,500,000) Administrative expenses (1,220,000) (1,000,000) Total operating expenses $ (2,990,000) $ (2,500,000) Operating income $ 2,310,000 $ 2,500,000 Other revenue 256,950 225,000 Income before income tax expense $ 2,566,950 $ 2,725,000 Income tax expense (1,413,000) (1,500,000) Net income $ 1,153,950 $ 1,225,000 1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Round percentages to one decimal place. For those boxes in which you must enter subtracted or negative numbers use a minus sign. (Picture attached for the chart)

For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparative income statement: McDade Company Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 16,800,000 $ 15,000,000 Cost of goods sold (11,500,000) (10,000,000) Gross profit $ 5,300,000 $ 5,000,000 Selling expenses $ (1,770,000) $ (1,500,000) Administrative expenses (1,220,000) (1,000,000) Total operating expenses $ (2,990,000) $ (2,500,000) Operating income $ 2,310,000 $ 2,500,000 Other revenue 256,950 225,000 Income before income tax expense $ 2,566,950 $ 2,725,000 Income tax expense (1,413,000) (1,500,000) Net income $ 1,153,950 $ 1,225,000 1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Round percentages to one decimal place. For those boxes in which you must enter subtracted or negative numbers use a minus sign. (Picture attached for the chart)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.17E: Profitability metrics The following selected data were taken from the financial statements of The...

Related questions

Question

100%

Horizontal analysis of income statement

(What did I do wrong? Anyone know the correct answers to the ones I got wrong?)

For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparative income statement:

| McDade Company | ||

| Comparative Income Statement | ||

| For the Years Ended December 31, 20Y2 and 20Y1 | ||

| 20Y2 | 20Y1 | |

| Sales | $ 16,800,000 | $ 15,000,000 |

| Cost of goods sold | (11,500,000) | (10,000,000) |

| Gross profit | $ 5,300,000 | $ 5,000,000 |

| Selling expenses | $ (1,770,000) | $ (1,500,000) |

| Administrative expenses | (1,220,000) | (1,000,000) |

| Total operating expenses | $ (2,990,000) | $ (2,500,000) |

| Operating income | $ 2,310,000 | $ 2,500,000 |

| Other revenue | 256,950 | 225,000 |

| Income before income tax expense | $ 2,566,950 | $ 2,725,000 |

| Income tax expense | (1,413,000) | (1,500,000) |

| Net income | $ 1,153,950 | $ 1,225,000 |

1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Round percentages to one decimal place. For those boxes in which you must enter subtracted or negative numbers use a minus sign. (Picture attached for the chart)

Transcribed Image Text:2. BE 14.06 ALGO

McDade Company

Comparative Income Statement

3. BE 14.07 ALGO

For the Years Ended December 31, 20Y2 and 20Y1

Increase/(Decrease)

4. EX 14 05

20Y2

20Y1

Amount

Percent

16.800.000 v

11.500.000 x

5. EX 14.06 ALGO

15.000.000

10.000.000 x

Sales

1000.000.00

12.00

Cost of goods sold

1.500.000.00 v

15.0 v

6. EX 14.07 ALGO

Gross profit

5.000.000 v 300.000.00

6.0 v

5.300.000

7. PR.14.01A

1.770.000 x s 1.500.000 xS 270.000.00 v

18.0

22.0 v%

Selling expenses

8. PR14.0SA

Administrative expenses

1.220,000 X

220.000.00V

1.000,000 X

Total operating expenses

2.990.000 x

2.500.000 X

490.000.00

19.6 v

Operating income

2310.000

2.500,000 v s 190.000.00 v

1.6 v

254.950

225.000 V

31950.00

Other revenue

142

Income before income tax expense

2.566.950

2.725.000 v

158.050.00

Income tax expense

1413.000 x

1.500.000 x

47.000.00 v

Net income

1.153.950

1.225.000

-71.050.00

Check My Work

Previous

Next

Progress: 7/ items

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning