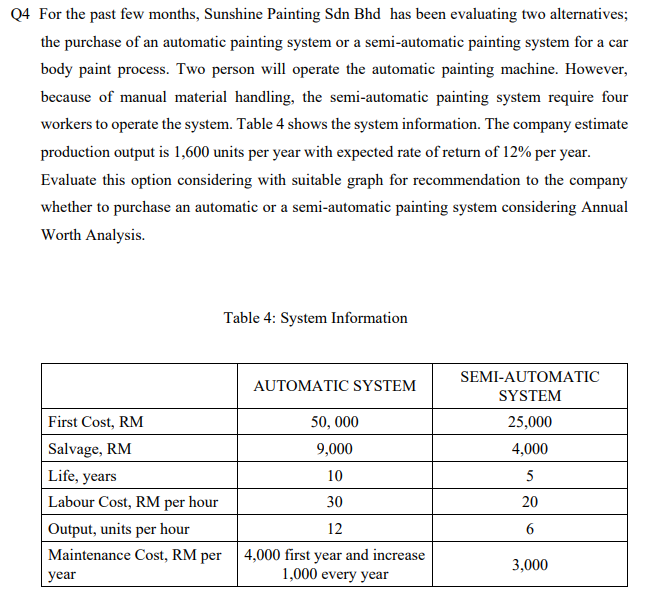

For the past few months, Sunshine Painting Sdn Bhd has been evaluating two alternatives; the purchase of an automatic painting system or a semi-automatic painting system for a car body paint process. Two person will operate the automatic painting machine. However, because of manual material handling, the semi-automatic painting system require four workers to operate the system. Table 4 shows the system information. The company estimate production output is 1,600 units per year with expected rate of return of 12% per year. Evaluate this option considering with suitable graph for recommendation to the company whether to purchase an automatic or a semi-automatic painting system considering Annual Worth Analysis. Table 4: System Information SEMI-AUTOMATIC AUTOMATIC SYSTEM SYSTEM First Cost, RM 50, 000 25,000 Salvage, RM 9,000 4,000 Life, years 10 5 Labour Cost, RM per hour 30 20 Output, units per hour 12 Maintenance Cost, RM per 4,000 first year and increase 1,000 every year 3,000 year

For the past few months, Sunshine Painting Sdn Bhd has been evaluating two alternatives; the purchase of an automatic painting system or a semi-automatic painting system for a car body paint process. Two person will operate the automatic painting machine. However, because of manual material handling, the semi-automatic painting system require four workers to operate the system. Table 4 shows the system information. The company estimate production output is 1,600 units per year with expected rate of return of 12% per year. Evaluate this option considering with suitable graph for recommendation to the company whether to purchase an automatic or a semi-automatic painting system considering Annual Worth Analysis. Table 4: System Information SEMI-AUTOMATIC AUTOMATIC SYSTEM SYSTEM First Cost, RM 50, 000 25,000 Salvage, RM 9,000 4,000 Life, years 10 5 Labour Cost, RM per hour 30 20 Output, units per hour 12 Maintenance Cost, RM per 4,000 first year and increase 1,000 every year 3,000 year

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 8P: The production of a new product required Zion Manufacturing Co. to lease additional plant...

Related questions

Question

Transcribed Image Text:Q4 For the past few months, Sunshine Painting Sdn Bhd has been evaluating two alternatives;

the purchase of an automatic painting system or a semi-automatic painting system for a car

body paint process. Two person will operate the automatic painting machine. However,

because of manual material handling, the semi-automatic painting system require four

workers to operate the system. Table 4 shows the system information. The company estimate

production output is 1,600 units per year with expected rate of return of 12% per year.

Evaluate this option considering with suitable graph for recommendation to the company

whether to purchase an automatic or a semi-automatic painting system considering Annual

Worth Analysis.

Table 4: System Information

SEMI-AUTOMATIC

AUTOMATIC SYSTEM

SYSTEM

First Cost, RM

50, 000

25,000

Salvage, RM

9,000

4,000

Life, years

10

5

Labour Cost, RM per hour

30

20

Output, units per hour

12

Maintenance Cost, RM per 4,000 first year and increase

1,000 every year

3,000

year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning