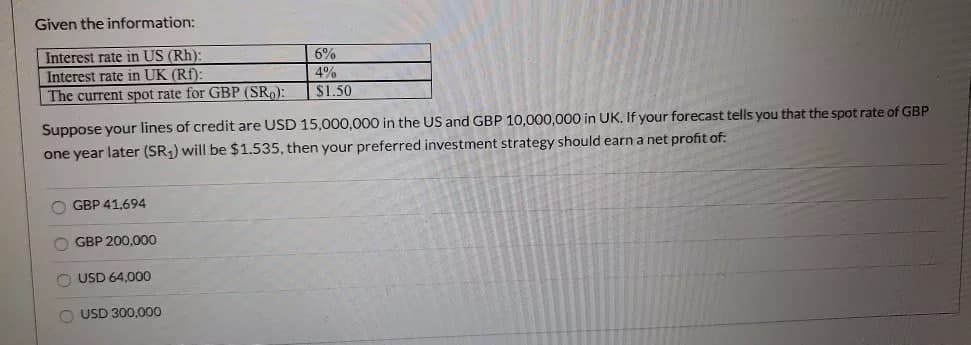

Given the information: Interest rate in US (Rh): Interest rate in UK (Rf): The current spot rate for GBP (SR₂): Suppose your lines of credit are USD 15,000,000 in the US and GBP 10,000,000 in UK. If your forecast tells you that the spot rate of GBP one year later (SR₁) will be $1.535, then your preferred investment strategy should earn a net profit of: GBP 41,694 GBP 200,000 USD 64,000 6% 4% $1.50 USD 300,000

Given the information: Interest rate in US (Rh): Interest rate in UK (Rf): The current spot rate for GBP (SR₂): Suppose your lines of credit are USD 15,000,000 in the US and GBP 10,000,000 in UK. If your forecast tells you that the spot rate of GBP one year later (SR₁) will be $1.535, then your preferred investment strategy should earn a net profit of: GBP 41,694 GBP 200,000 USD 64,000 6% 4% $1.50 USD 300,000

Chapter20: Monetary Policy

Section: Chapter Questions

Problem 3SQP

Related questions

Question

Transcribed Image Text:Given the information:

Interest rate in US (Rh):

Interest rate in UK (Rf):

The current spot rate for GBP (SR₂):

Suppose your lines of credit are USD 15,000,000 in the US and GBP 10,000,000 in UK. If your forecast tells you that the spot rate of GBP

one year later (SR₁) will be $1.535, then your preferred investment strategy should earn a net profit of:

OGBP 41,694

OGBP 200,000

USD 64,000

6%

4%

$1.50

O USD 300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning