Hello can I find the Total asset turnover ratio, Fixed asset turnover ratio, Receivables turnover ratio, Inventory turnover ratio, Accounts payable turnover ratio, and Cash conversion cycle length for 2021 and 2020?

Hello can I find the Total asset turnover ratio, Fixed asset turnover ratio, Receivables turnover ratio, Inventory turnover ratio, Accounts payable turnover ratio, and Cash conversion cycle length for 2021 and 2020?

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 13MC: A responsibility center structure that considers investments made by the operating segments by using...

Related questions

Question

Hello can I find the Total asset turnover ratio, Fixed asset turnover ratio, Receivables turnover ratio, Inventory turnover ratio, Accounts payable turnover ratio, and Cash conversion cycle length for 2021 and 2020?

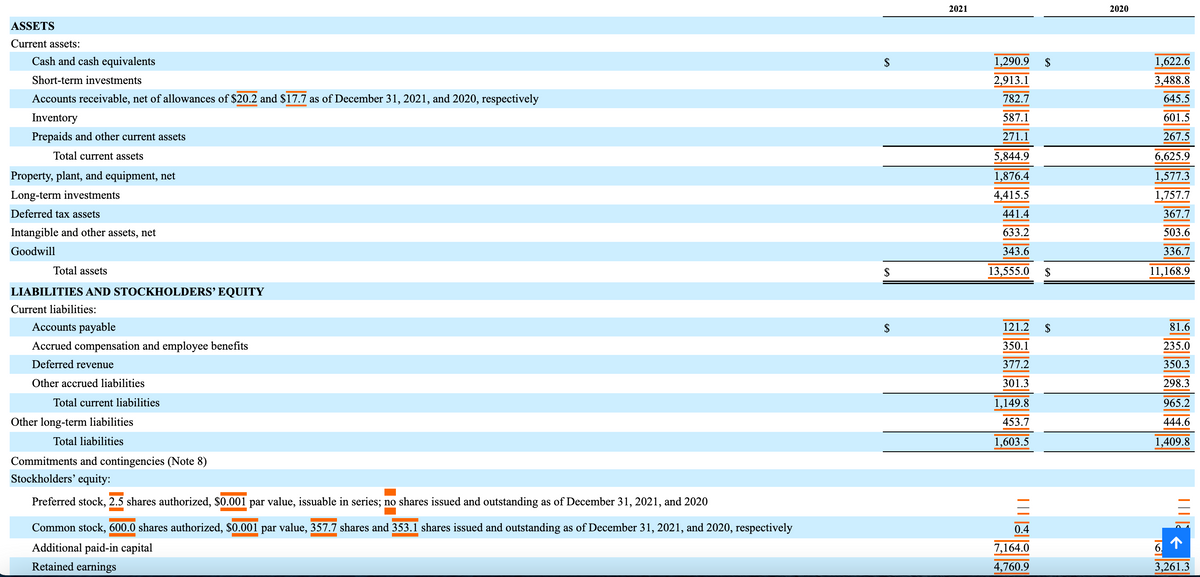

Transcribed Image Text:ASSETS

Current assets:

Cash and cash equivalents

Short-term investments

Accounts receivable, net of allowances of $20.2 and $17.7 as of December 31, 2021, and 2020, respectively

Inventory

Prepaids and other current assets

Total current assets

Property, plant, and equipment, net

Long-term investments

Deferred tax assets

Intangible and other assets, net

Goodwill

Total assets

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

Accrued compensation and employee benefits

Deferred revenue

Other accrued liabilities

Total current liabilities

Other long-term liabilities

Total liabilities

Commitments and contingencies (Note 8)

Stockholders' equity:

Preferred stock, 2.5 shares authorized, $0.001 par value, issuable in series; no shares issued and outstanding as of December 31, 2021, and 2020

Common stock, 600.0 shares authorized, $0.001 par value, 357.7 shares and 353.1 shares issued and outstanding as of December 31, 2021, and 2020, respectively

Additional paid-in capital

Retained earnings

$

2021

1,290.9

2,913.1

782.7

587.1

271.1

5,844.9

1,876.4

4,415.5

441.4

633.2

343.6

13,555.0

121.2

350.1

377.2

301.3

1,149.8

453.7

1,603.5

=

0.4

7,164.0

4,760.9

$

$

$

2020

1,622.6

3,488.8

645.5

601.5

267.5

6,625.9

1,577.3

1,757.7

367.7

503.6

336.7

11,168.9

81.6

235.0

350.3

298.3

965.2

444.6

1,409.8

BLITT

6.

3,261.3

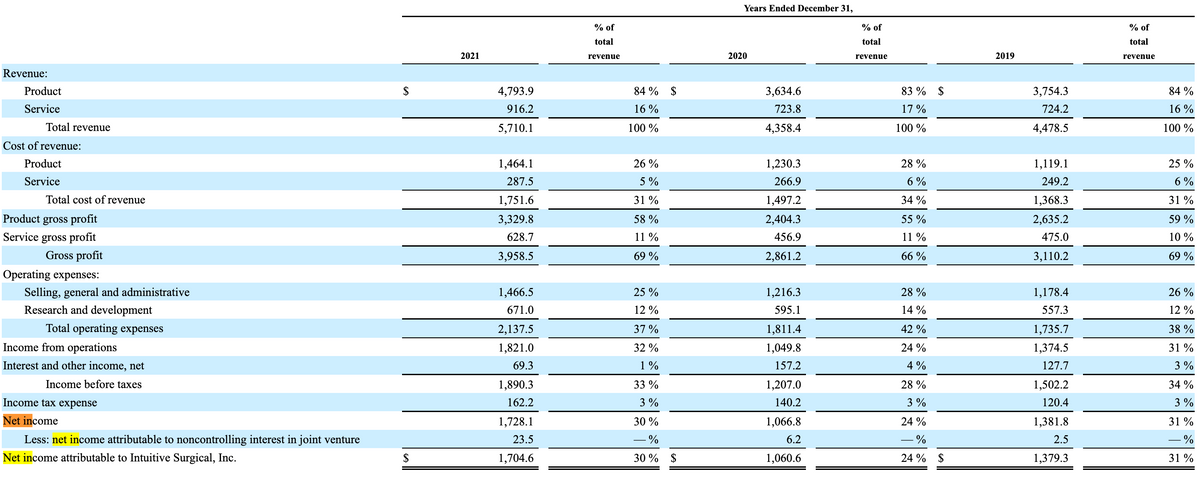

Transcribed Image Text:Revenue:

Product

Service

Total revenue

Cost of revenue:

Product

Service

Total cost of revenue

Product gross profit

Service gross profit

Gross profit

Operating expenses:

Selling, general and administrative

Research and development

Total operating expenses

Income from operations

Interest and other income, net

Income before taxes

Income tax expense

Net income

Less: net income attributable to noncontrolling interest in joint venture

Net income attributable to Intuitive Surgical, Inc.

$

$

2021

4,793.9

916.2

5,710.1

1,464.1

287.5

1,751.6

3,329.8

628.7

3,958.5

1,466.5

671.0

2,137.5

1,821.0

69.3

1,890.3

162.2

1,728.1

23.5

1,704.6

% of

total

revenue

84% $

16%

100 %

26%

5%

31%

58 %

11%

69 %

25 %

12%

37%

32%

1%

33 %

3%

30%

- %

30% $

Years Ended December 31,

2020

3,634.6

723.8

4,358.4

1,230.3

266.9

1,497.2

2,404.3

456.9

2,861.2

1,216.3

595.1

1,811.4

1,049.8

157.2

1,207.0

140.2

1,066.8

6.2

1,060.6

% of

total

revenue

83% $

17%

100 %

28 %

6%

34%

55 %

11%

66 %

28%

14%

42%

24 %

4%

28%

3%

24 %

-%

24% $

2019

3,754.3

724.2

4,478.5

1,119.1

249.2

1,368.3

2,635.2

475.0

3,110.2

1,178.4

557.3

1,735.7

1,374.5

127.7

1,502.2

120.4

1,381.8

2.5

1,379.3

% of

total

revenue

84 %

16%

100%

25%

6%

31%

59%

10%

69%

26%

12%

38 %

31%

3%

34%

3%

31%

-%

31%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning