hich one of t pital accoun qi thwa? O A. 147

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Please assist with the following questions

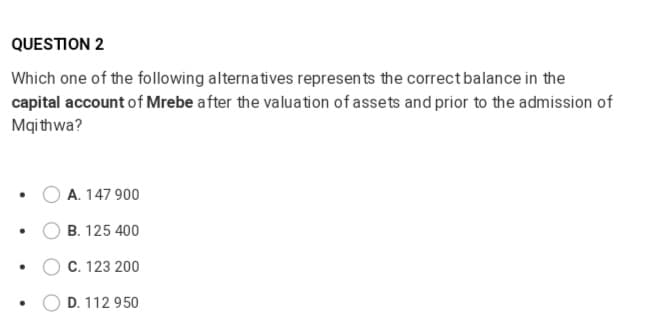

Transcribed Image Text:QUESTION 2

Which one of the following alternatives represen ts the correctbalance in the

capital account of Mrebe after the valuation of assets and prior to the admission of

Mqi thwa?

A. 147 900

B. 125 400

C. 123 200

D. 112 950

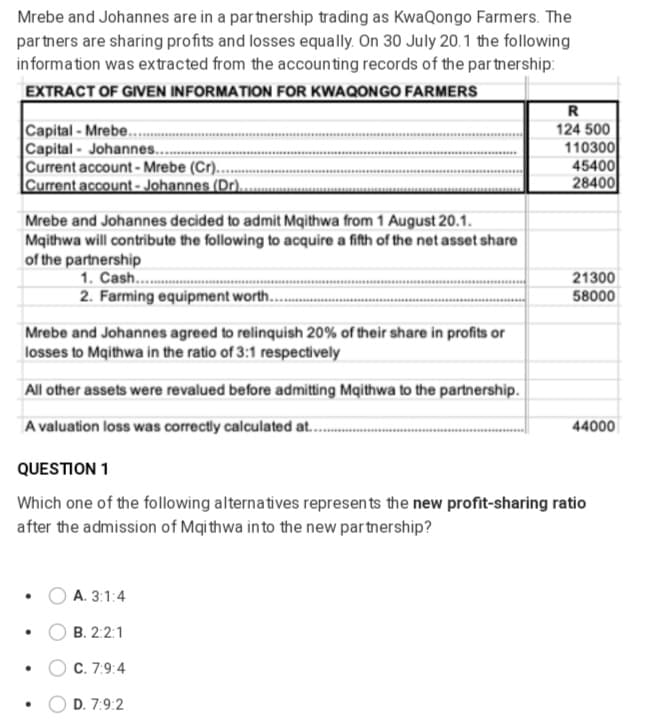

Transcribed Image Text:Mrebe and Johannes are in a partnership trading as KwaQongo Farmers. The

par tners are sharing profits and losses equally. On 30 July 20.1 the following

information was extracted from the accounting records of the partnership:

EXTRACT OF GIVEN INFORMATION FOR KWAQONGO FARMERS

Capital - Mrebe...

Capital - Johannes...

Current account - Mrebe (Cr)..

Current account- Johannes (Dr).

R

124 500

110300

45400

28400

Mrebe and Johannes decided to admit Mqithwa from 1 August 20.1.

Mqithwa will contribute the following to acquire a fifth of the net asset share

of the partnership

1. Cash..

21300

58000

2. Farming equipment worth..

Mrebe and Johannes agreed to relinquish 20% of their share in profits or

losses to Mqithwa in the ratio of 3:1 respectively

All other assets were revalued before admitting Mqithwa to the partnership.

A valuation loss was correctly calculated at...

44000

QUESTION 1

Which one of the following alternatives represents the new profit-sharing ratio

after the admission of Mqi thwa in to the new partnership?

A. 3:1:4

B. 2:2:1

C. 7:9:4

D. 7:9:2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College