a) Calculate the net present value for both projects. Answer to the nearest cent b) Find the internal rate of return for both projects. Answer as a percent to 2 decimals. c) Which of these projects you would choose to invest in and why?

a) Calculate the net present value for both projects. Answer to the nearest cent b) Find the internal rate of return for both projects. Answer as a percent to 2 decimals. c) Which of these projects you would choose to invest in and why?

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 9CQ

Related questions

Question

Please provide clear workout and correct solution. Greatly Appreciated!

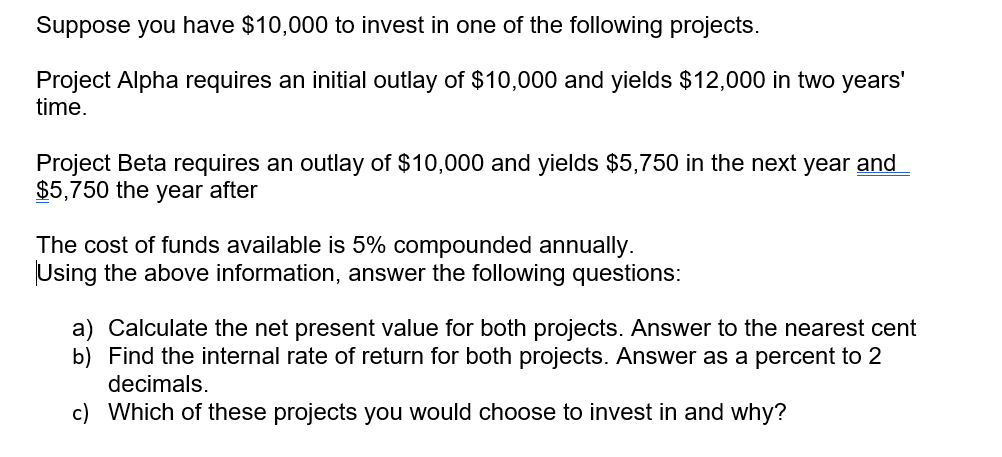

Transcribed Image Text:Suppose you have $10,000 to invest in one of the following projects.

Project Alpha requires an initial outlay of $10,000 and yields $12,000 in two years'

time.

Project Beta requires an outlay of $10,000 and yields $5,750 in the next year and

$5,750 the year after

The cost of funds available is 5% compounded annually.

Using the above information, answer the following questions:

a) Calculate the net present value for both projects. Answer to the nearest cent

b) Find the internal rate of return for both projects. Answer as a percent to

decimals.

c) Which of these projects you would choose to invest in and why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 26 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I was told that the

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning