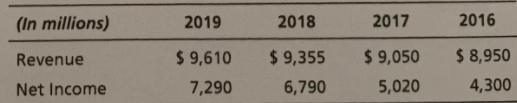

(In millions) 2019 2018 2017 2016 Revenue $ 9,610 $ 9,355 $ 9,050 $ 8,950 Net Income 7,290 6,790 5,020 4,300

Q: JFK Company's data for the year 2019 and 2020 2020 2019 Cash 4,000 14,000 Accounts Receivable 25,000…

A: Cash flows from operating, financing, and investing activities can be calculated by direct and…

Q: Use the following Information to answer this question. Windswept, Inc. 2017 Income Statement ($ in…

A: The question is related to Cash Coverage Ratio for the year 2017. The Cash Coverage is calculated…

Q: Net income was $504,500 in 2020, $489,000 in 2021, and $526,500 in 2022. What is the percentage of…

A: Percentage change in net income from year 2020 to 2021 = (Change in net income between 2020 to…

Q: Figures are in millions. Total assets Total liabilities Net sales Net income December 31, 2019…

A: Total asset in year 2019=$930.90 millions Total asset in year 2018=$920.10 millions Asset…

Q: _1. On 2020, an entity made cash sales of P3,000,000. It paid P1,000,000 in expenses and owed…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Kingbird, Inc. reported income taxes of $421,800,000 on its 2022 income statement and income taxes…

A: Tax means the mandatory payment made by assesse to the government without expecting anything…

Q: CALCULATE THE INTEREST COVERAGE RATIO. For the year ended December 31, Notes 2020 2019…

A: An Interest Coverage Ratio seems to be a profitability measure often used to evaluate a firm's…

Q: Given this information: 2019 2020 2019 2020 Cash $2,400 $6,100 Accounts payable $7,700 $2,400…

A: The cash flow statement consists of operating, investing, and financing activities that depict the…

Q: #210 BALJEET Company reported the following information for the year ended December 31, 2020:…

A: Solution:- Preparation of the income statement of "BALJEET" Company for the year ended December 31,…

Q: ABC Inc. reported revenue of P1,980,000 in its income statement for the year ended December 31,…

A: The revenue reported on the income statement may contain credit sales and cash sales both. This…

Q: Yana Co. collected P15,000 interest during 2020. It showed P2,000 interestreceivable on its December…

A: Accrual system of accounting says that every thing which is accrued has to be provided in books of…

Q: TS Corp. collected P24,700 in interest during 2021. BTS showed P3,700 in interest receivable on its…

A: Solution: Interest revenue = Interest collected + ending interest receivable - beginning interest…

Q: Lan & Chen Technologies: Income Statements for Year Ending December 31…

A: Hey, since there are multiple sub-part questions posted, we will answer the first three questions.…

Q: O What happened to the company's return on assets and equity for the pasy five (5) years? 2016 2017…

A: The return on investment indicates the return on the amount of investment in assets, It also…

Q: As Reported Annual Income Statement Report Date Scale 2019 Thousands 2018 2017 Thousands Thousands…

A: Ratio analysis is a kind of analysis in which ratios are calculated to estimate the company’s…

Q: Lan & Chen Technologies: Income Statements for Year Ending December 31…

A: Hey, since there are multiple sub-part questions posted, we will answer the first three questions.…

Q: gures are in millions. Total assets Total liabilities Net sales Net income December 31, 2019 $930.90…

A: The ratio analysis helps to analyse the financial statements of the business on the basis of various…

Q: As Reported Annual Balance Sheet Report Date Scale 2018 Thousands 2016 Thousands 2019 2017 Thousands…

A: Formula: Quick ratio = Quick Assets / Current liabilities. Working capital = Current assets -…

Q: Ramakrishnan, Inc., reported 2021 net income of $20 million and depreciation of $2,700,000. The top…

A: Net Income = 20 million Depreciation = 2.7 million Increase in Cash and Marketable securities = 13…

Q: Arlington Corporation's financial statements (dollars and shares are in millions) are provided here.…

A: Working Capital: Working capital represents the capital required to finance the daily expenses of…

Q: ABC Inc. reported revenue of P1,980,000 in its income statement for the year ended December 31,…

A: The revenue reported on the income statement includes cash revenue and credit revenue both. The…

Q: This Information will be used for all questions: Selected Balance Sheet Information Year 2020…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: As Reported Annual Balance Sheet Report Date Scale 2019 2018 2017 2016 Thousands Thousands Thousands…

A: Formula: Working capital = Current Assets - Current liabilities.

Q: Dec. 31, 2019 $4,085,000 4,300,000 Dec. 31, 2018 $2,880,000 Total liabilities Total owner's equity…

A: The Liabilities to equity, otherwise commonly known as the Debt to Equity ratio measures the amount…

Q: Income Taxes 190,400 246,750 Net Income 353,600 458,250 Convert the above 2021 GAAP data to cash…

A: Net Cash flow refers to the total net amount of cash used and receives during a particular point of…

Q: he following information to answer this question. Windswept, Inc. 2017 Income Statement ($ in…

A: Quick ratio = Quick Assets / Current liabilities

Q: Ramakrishnan, Inc, reported 2021 net income of $20 million and depreciation of $2,700,000. The top…

A: The cash generated or used through operating activities of a business is known as cash flow from…

Q: Income Statement for the years ending 31 August: 2020…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: Walmart As Reported Annual Balance Sheet Report Date 2019 2018 2017 2016 Scale Thousands Thousands…

A: Inventory turnover ratio indicates about that how frequent an entity sale their finished inventory…

Q: INCOME STATEMENT, 2019 Sales $ 230,000 Costs 165,000 EBIT $ 65,000…

A: External financing is the means of financing through external means like bank, creditors or markets.…

Q: Financial information for Powell Panther Corporation is shown here. a. What was net operating…

A: The explanation is given as,

Q: Los Altos, Inc. Balance Sheet December 31, 2020 and 2019 (in millions) 2020 2019 Assets Current…

A: The quick ratio is calculated as ratio of liquid assets and current liabilities.

Q: CARDINAL FINANCIAL STATEMENTS in USD CY 2018 CY 2019 CY 2020 INCOME STATEMENT Revenue Interest…

A: Financial statement disclosures refer to the footnotes accompanying the financial statement. These…

Q: The current sections of Famous’s statements of financial position at December 31, 2019 and 2020, are…

A: Financial statements are the financial reports that depict the performance of the business during…

Q: Midnight Corporation's interest revenue for 2019 was P39,300. Accrued interest receivable on…

A: Accrual system of accounting says that every thing which is accrued has to be provided in books of…

Q: What are the firm's days' sales outstanding for 2018 and 2019? Income Statements ($ in millions)…

A: Days' sales Outstanding = 365 × Account Receivable / Sales 2018 (in million) 2019 (in…

Q: Given this information: 2019 2020 2019 2020 Cash $3,000 $4,20O Accounts payable $8,500 $5,100…

A: Cash collected during the year = Beginning Accounts receivable + Sales - Ending Accounts receivable

Q: The cash received for interest during 2020 was

A: Here interest recievable is an asset Interest revenue is recognized as and when it is recievable as…

Q: The comparative balance sheets for 2021 and 2020 are given below for Surmise Company. Net income for…

A: Cash flow is a financial statement that shows the amount of cash flowing in and out of the business…

Q: Please explain how you get the journal entries below. The DeVille Company reported pretax…

A: SNo. Particulars Amount ($) Amount ($) Year 2021 Income Tax Expense A/c To Income Tax payment…

Q: Holden Company reports Interest Expense of $325,000 on its 2020 Income Statement. Holden's Balance…

A: The following formula is being used for calculating the interest payment amount A Interest…

Q: Assume the company generated $3,400 in net operating profits after taxes. Using the information…

A: free cashflow formula: free cashflow = NOPAT - change in working capital - change in capex

Q: The income statement of Barela Corporation for 2020 included the following items: Interest income…

A: The Question requires us to calculate the cash paid for Salaries during 2020.

Q: 2018 2019 2020 Income before depreciation, amortization, interest, and taxes $1,598 $2,832 $3,618…

A: Formula: Debt to equity ratio = Total debts / Total shareholders equity Net debt as a percentage of…

Q: ________1. On 2020, an entity made cash sales of ₱3,000,000. It paid ₱1,000,000 in expenses and owed…

A: Net Profit = Sales - Total Expenses Note: Expense includes both cash expense and credit expense

Q: CARDINAL FINANCIAL STATEMENTS in USD CY 2018 CY 2019 CY 2020 INCOME STATEMENT Revenue Interest…

A: Balance sheet is the financial statement of a company. It helps in maintaining the records of…

Q: Use the following information to answer this question. Windswept, Inc. 2017 Income Statement ($ in…

A: The quick ratio is a part of the liquidity ratio. The liquidity ratio indicates the liquidity of the…

Q: Rhodes Corporation: Income Statements for Year Ending December 31 2019 2018 Sales 11,000,000…

A: Financial statements consists of the following:- Statement of Financial position; Income Statement;…

Q: ABC Inc. reported revenue of P1,980,000 in its income statement for the year ended December 31,…

A: Cash basis revenue for 2020 = Beginning Accounts receivable + revenue - Ending Accounts receivable

Q: The following data is given: December 31, 2021 2020 Cash $59,000 $49,500 Accounts receivable (net)…

A: I am answering the first 3 sub-parts of the question as per bartleby guidelines. Please re-submit…

Show trend perecntage as base year 2016.

Step by step

Solved in 2 steps with 2 images