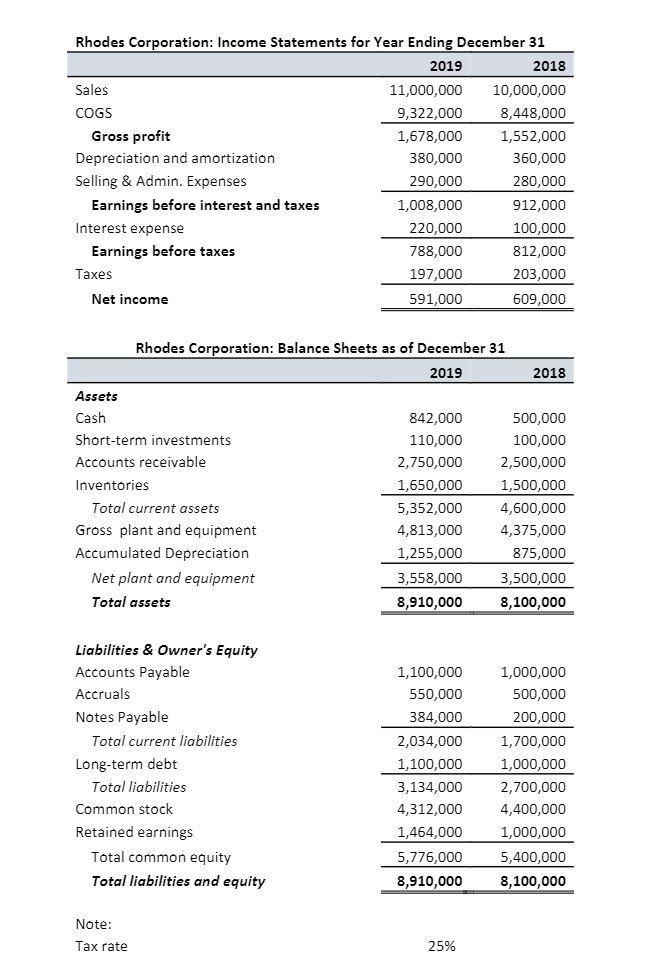

Rhodes Corporation: Income Statements for Year Ending December 31 2019 2018 Sales 11,000,000 10,000,000 COGS 9,322,000 8,448,000 Gross profit 1,678,000 1,552,000 Depreciation and amortization 380,000 360,000 Selling & Admin. Expenses 290,000 280,000 Earnings before interest and taxes 1,008,000 912,000 Interest expense 220,000 100,000 Earnings before taxes 788,000 812,000 Таxes 197,000 203,000 Net income 591,000 609,000 Rhodes Corporation: Balance Sheets as of December 31 2019 2018 Assets Cash 842,000 500,000 Short-term investments 110,000 100,000 Accounts receivable 2,750,000 2,500,000 Inventories 1,650,000 1,500,000 Total current assets 5,352,000 4,600,000 Gross plant and equipment 4,813,000 4,375,000 Accumulated Depreciation 1,255,000 875,000 Net plant and equipment 3,558,000 3,500,000 Total assets 8,910,000 8,100,000 Liabilities & Owner's Equity Accounts Payable 1,100,000 1,000,000 Accruals 550,000 500,000 Notes Payable 384,000 200,000 Total current liabilities 2,034,000 1,700,000 Long-term debt 1,100,000 1,000,000 Total liabilities 3,134,000 2,700,000 Common stock 4,312,000 4,400,000 Retained earnings 1,464,000 1,000,000 Total common equity 5,776,000 8,910,000 5,400,000 Total liabilities and equity 8,100,000 Note: Tax rate 25%

Rhodes Corporation: Income Statements for Year Ending December 31 2019 2018 Sales 11,000,000 10,000,000 COGS 9,322,000 8,448,000 Gross profit 1,678,000 1,552,000 Depreciation and amortization 380,000 360,000 Selling & Admin. Expenses 290,000 280,000 Earnings before interest and taxes 1,008,000 912,000 Interest expense 220,000 100,000 Earnings before taxes 788,000 812,000 Таxes 197,000 203,000 Net income 591,000 609,000 Rhodes Corporation: Balance Sheets as of December 31 2019 2018 Assets Cash 842,000 500,000 Short-term investments 110,000 100,000 Accounts receivable 2,750,000 2,500,000 Inventories 1,650,000 1,500,000 Total current assets 5,352,000 4,600,000 Gross plant and equipment 4,813,000 4,375,000 Accumulated Depreciation 1,255,000 875,000 Net plant and equipment 3,558,000 3,500,000 Total assets 8,910,000 8,100,000 Liabilities & Owner's Equity Accounts Payable 1,100,000 1,000,000 Accruals 550,000 500,000 Notes Payable 384,000 200,000 Total current liabilities 2,034,000 1,700,000 Long-term debt 1,100,000 1,000,000 Total liabilities 3,134,000 2,700,000 Common stock 4,312,000 4,400,000 Retained earnings 1,464,000 1,000,000 Total common equity 5,776,000 8,910,000 5,400,000 Total liabilities and equity 8,100,000 Note: Tax rate 25%

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

a) Recreate the income statement and balance sheet using formulas wherever possible. Each statement should be on a separate worksheet. Please show all dollar amount to thousands of dollars.

b) On another sheet, create a statement of cash flows for 2019. Do not enter any numbers directly on this sheet. All formulas should be linked directly to the source on previous worksheets.

Transcribed Image Text:Rhodes Corporation: Income Statements for Year Ending December 31

2019

2018

Sales

11,000,000

10,000,000

COGS

9,322,000

8,448,000

Gross profit

1,678,000

1,552,000

Depreciation and amortization

380,000

360,000

Selling & Admin. Expenses

290,000

280,000

Earnings before interest and taxes

1,008,000

912,000

Interest expense

220,000

100,000

Earnings before taxes

788,000

812,000

Taxes

197,000

203,000

Net income

591,000

609,000

Rhodes Corporation: Balance Sheets as of December 31

2019

2018

Assets

Cash

842,000

500,000

Short-term investments

110,000

100,000

Accounts receivable

2,750,000

2,50

Inventories

1,650,000

1,500,000

Total current assets

5,352,000

4,600,000

Gross plant and equipment

4,813,000

4,375,000

Accumulated Depreciation

1,255,000

875,000

Net plant and equipment

3,558,000

3,500,000

Total assets

8,910,000

8,100,000

Liabilities & Owner's Equity

Accounts Payable

1,100,000

1,000,000

Accruals

550,000

500,000

Notes Payable

384,000

200,000

Total current liabilities

2,034,000

1,700,000

Long-term debt

1,100,000

1,000,000

Total liabilities

3,134,000

2,700,000

Common stock

4,312,000

4,400,000

Retained earnings

1,464,000

1,000,000

Total common equity

5,776,000

5,400,000

Total liabilities and equity

8,910,000

8,100,000

Note:

Tax rate

25%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning