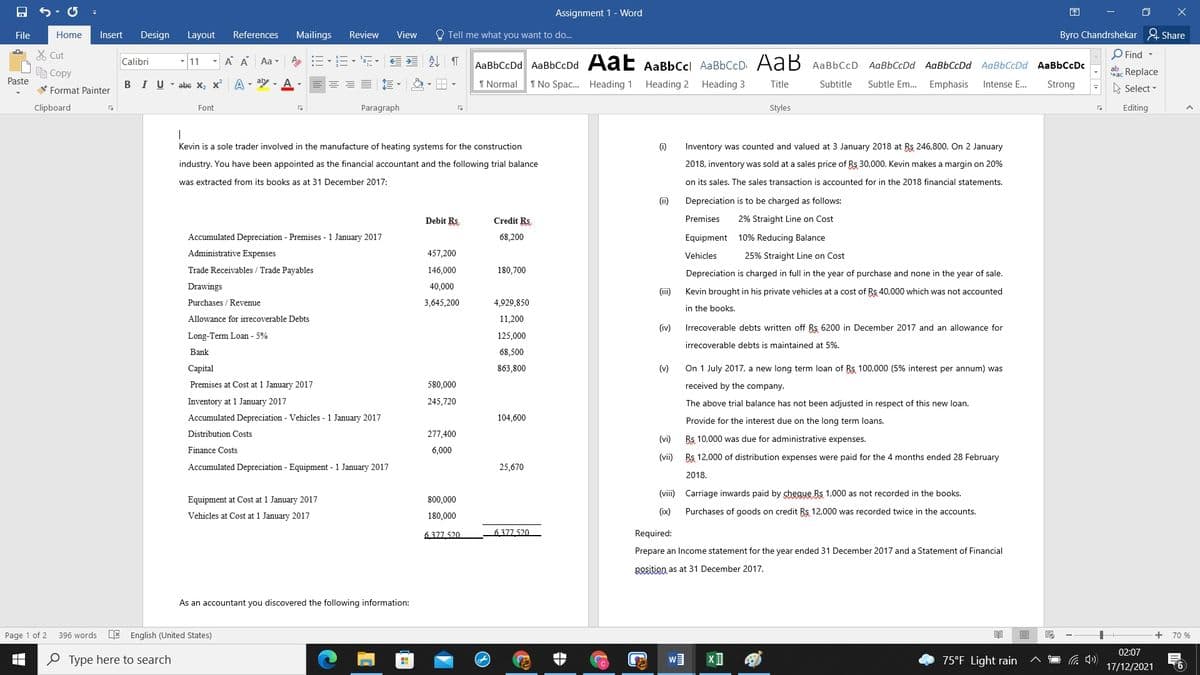

Kevin is a sole trader involved in the manufacture of heating systems for the construction Inventory was counted and valued at 3 January 2018 at Ba 246.800. On 2 January industry. You have been appointed as the financial accountant and the following trial balance 2018. inventory was sold at a sales price of Ba 30.000. Kevin makes a margin on 20% was extracted from its books as at 31 December 2017: on its sales. The sales transaction is accounted for in the 2018 financial statements. O Depreciation is to be charged as follows: Debit Rs. Credir Rs Premises 2% Straight Line on Cost Accumulated Depreciation - Premises - 1 January 2017 68,200 Equipment 10% Reducing Balance Administrative Expenses 457,200 Vehicles 25% Straight Line on Cost Trade Receivables / Trade Payables 146,000 180,700 Depreciation is charged in full in the year of purchase and none in the year of sale. Drawings Purchases / Revenue 40,000 O Kevin brought in his private vehicles at a cost of Bg 40.000 which was not accounted 3,645,200 4,929,850 in the books. Allowance for irecoverable Debts 11,200 (w) Irrecoverable debts written off Rs 6200 in December 2017 and an allowance for Long-Term Loan - 5% 125,000 irrecoverable debts is maintained at 5%. Bank 68,500 Capital 863,800 M On 1 July 2017, a new long term loan of Bs 100.000 (5% interest per annum) was Premises at Cost at 1 January 2017 580,000 received by the company. Inventory at 1 Jamuary 2017 245,720 The above trial balance has not been adjusted in respect of this new loan. Accumulated Depreciation - Vehicles - 1 January 2017 104,600 Provide for the interest due on the long term loans. Distribution Costs 277,400 (w) Bs 10.000 was due for administrative expenses. Finance Costs 6,000 (vii) Ba 12.000 of distribution expenses were paid for the 4 months ended 28 February Accumulated Depreciation - Equipment - 1 January 2017 25,670 2018. (vii) Carriage imwards paid by shesue Bs 1.000 as not recorded in the books. (0 Purchases of goods on credit Ba 12.000 was recorded twice in the accounts. Equipment at Cost at 1 January 2017 s00,000 Vehicles at Cost at 1 January 2017 180,000 327 520 6377 520 Required: Prepare an Income statement for the year ended 31 December 2017 and a Statement of Financial BRAtien as at 31 December 2017.

Kevin is a sole trader involved in the manufacture of heating systems for the construction Inventory was counted and valued at 3 January 2018 at Ba 246.800. On 2 January industry. You have been appointed as the financial accountant and the following trial balance 2018. inventory was sold at a sales price of Ba 30.000. Kevin makes a margin on 20% was extracted from its books as at 31 December 2017: on its sales. The sales transaction is accounted for in the 2018 financial statements. O Depreciation is to be charged as follows: Debit Rs. Credir Rs Premises 2% Straight Line on Cost Accumulated Depreciation - Premises - 1 January 2017 68,200 Equipment 10% Reducing Balance Administrative Expenses 457,200 Vehicles 25% Straight Line on Cost Trade Receivables / Trade Payables 146,000 180,700 Depreciation is charged in full in the year of purchase and none in the year of sale. Drawings Purchases / Revenue 40,000 O Kevin brought in his private vehicles at a cost of Bg 40.000 which was not accounted 3,645,200 4,929,850 in the books. Allowance for irecoverable Debts 11,200 (w) Irrecoverable debts written off Rs 6200 in December 2017 and an allowance for Long-Term Loan - 5% 125,000 irrecoverable debts is maintained at 5%. Bank 68,500 Capital 863,800 M On 1 July 2017, a new long term loan of Bs 100.000 (5% interest per annum) was Premises at Cost at 1 January 2017 580,000 received by the company. Inventory at 1 Jamuary 2017 245,720 The above trial balance has not been adjusted in respect of this new loan. Accumulated Depreciation - Vehicles - 1 January 2017 104,600 Provide for the interest due on the long term loans. Distribution Costs 277,400 (w) Bs 10.000 was due for administrative expenses. Finance Costs 6,000 (vii) Ba 12.000 of distribution expenses were paid for the 4 months ended 28 February Accumulated Depreciation - Equipment - 1 January 2017 25,670 2018. (vii) Carriage imwards paid by shesue Bs 1.000 as not recorded in the books. (0 Purchases of goods on credit Ba 12.000 was recorded twice in the accounts. Equipment at Cost at 1 January 2017 s00,000 Vehicles at Cost at 1 January 2017 180,000 327 520 6377 520 Required: Prepare an Income statement for the year ended 31 December 2017 and a Statement of Financial BRAtien as at 31 December 2017.

Chapter7: Payroll

Section: Chapter Questions

Problem 2.11C

Related questions

Question

Transcribed Image Text:Assignment 1 - Word

困

File

Home

Insert

Design

Layout

References

Mailings

Review

View

O Tell me what you want to do...

Byro Chandrshekar & Share

X Cut

A A

外 T

O Find -

Calibri

11

Aa-

AaBbCcDd AaBbCcDd Aa E AaBbCcl AaBbCcD AaB AaBbCcD AaBbCcDd AaBbCcDd AaBbCcDd AaBbCcDc

e Copy

Sac Replace

Paste

V Format Painter

BIU-abe X, x A - aly - A

1 Normal

I No Spac. Heading 1

Heading 2

Heading 3

Title

Subtitle

Subtle Em.. Emphasis

Intense E...

Strong

A Select -

Clipboard

Font

Paragraph

Styles

Editing

Kevin is a sole trader involved in the manufacture of heating systems for the construction

(i)

Inventory was counted and valued at 3 January 2018 at Rs 246,800. On 2 January

industry. You have been appointed as the financial accountant and the following trial balance

2018, inventory was sold at a sales price of Rs 30,000. Kevin makes a margin on 20%

was extracted from its books as at 31 December 2017:

on its sales. The sales transaction is accounted for in the 2018 financial statements.

(ii)

Depreciation is to be charged as follows:

Debit Rs

Credit Rs.

Premises

2% Straight Line on Cost

Accumulated Depreciation - Premises - 1 January 2017

68,200

Equipment 10% Reducing Balance

Administrative Expenses

457,200

25% Straight Line on Cost

Vehicles

Trade Receivables / Trade Payables

146,000

180,700

Depreciation is charged in full in the year of purchase and none in the year of sale.

Drawings

40,000

(ii)

Kevin brought in his private vehicles at a cost of Rs 40,000 which was not accounted

Purchases / Revenue

3,645,200

4,929,850

in the books.

Allowance for irrecoverable Debts

11,200

(iv)

Irrecoverable debts written off Rs 6200 in December 2017 and an allowance for

Long-Term Loan - 5%

125,000

irrecoverable debts is maintained at 5%.

Bank

68,500

Capital

863,800

(v)

On 1 July 2017, a new long term loan of Rs 100,000 (5% interest per annum) was

Premises at Cost at 1 January 2017

580,000

received by the company.

Inventory at 1 January 2017

245,720

The above trial balance has not been adjusted in respect of this new loan.

Accumulated Depreciation - Vehicles - 1 January 2017

104,600

Provide for the interest due on the long term loans.

Distribution Costs

277,400

(vi)

Rs 10,000 was due for administrative expenses.

Finance Costs

6,000

(vii) Rs 12,000 of distribution expenses were paid for the 4 months ended 28 February

Accumulated Depreciation - Equipment - 1 January 2017

25,670

2018.

(viii) Carriage inwards paid by cheque Rs 1,000 as not recorded in the books.

Equipment at Cost at 1 January 2017

800,000

Vehicles at Cost at 1 January 2017

180,000

(ix)

Purchases of goods on credit Rs 12,000 was recorded twice in the accounts.

6377 520

6 377 520

Required:

Prepare an Income statement for the year ended 31 December 2017 and a Statement of Financial

Bosition as at 31 December 2017.

As an accountant you discovered the following information:

Page 1 of 2

396 words

E English (United States)

+

70 %

02:07

O Type here to search

75°F Light rain

17/12/2021

(6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you