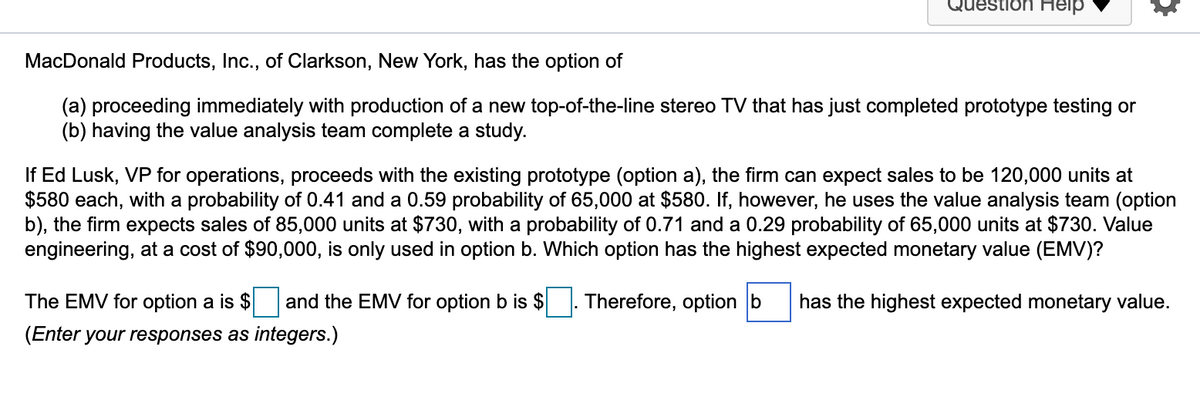

MacDonald Products, Inc., of Clarkson, New York, has the option of (a) proceeding immediately with production of a new top-of-the-line stereo TV that has just completed prototype testing or (b) having the value analysis team complete a study. If Ed Lusk, VP for operations, proceeds with the existing prototype (option a), the firm can expect sales to be 120,000 units at $580 each, with a probability of 0.41 and a 0.59 probability of 65,000 at $580. If, however, he uses the value analysis team (option b), the firm expects sales of 85,000 units at $730, with a probability of 0.71 and a 0.29 probability of 65,000 units at $730. Value engineering, at a cost of $90,000, is only used in option b. Which option has the highest expected monetary value (EMV)? The EMV for option a is $ and the EMV for option b is $ Therefore, option b has the highest expected monetary value. (Enter your responses as integers.)

MacDonald Products, Inc., of Clarkson, New York, has the option of (a) proceeding immediately with production of a new top-of-the-line stereo TV that has just completed prototype testing or (b) having the value analysis team complete a study. If Ed Lusk, VP for operations, proceeds with the existing prototype (option a), the firm can expect sales to be 120,000 units at $580 each, with a probability of 0.41 and a 0.59 probability of 65,000 at $580. If, however, he uses the value analysis team (option b), the firm expects sales of 85,000 units at $730, with a probability of 0.71 and a 0.29 probability of 65,000 units at $730. Value engineering, at a cost of $90,000, is only used in option b. Which option has the highest expected monetary value (EMV)? The EMV for option a is $ and the EMV for option b is $ Therefore, option b has the highest expected monetary value. (Enter your responses as integers.)

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 21P

Related questions

Question

Transcribed Image Text:uestlon Help

MacDonald Products, Inc., of Clarkson, New York, has the option of

(a) proceeding immediately with production of a new top-of-the-line stereo TV that has just completed prototype testing or

(b) having the value analysis team complete a study.

If Ed Lusk, VP for operations, proceeds with the existing prototype (option a), the firm can expect sales to be 120,000 units at

$580 each, with a probability of 0.41 and a 0.59 probability of 65,000 at $580. If, however, he uses the value analysis team (option

b), the firm expects sales of 85,000 units at $730, with a probability of 0.71 and a 0.29 probability of 65,000 units at $730. Value

engineering, at a cost of $90,000, is only used in option b. Which option has the highest expected monetary value (EMV)?

The EMV for option a is $

and the EMV for option b is $

Therefore, option b

has the highest expected monetary value.

(Enter your responses as integers.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,