Mara Company provided the following data on December 31, 2020: • Cash in general checking account • Sinking fund to be used to retire bonds in 2023 • Cash held to pay value added taxes • Notes receivable due on February 2022 • Accounts receivable • Inventory P 500,000 1,200,000 300,000 2,200,000 2,100,000 1,500,000 Prepaid insurance 300,000 • Vacant land held as investment 5,000,000

Mara Company provided the following data on December 31, 2020: • Cash in general checking account • Sinking fund to be used to retire bonds in 2023 • Cash held to pay value added taxes • Notes receivable due on February 2022 • Accounts receivable • Inventory P 500,000 1,200,000 300,000 2,200,000 2,100,000 1,500,000 Prepaid insurance 300,000 • Vacant land held as investment 5,000,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 43E: Determining Cash Flows from Financing Activities Solomon Construction Company reported the following...

Related questions

Question

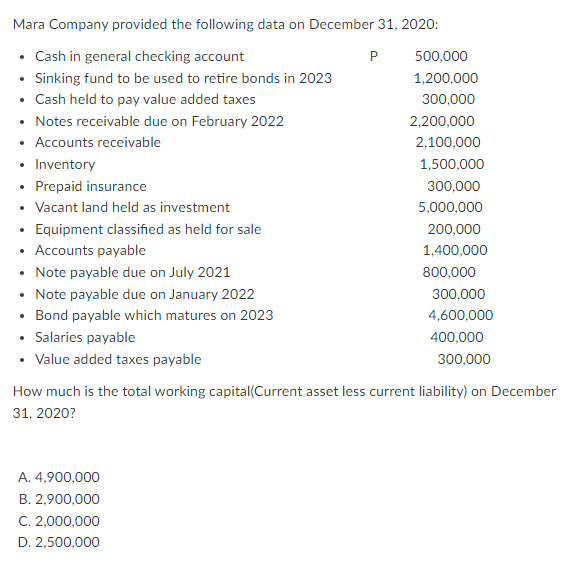

Transcribed Image Text:Mara Company provided the following data on December 31, 2020:

• Cash in general checking account

• Sinking fund to be used to retire bonds in 2023

• Cash held to pay value added taxes

• Notes receivable due on February 2022

• Accounts receivable

• Inventory

• Prepaid insurance

• Vacant land held as investment

• Equipment classified as held for sale

P

500,000

1,200,000

300,000

2,200,000

2,100,000

1,500,000

300,000

5,000,000

200,000

Accounts payable

1,400,000

• Note payable due on July 2021

• Note payable due on January 2022

• Bond payable which matures on 2023

• Salaries payable

• Value added taxes payable

800,000

300,000

4,600,000

400,000

300,000

How much is the total working capital(Current asset less current liability) on December

31, 2020?

A. 4,900,000

B. 2,900,000

C. 2,000,000

D. 2,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning