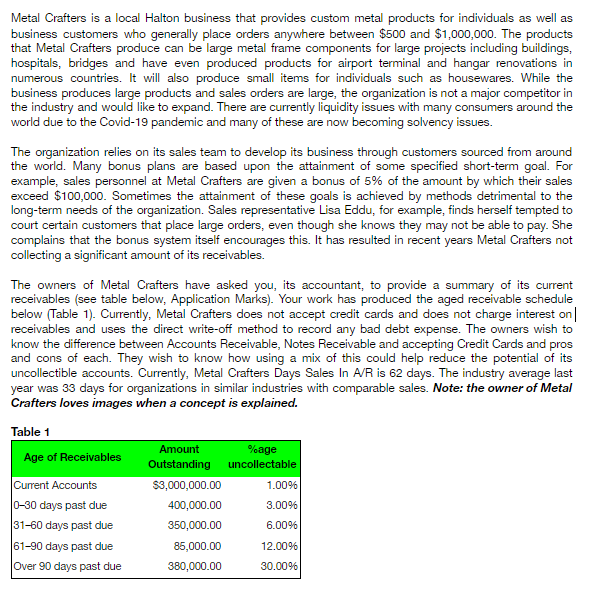

Metal Crafters is a local Halton business that provides custom metal products for individuals as well as business customers who generally place orders anywhere between $500 and $1,000,000. The products that Metal Crafters produce can be large metal frame components for large projects including buildings, hospitals, bridges and have even produced products for airport terminal and hangar renovations in numerous countries. It will also produce small items for individuals such as housewares. While the business produces large products and sales orders are large, the organization is not a major competitor in the industry and would like to expand. There are currently liquidity issues with many consumers around the world due to the Covid-19 pandemic and many of these are now becoming solvency issues. The organization relies on its sales team to develop its business through customers sourced from around the world. Many bonus plans are based upon the attainment of some specified short-term goal. For example, sales personnel at Metal Crafters are given a bonus of 5% of the amount by which their sales exceed $100,000. Sometimes the attainment of these goals is achieved by methods detrimental to the long-term needs of the organization. Sales representative Lisa Eddu, for example, finds herself tempted to court certain customers that place large orders, even though she knows they may not be able to pay. She complains that the bonus system itself encourages this. It has resulted in recent years Metal Crafters not collecting a significant amount of its receivables. The owners of Metal Crafters have asked you, its accountant, to provide a summary of its curent receivables (see table below, Application Marks). Your work has produced the aged receivable schedule below (Table 1). Currently, Metal Crafters does not accept credit cards and does not charge interest on receivables and uses the direct write-off method to record any bad debt expense. The owners wish to know the difference between Accounts Receivable, Notes Receivable and accepting Credit Cards and pros and cons of each. They wish to know how using a mix of this could help reduce the potential of its uncollectible accounts. Currently, Metal Crafters Days Sales In A/R is 62 days. The industry average last year was 33 days for organizations in similar industries with comparable sales. Note: the owner of Metal Crafters loves images when a concept is explained. Table 1 Amount Outstanding uncollectable %age Age of Receivables Current Accounts 0-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due $3,000,000.00 1.00% 400,000.00 3.00% 350,000.00 6.009%6 85,000.00 12.00% 380,000.00 30.00%

Metal Crafters is a local Halton business that provides custom metal products for individuals as well as business customers who generally place orders anywhere between $500 and $1,000,000. The products that Metal Crafters produce can be large metal frame components for large projects including buildings, hospitals, bridges and have even produced products for airport terminal and hangar renovations in numerous countries. It will also produce small items for individuals such as housewares. While the business produces large products and sales orders are large, the organization is not a major competitor in the industry and would like to expand. There are currently liquidity issues with many consumers around the world due to the Covid-19 pandemic and many of these are now becoming solvency issues. The organization relies on its sales team to develop its business through customers sourced from around the world. Many bonus plans are based upon the attainment of some specified short-term goal. For example, sales personnel at Metal Crafters are given a bonus of 5% of the amount by which their sales exceed $100,000. Sometimes the attainment of these goals is achieved by methods detrimental to the long-term needs of the organization. Sales representative Lisa Eddu, for example, finds herself tempted to court certain customers that place large orders, even though she knows they may not be able to pay. She complains that the bonus system itself encourages this. It has resulted in recent years Metal Crafters not collecting a significant amount of its receivables. The owners of Metal Crafters have asked you, its accountant, to provide a summary of its curent receivables (see table below, Application Marks). Your work has produced the aged receivable schedule below (Table 1). Currently, Metal Crafters does not accept credit cards and does not charge interest on receivables and uses the direct write-off method to record any bad debt expense. The owners wish to know the difference between Accounts Receivable, Notes Receivable and accepting Credit Cards and pros and cons of each. They wish to know how using a mix of this could help reduce the potential of its uncollectible accounts. Currently, Metal Crafters Days Sales In A/R is 62 days. The industry average last year was 33 days for organizations in similar industries with comparable sales. Note: the owner of Metal Crafters loves images when a concept is explained. Table 1 Amount Outstanding uncollectable %age Age of Receivables Current Accounts 0-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due $3,000,000.00 1.00% 400,000.00 3.00% 350,000.00 6.009%6 85,000.00 12.00% 380,000.00 30.00%

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter20: Inventory Management: Economic Order Quantity, Jit, And The Theory Of Constraints

Section: Chapter Questions

Problem 16E

Related questions

Question

can you please tell me the Calculations of aged receivables and uncollectible amounts usiing the information in the picture please for my homework

Transcribed Image Text:Metal Crafters is a local Halton business that provides custom metal products for individuals as well as

business customers who generally place orders anywhere between $500 and $1,000,000. The products

that Metal Crafters produce can be large metal frame components for large projects including buildings,

hospitals, bridges and have even produced products for airport terminal and hangar renovations in

numerous countries. It will also produce small items for individuals such as housewares. While the

business produces large products and sales orders are large, the organization is not a major competitor in

the industry and would like to expand. There are currently liquidity issues with many consumers around the

world due to the Covid-19 pandemic and many of these are now becoming solvency issues.

The organization relies on its sales team to develop its business through customers sourced from around

the world. Many bonus plans are based upon the attainment of some specified short-term goal. For

example, sales personnel at Metal Crafters are given a bonus of 5% of the amount by which their sales

exceed $100,000. Sometimes the attainment of these goals is achieved by methods detrimental to the

long-term needs of the organization. Sales representative Lisa Eddu, for example, finds herself tempted to

court certain customers that place large orders, even though she knows they may not be able to pay. She

complains that the bonus system itself encourages this. It has resulted in recent years Metal Crafters not

collecting a significant amount of its receivables.

The owners of Metal Crafters have asked you, its accountant, to provide a summary of its current

receivables (see table below, Application Marks). Your work has produced the aged receivable schedule

below (Table 1). Currently, Metal Crafters does not accept credit cards and does not charge interest on|

receivables and uses the direct write-off method to record any bad debt expense. The owners wish to

know the difference between Accounts Receivable, Notes Receivable and accepting Credit Cards and pros

and cons of each. They wish to know how using a mix of this could help reduce the potential of its

uncollectible accounts. Currently, Metal Crafters Days Sales In A/R is 62 days. The industry average last

year was 33 days for organizations in similar industries with comparable sales. Note: the owner of Metal

Crafters loves images when a concept is explained.

Table 1

Amount

%age

Age of Receivables

Outstanding

uncollectable

Current Accounts

0-30 days past due

31-60 days past due

$3,000,000.00

1.00%

400,000.00

3.00%

350,000.00

6.00%

61-90 days past due

85,000.00

12.00%

Over 90 days past due

380,000.00

30.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning