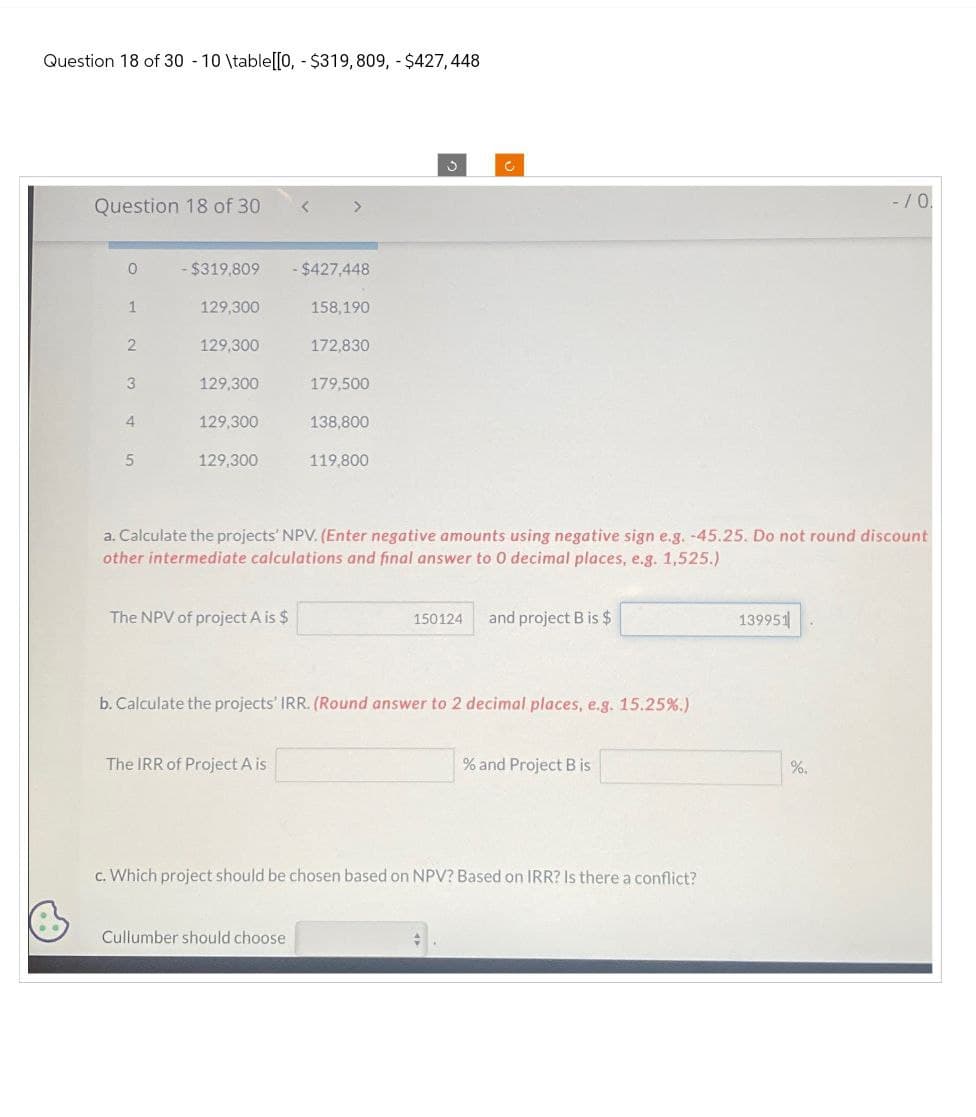

Question 18 of 30 -10 \table[[0,- $319,809, - $427,448 Question 18 of 30 > 0 - $319,809 - $427,448 1 129,300 158,190 2 129,300 172,830 3 129,300 179,500 4 129,300 138,800 5 129,300 119,800 C C -/ 0. a. Calculate the projects' NPV. (Enter negative amounts using negative sign e.g. -45.25. Do not round discount other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV of project A is $ 150124 and project B is $ b. Calculate the projects' IRR. (Round answer to 2 decimal places, e.g. 15.25%.) The IRR of Project A is % and Project B is c. Which project should be chosen based on NPV? Based on IRR? Is there a conflict? Cullumber should choose 139951 %.

Question 18 of 30 -10 \table[[0,- $319,809, - $427,448 Question 18 of 30 > 0 - $319,809 - $427,448 1 129,300 158,190 2 129,300 172,830 3 129,300 179,500 4 129,300 138,800 5 129,300 119,800 C C -/ 0. a. Calculate the projects' NPV. (Enter negative amounts using negative sign e.g. -45.25. Do not round discount other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV of project A is $ 150124 and project B is $ b. Calculate the projects' IRR. (Round answer to 2 decimal places, e.g. 15.25%.) The IRR of Project A is % and Project B is c. Which project should be chosen based on NPV? Based on IRR? Is there a conflict? Cullumber should choose 139951 %.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 19PROB

Related questions

Question

None

Transcribed Image Text:Question 18 of 30 -10 \table[[0,- $319,809, - $427,448

Question 18 of 30

>

0 - $319,809

- $427,448

1

129,300

158,190

2 129,300

172,830

3

129,300

179,500

4

129,300

138,800

5

129,300

119,800

C

C

-/ 0.

a. Calculate the projects' NPV. (Enter negative amounts using negative sign e.g. -45.25. Do not round discount

other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.)

The NPV of project A is $

150124

and project B is $

b. Calculate the projects' IRR. (Round answer to 2 decimal places, e.g. 15.25%.)

The IRR of Project A is

% and Project B is

c. Which project should be chosen based on NPV? Based on IRR? Is there a conflict?

Cullumber should choose

139951

%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you