On April 1, the price of gas at Bob's Corner Station was $3.70 per gallon. On May 1, the price was $4.20 per gallon. On June 1, it was back down to $3.70 per gallon. Between April 1 and May 1, Bob's price increased by ör Between May 1 and June 1, Bob's price decreased by or Suppose that at a gas station across the street, prices are always 20% higher than Bob's. In absolute dollar terms, the difference between Bob's prices and the prices across the street is v when gas costs $4.20 than when gas costs $3.70. Some economists blame high commodity prices (including the price of gas) on interest rates being too low. Suppose the Fed raises the target for the federal funds rate from 2% to 2.5%. This change of V percentage points means that the Fed raised its target by approximately

On April 1, the price of gas at Bob's Corner Station was $3.70 per gallon. On May 1, the price was $4.20 per gallon. On June 1, it was back down to $3.70 per gallon. Between April 1 and May 1, Bob's price increased by ör Between May 1 and June 1, Bob's price decreased by or Suppose that at a gas station across the street, prices are always 20% higher than Bob's. In absolute dollar terms, the difference between Bob's prices and the prices across the street is v when gas costs $4.20 than when gas costs $3.70. Some economists blame high commodity prices (including the price of gas) on interest rates being too low. Suppose the Fed raises the target for the federal funds rate from 2% to 2.5%. This change of V percentage points means that the Fed raised its target by approximately

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter3: Demand Analysis

Section: Chapter Questions

Problem 9E

Related questions

Question

Solve the attahment.

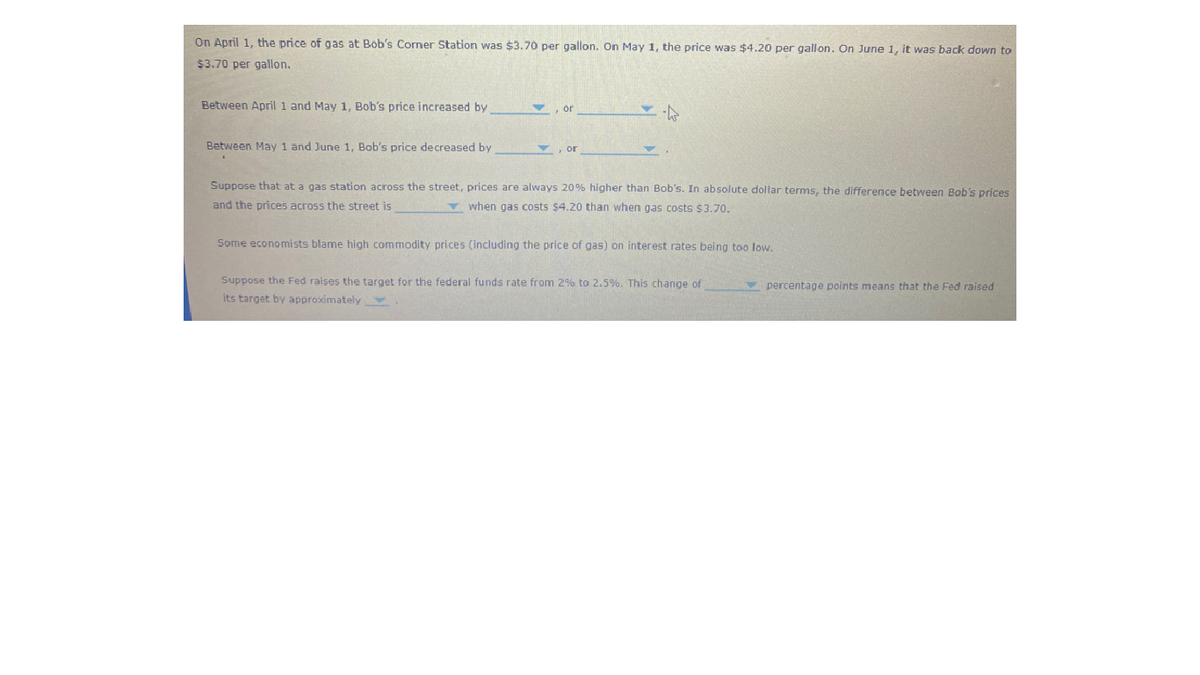

Transcribed Image Text:On April 1, the price of gas at Bob's Corner Station was $3.70 per gallon. On May 1, the price was $4.20 per gallon. On June 1, it was back down to

$3.70 per gallon.

Between April 1 and May 1, Bob's price increased by

ör

Between May 1 and June 1, Bob's price decreased by

or

Suppose that at a gas station across the street, prices are always 20% higher than Bob's. In absolute dollar terms, the difference between Bob's prices

and the prices across the street is

v when gas costs $4.20 than when gas costs $3.70.

Some economists blame high commodity prices (including the price of gas) on interest rates being too low.

Suppose the Fed raises the target for the federal funds rate from 2% to 2.5%. This change of

V percentage points means that the Fed raised

its target by approximately

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax