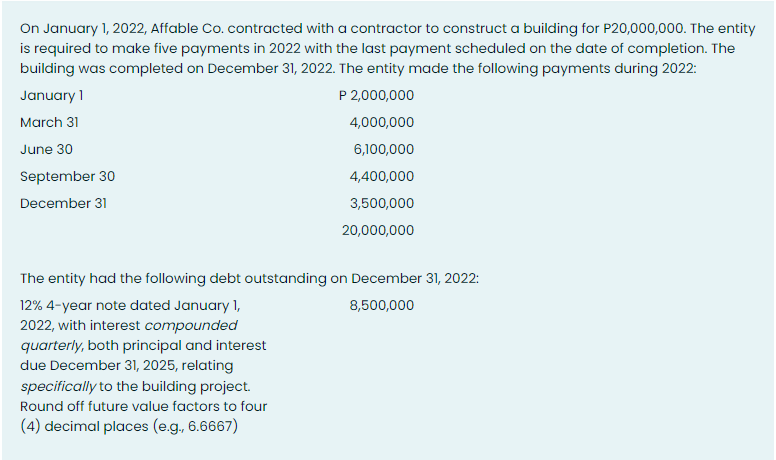

On January 1, 2022, Affable Co. contracted with a contractor to construct a building for P20,000,000. The entity is required to make five payments in 2022 with the last payment scheduled on the date of completion. The building was completed on December 31, 2022. The entity made the following payments during 2022: January 1 P 2,000,000 March 31 4,000,000 June 30 6,100,000 September 30 4,400,000 December 31 3,500,000 20,000,000 The entity had the following debt outstanding on December 31, 2022: 8,500,000 12% 4-year note dated January 1, 2022, with interest compounded quarterly, both principal and interest due December 31, 2025, relating specifically to the building project. Round off future value factors to four (4) decimal places (e.g., 6.6667)

On January 1, 2022, Affable Co. contracted with a contractor to construct a building for P20,000,000. The entity is required to make five payments in 2022 with the last payment scheduled on the date of completion. The building was completed on December 31, 2022. The entity made the following payments during 2022: January 1 P 2,000,000 March 31 4,000,000 June 30 6,100,000 September 30 4,400,000 December 31 3,500,000 20,000,000 The entity had the following debt outstanding on December 31, 2022: 8,500,000 12% 4-year note dated January 1, 2022, with interest compounded quarterly, both principal and interest due December 31, 2025, relating specifically to the building project. Round off future value factors to four (4) decimal places (e.g., 6.6667)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 26E

Related questions

Question

Transcribed Image Text:On January 1, 2022, Affable Co. contracted with a contractor to construct a building for P20,000,000. The entity

is required to make five payments in 2022 with the last payment scheduled on the date of completion. The

building was completed on December 31, 2022. The entity made the following payments during 2022:

January 1

P 2,000,000

March 31

4,000,000

June 30

6,100,000

September 30

4,400,000

December 31

3,500,000

20,000,000

The entity had the following debt outstanding on December 31, 2022:

12% 4-year note dated January 1,

8,500,000

2022, with interest compounded

quarterly, both principal and interest

due December 31, 2025, relating

specifically to the building project.

Round off future value factors to four

(4) decimal places (e.g., 6.6667)

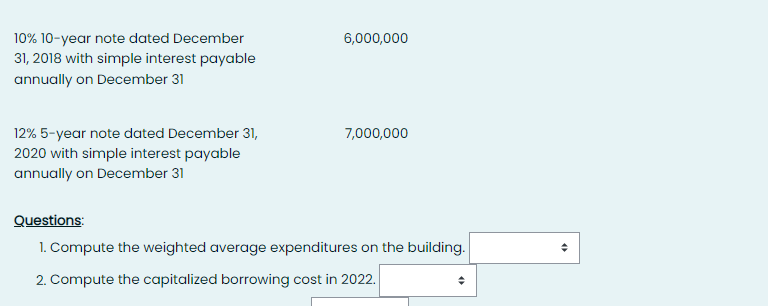

Transcribed Image Text:10% 10-year note dated December

31, 2018 with simple interest payable

annually on December 31

12% 5-year note dated December 31,

2020 with simple interest payable

annually on December 31

6,000,000

7,000,000

Questions:

1. Compute the weighted average expenditures on the building.

2. Compute the capitalized borrowing cost in 2022.

(

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT