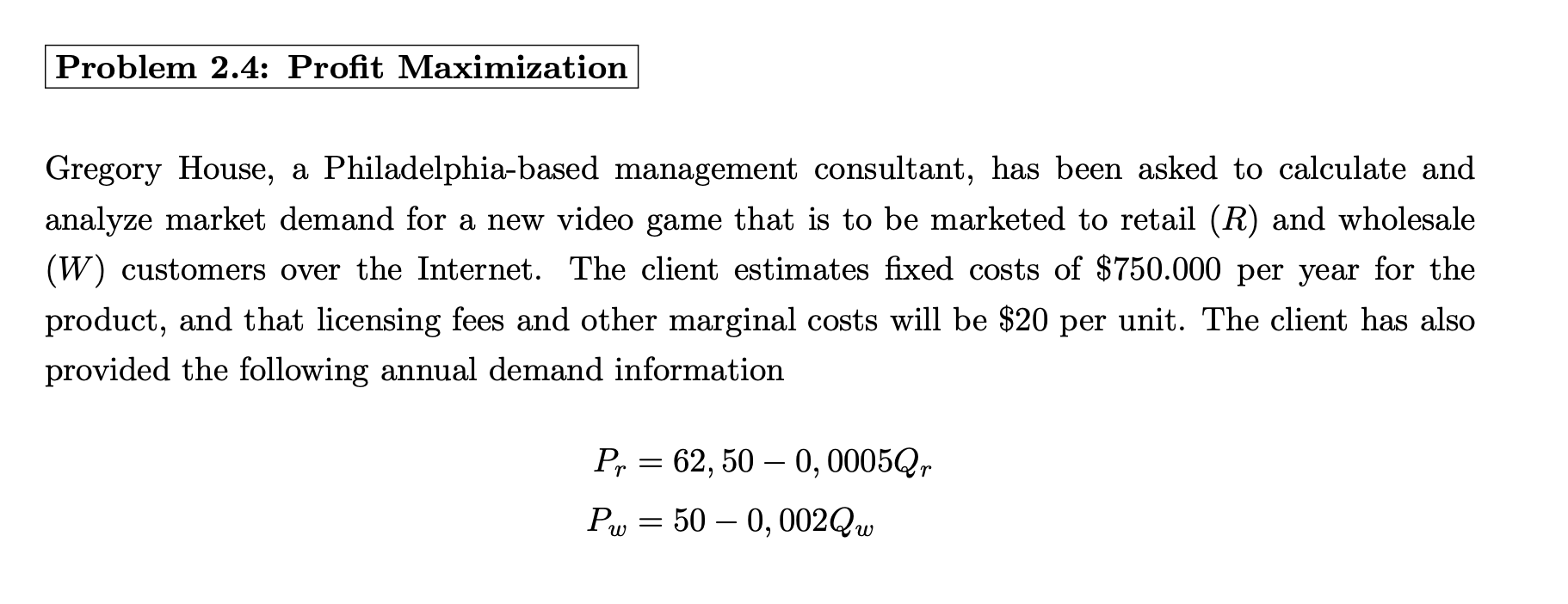

|Problem 2.4: Profit Maximization Gregory House, a Philadelphia-based management consultant, has been asked to calculate and analyze market demand for a new video game that is to be marketed to retail (R) and wholesale (W) customers over the Internet. The client estimates fixed costs of $750.000 per year for the product, and that licensing fees and other marginal costs will be $20 per unit. The client has also provided the following annual demand information Pr = 62, 50 – 0, 0005Q, Pw = 50 – 0, 002QW

|Problem 2.4: Profit Maximization Gregory House, a Philadelphia-based management consultant, has been asked to calculate and analyze market demand for a new video game that is to be marketed to retail (R) and wholesale (W) customers over the Internet. The client estimates fixed costs of $750.000 per year for the product, and that licensing fees and other marginal costs will be $20 per unit. The client has also provided the following annual demand information Pr = 62, 50 – 0, 0005Q, Pw = 50 – 0, 002QW

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter10: Prices, Output, And Strategy: Pure And Monopolistic Competition

Section: Chapter Questions

Problem 8E

Related questions

Question

(a) Express quantity as a function of price for both retail and wholesale customers. Add these quantities together to calculate the market

(b) Calculate total revenue (TR), total cost (TC) and total profit (π) based on total market inverse demand.

(c) Calculate the profit-maximizing price-output combination and total profit. Calculate the break- even points.

Transcribed Image Text:|Problem 2.4: Profit Maximization

Gregory House, a Philadelphia-based management consultant, has been asked to calculate and

analyze market demand for a new video game that is to be marketed to retail (R) and wholesale

(W) customers over the Internet. The client estimates fixed costs of $750.000 per year for the

product, and that licensing fees and other marginal costs will be $20 per unit. The client has also

provided the following annual demand information

Pr = 62, 50 – 0, 0005Q,

Pw = 50 – 0, 002QW

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning