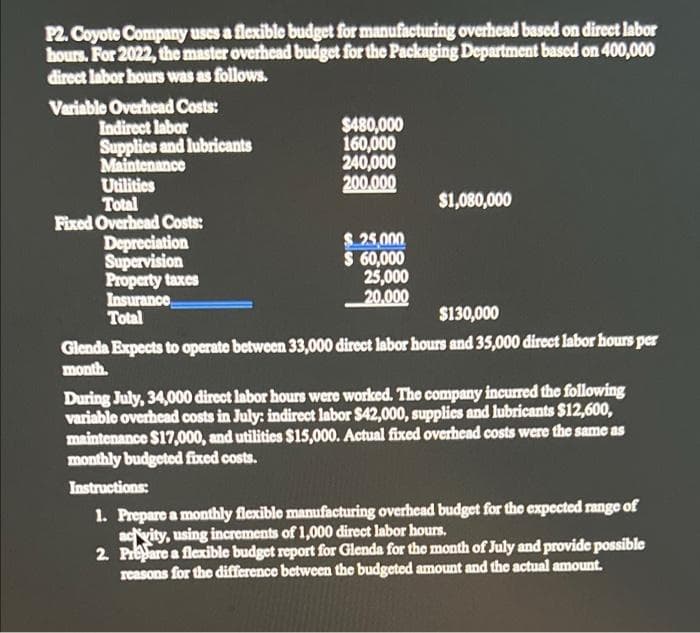

P2. Coyote Company uses a flexible budget for manufacturing overhead based on direct labor hours. For 2022, the master overhead budget for the Packaging Department based on 400,000 direct labor hours was as follows. Variable Overhead Costs: Indirect labor Supplics and lubricants Maintenance Uilities Total Fixed Overhead Costs: $480,000 160,000 240,000 200.000 $1,080,000 Depreciation Supervision Property taxes Insurance Total $ 25,000 $ 60,000 25,000 20.000 $130,000 Glenda Expects to operate between 33,000 direct labor hours and 35,000 direct labor hours per month. During July, 34,000 direct labor hours were worked. The company incurred the following variable overhcad costs in July: indirect labor $42,000, supplies and lubricants $12,600, maintenance $17,000, and utilities $15,000. Actual fixed overhead costs were the same as monthly budgeted fixed costs. Instructions: 1. Prepare a monthly flexible manufacturing overhead budget for the expected range of acvity, using increments of 1,000 direct labor hours. 2 Preare a flexible budget report for Glenda for the month of July and provide possible reasons for the difference between the budgeted amount and the actual amount.

P2. Coyote Company uses a flexible budget for manufacturing overhead based on direct labor hours. For 2022, the master overhead budget for the Packaging Department based on 400,000 direct labor hours was as follows. Variable Overhead Costs: Indirect labor Supplics and lubricants Maintenance Uilities Total Fixed Overhead Costs: $480,000 160,000 240,000 200.000 $1,080,000 Depreciation Supervision Property taxes Insurance Total $ 25,000 $ 60,000 25,000 20.000 $130,000 Glenda Expects to operate between 33,000 direct labor hours and 35,000 direct labor hours per month. During July, 34,000 direct labor hours were worked. The company incurred the following variable overhcad costs in July: indirect labor $42,000, supplies and lubricants $12,600, maintenance $17,000, and utilities $15,000. Actual fixed overhead costs were the same as monthly budgeted fixed costs. Instructions: 1. Prepare a monthly flexible manufacturing overhead budget for the expected range of acvity, using increments of 1,000 direct labor hours. 2 Preare a flexible budget report for Glenda for the month of July and provide possible reasons for the difference between the budgeted amount and the actual amount.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter23: Flexible Budgeting (flexbud)

Section: Chapter Questions

Problem 4R

Related questions

Question

100%

Please help me to solve this problem

Transcribed Image Text:P2. Coyote Company uses a flexible budget for manufacturing overhead based on direct labor

hours. For 2022, the master overhead budget for the Packaging Department based on 400,000

direct labor hours was as follows.

Variable Overhead Costs:

Indirect labor

Supplics and lubricants

Maintenance

Utilitics

Total

Fixed Overhead Costs:

$480,000

160,000

240,000

200.000

$1,080,000

Depreciation

Supervision

Property taxes

Insurance

Total

25,000

$ 60,000

25,000

20.000

$130,000

Glenda Expects to operate between 33,000 direct labor hours and 35,000 direct labor hours per

month.

During July, 34,000 direct labor hours were worked. The company incurred the following

variable overhead costs in July: indirect labor $42,000, supplics and lubricants $12,600,

maintenance $17,000, and utilitics $15,000. Actual fixed overhead costs were the same as

monthly budgeted fixed costs.

Instructions:

1. Prepare a monthly flexible manufacturing overhead budget for the expected range of

acwity, using increments of 1,000 direct labor hours.

2 Prepare a flexible budget report for Glenda for the month of July and provide possible

reasons for the difference between the budgeted amount and the actual amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College