Pollution Prevention, P2 Investment Heaps Company produces jewelry that requires electroplating with gold, silver, and other valuable metals. Electroplating uses large amounts of water and chemicals, producing wastewater with a number of toxic residuals. Currently, Heaps uses settlement tanks to remove waste; unfortunately, the approach is inefficient, and much of the toxic residue is left in the water that is discharged into a local river. The amount of toxic discharge exceeds the legal, allowable amounts, and the company is faced with substantial, ongoing environmental fines. The environmental violations are also drawing unfavorable public reaction, and sales are being affected. A lawsuit is also impending, which could prove to be quite costly. Management is now considering the installation of a zero-discharge, closed-loop system to treat the wastewater. The proposed closed-loop system would not only purify the wastewater, but also produce cleaner water than that currently being used, increasing plating quality. The closed-loop system would produce only four pounds of sludge, and the sludge would be virtually pure metal, with significant market value. The system requires an investment of $623,700 and will cost $44,180 in increased annual operation plus an annual purchase of $7,070 of filtration medium. However, management projects the following savings: Water usage $ 67,760 Chemical usage 42,070 Sludge disposal 90,320 Recovered metal sales 45,170 Sampling of discharge 120,220 Total $ 365,540 The equipment qualifies as a seven-year MACRS asset. Management has decided to use straight-line depreciation for tax purposes, using the required half-year convention. The tax rate is 40 percent. The projected life of the system is 10 years. The hurdle rate is 16 percent for all capital budgeting projects, although the company’s cost of capital is 12 percent. The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems. Required: 4. The calculation in Requirement 3 ignored several factors that could affect the project’s viability: savings from avoiding the annual fines, positive effect on sales due to favorable environmental publicity, increased plating quality from the new system, and the avoidance of the lawsuit. Can these factors be quantified? Suppose, for example, that the annual fines being incurred are $74,710, the sales effect is $59,710 per year, the quality effect is not estimable, and cancellation of the lawsuit because of the new system would avoid an expected settlement at the end of Year 3 (including legal fees) of $308,600. Assuming these are all after-tax amounts, what effect would their inclusion have on the payback period? On the NPV? Round payback to two decimal places and round NPV calculation and final answer to the nearest dollar. Payback Decreases by fill in the blank years NPV Increases by $fill in the blank

Pollution Prevention, P2 Investment

Heaps Company produces jewelry that requires electroplating with gold, silver, and other valuable metals. Electroplating uses large amounts of water and chemicals, producing wastewater with a number of toxic residuals. Currently, Heaps uses settlement tanks to remove waste; unfortunately, the approach is inefficient, and much of the toxic residue is left in the water that is discharged into a local river. The amount of toxic discharge exceeds the legal, allowable amounts, and the company is faced with substantial, ongoing environmental fines. The environmental violations are also drawing unfavorable public reaction, and sales are being affected. A lawsuit is also impending, which could prove to be quite costly.

Management is now considering the installation of a zero-discharge, closed-loop system to treat the wastewater. The proposed closed-loop system would not only purify the wastewater, but also produce cleaner water than that currently being used, increasing plating quality. The closed-loop system would produce only four pounds of sludge, and the sludge would be virtually pure metal, with significant market value. The system requires an investment of $623,700 and will cost $44,180 in increased annual operation plus an annual purchase of $7,070 of filtration medium. However, management projects the following savings:

| Water usage | $ | 67,760 |

| Chemical usage | 42,070 | |

| Sludge disposal | 90,320 | |

| Recovered metal sales | 45,170 | |

| Sampling of discharge | 120,220 | |

| Total | $ | 365,540 |

The equipment qualifies as a seven-year MACRS asset. Management has decided to use straight-line

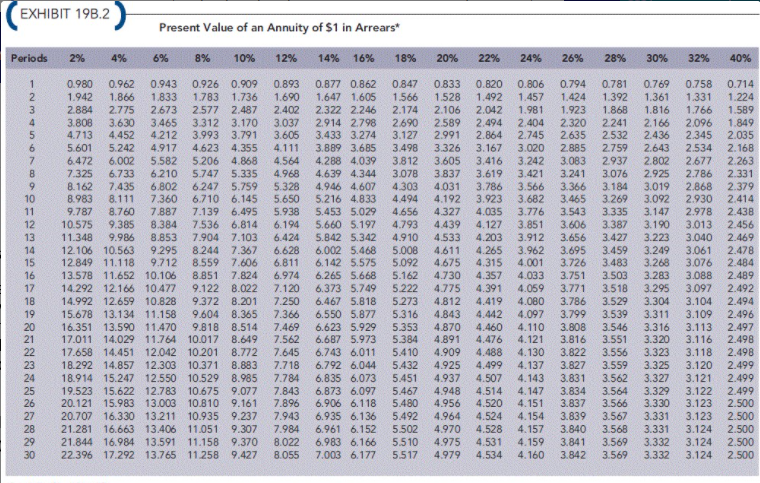

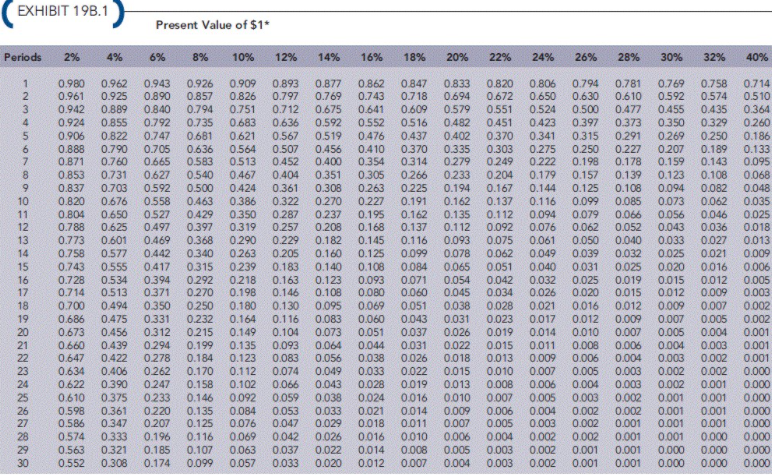

The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems.

Required:

4. The calculation in Requirement 3 ignored several factors that could affect the project’s viability: savings from avoiding the annual fines, positive effect on sales due to favorable environmental publicity, increased plating quality from the new system, and the avoidance of the lawsuit. Can these factors be quantified?

Suppose, for example, that the annual fines being incurred are $74,710, the sales effect is $59,710 per year, the quality effect is not estimable, and cancellation of the lawsuit because of the new system would avoid an expected settlement at the end of Year 3 (including legal fees) of $308,600. Assuming these are all after-tax amounts, what effect would their inclusion have on the payback period? On the NPV? Round payback to two decimal places and round NPV calculation and final answer to the nearest dollar.

| Payback | Decreases | by | fill in the blank | years |

| NPV | Increases | by | $fill in the blank |

Trending now

This is a popular solution!

Step by step

Solved in 10 steps with 16 images