Prepare the journat entries to record the 1ormation of the partnership

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 41P

Related questions

Question

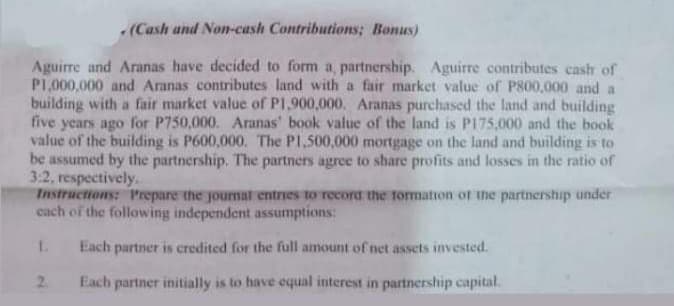

Transcribed Image Text:(Cash and Non-cash Contributions; Bonus)

Aguirre and Aranas have decided to form a, partnership. Aguirre contributes cash of

PI,000,000 and Aranas contributes land with a fair market value of P800,000 and a

building with a fair market value of PI,900,000. Aranas purchased the land and building

five years ago for P750,000. Aranas' book value of the land is P175,000 and the book

value of the building is P600,000. The PI.500,000 mortgage on the land and building is to

be assumed by the partnership. The partners agree to share profits and losses in the ratio of

3:2, respectively.

Instructions: 1Prepare the journat entries to record the formation of the partnership under

cach of the following independent assumptions:

Each partner is credited for the full amount of net assets invested.

2.

Each partner initially is to have equal interest in partnership capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT