Problem 6-17 The Nanny Tax (LO 6.7) Sally hires a maid to work in her home for $400 per month. The maid is 25 years old and not related to Sally. During 2021, the maid worked 10 months for Sally. Do not round immediate computations and round your final answers to two decimal places. a. What is the employer's share of Social Security tax Sally must pay? b. What is the employer's share of Medicare tax Sally must pay? Sally's employer's Medicare tax: $ c. What is the amount of Social Security and Medicare tax which must be withheld from the maid's wages? Sally should withhold for Social Security and Medicare tax of: $

Problem 6-17 The Nanny Tax (LO 6.7) Sally hires a maid to work in her home for $400 per month. The maid is 25 years old and not related to Sally. During 2021, the maid worked 10 months for Sally. Do not round immediate computations and round your final answers to two decimal places. a. What is the employer's share of Social Security tax Sally must pay? b. What is the employer's share of Medicare tax Sally must pay? Sally's employer's Medicare tax: $ c. What is the amount of Social Security and Medicare tax which must be withheld from the maid's wages? Sally should withhold for Social Security and Medicare tax of: $

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter8: Payroll Accounting: Employee Earnings And Deductions

Section: Chapter Questions

Problem 2MC

Related questions

Question

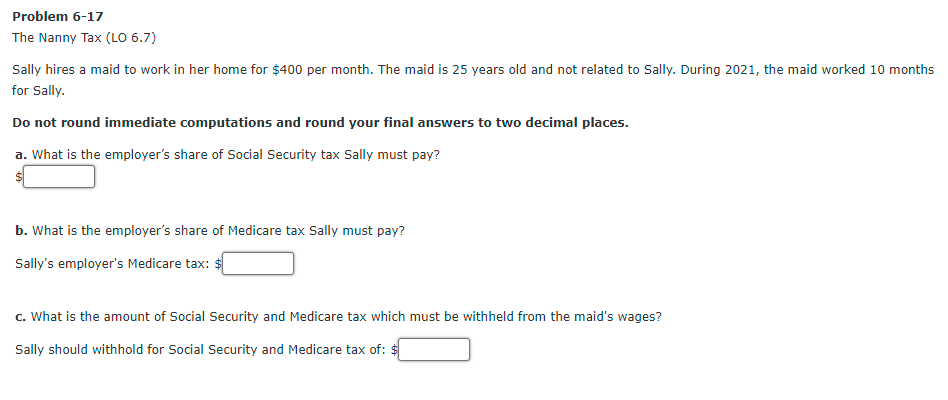

Transcribed Image Text:Problem 6-17

The Nanny Tax (LO 6.7)

Sally hires a maid to work in her home for $400 per month. The maid is 25 years old and not related to Sally. During 2021, the maid worked 10 months

for Sally.

Do not round immediate computations and round your final answers to two decimal places.

a. What is the employer's share of Social Security tax Sally must pay?

b. What is the employer's share of Medicare tax Sally must pay?

Sally's employer's Medicare tax: $

c. What is the amount of Social Security and Medicare tax which must be withheld from the maid's wages?

Sally should withhold for Social Security and Medicare tax of: $

Expert Solution

Step 1

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

a. Social Security Tax

Wage per month = $400

social security tax = ( wage per month x number of months worked) x tax rate

social security tax = ( 400 x 10 ) x 6.20%

social security tax =$248

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning