Problem 6-8 Unearned Income of Minor Children and Certain Students (LO 6.4) Brian and Kim have a 12-year-old child, Stan. For 2021, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. No election is made to include Stan's income on Brian and Kim's return. Click here to access the income tax rate schedules. a. For purposes of the tax on a child's unearned income, calculate Stan's taxable income. b. Calculate Stan's net unearned income. c. Calculate Stan's tax for 2021.

Problem 6-8 Unearned Income of Minor Children and Certain Students (LO 6.4) Brian and Kim have a 12-year-old child, Stan. For 2021, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. No election is made to include Stan's income on Brian and Kim's return. Click here to access the income tax rate schedules. a. For purposes of the tax on a child's unearned income, calculate Stan's taxable income. b. Calculate Stan's net unearned income. c. Calculate Stan's tax for 2021.

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 8P: PERSONAL TAXES Susan and Stan Britton are a married couple who file a joint income tax return, where...

Related questions

Question

100%

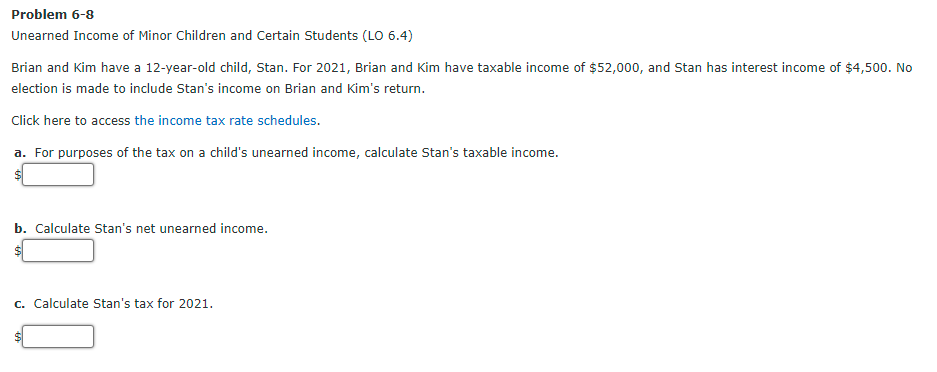

Transcribed Image Text:Problem 6-8

Unearned Income of Minor Children and Certain Students (LO 6.4)

Brian and Kim have a 12-year-old child, Stan. For 2021, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. No

election is made to include Stan's income on Brian and Kim's return.

Click here to access the income tax rate schedules.

a. For purposes of the tax on a child's unearned income, calculate Stan's taxable income.

b. Calculate Stan's net unearned income.

c. Calculate Stan's tax for 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT