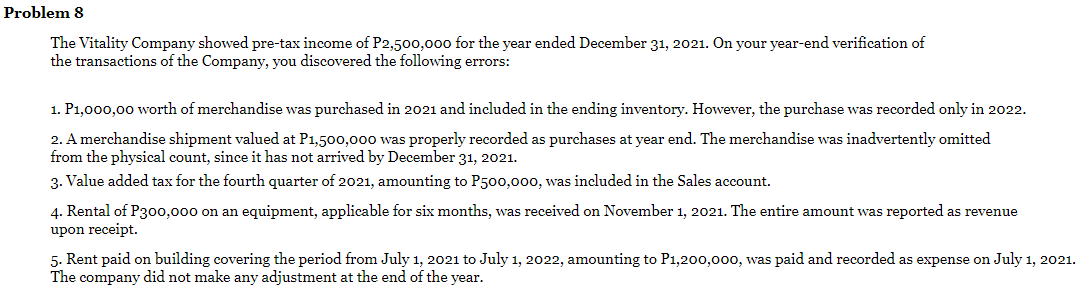

Problem 8 The Vitality Company showed pre-tax income of P2,500,000 for the year ended December 31, 2021. On your year-end verification of the transactions of the Company, you discovered the following errors: 1. P1,000,00 worth of merchandise was purchased in 2021 and included in the ending inventory. However, the purchase was recorded only in 2022. 2. A merchandise shipment valued at P1,500,000 was properly recorded as purchases at year end. The merchandise was inadvertently omitted from the physical count, since it has not arrived by December 31, 2021. 3. Value added tax for the fourth quarter of 2021, amounting to P500,000, was included in the Sales account. 4. Rental of P300,000 on an equipment, applicable for six months, was received on November 1, 2021. The entire amount was reported as revenue upon receipt. 5. Rent paid on building covering the period from July 1, 2021 to July 1, 2022, amounting to P1,200,000, was paid and recorded as expense on July 1, 2021. The company did not make any adjustment at the end of the year.

Problem 8 The Vitality Company showed pre-tax income of P2,500,000 for the year ended December 31, 2021. On your year-end verification of the transactions of the Company, you discovered the following errors: 1. P1,000,00 worth of merchandise was purchased in 2021 and included in the ending inventory. However, the purchase was recorded only in 2022. 2. A merchandise shipment valued at P1,500,000 was properly recorded as purchases at year end. The merchandise was inadvertently omitted from the physical count, since it has not arrived by December 31, 2021. 3. Value added tax for the fourth quarter of 2021, amounting to P500,000, was included in the Sales account. 4. Rental of P300,000 on an equipment, applicable for six months, was received on November 1, 2021. The entire amount was reported as revenue upon receipt. 5. Rent paid on building covering the period from July 1, 2021 to July 1, 2022, amounting to P1,200,000, was paid and recorded as expense on July 1, 2021. The company did not make any adjustment at the end of the year.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 14E: Refer to the information in E22-13. Required: Prepare the correcting journal entries if the company...

Related questions

Question

PROBLEM 8 - AUDITING PROBLEM

Compute the following:

1. The corrected pre-tax profit for 2021

2. What is the net effect of the foregoing errors on the total assets at December 31, 2021?

3. What is the total understatement of the total liabilities at December 31, 2021?

Transcribed Image Text:Problem 8

The Vitality Company showed pre-tax income of P2,500,000 for the year ended December 31, 2021. On your year-end verification of

the transactions of the Company, you discovered the following errors:

1. P1,000,00 worth of merchandise was purchased in 2021 and included in the ending inventory. However, the purchase was recorded only in 2022.

2. A merchandise shipment valued at P1,500,000 was properly recorded as purchases at year end. The merchandise was inadvertently omitted

from the physical count, since it has not arrived by December 31, 2021.

3. Value added tax for the fourth quarter of 2021, amounting to P500,000, was included in the Sales account.

4. Rental of P300,000 on an equipment, applicable for six months, was received on November 1, 2021. The entire amount was reported as revenue

upon receipt.

5. Rent paid on building covering the period from July 1, 2021 to July 1, 2022, amounting to P1,200,000, was paid and recorded as expense on July 1, 2021.

The company did not make any adjustment at the end of the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College