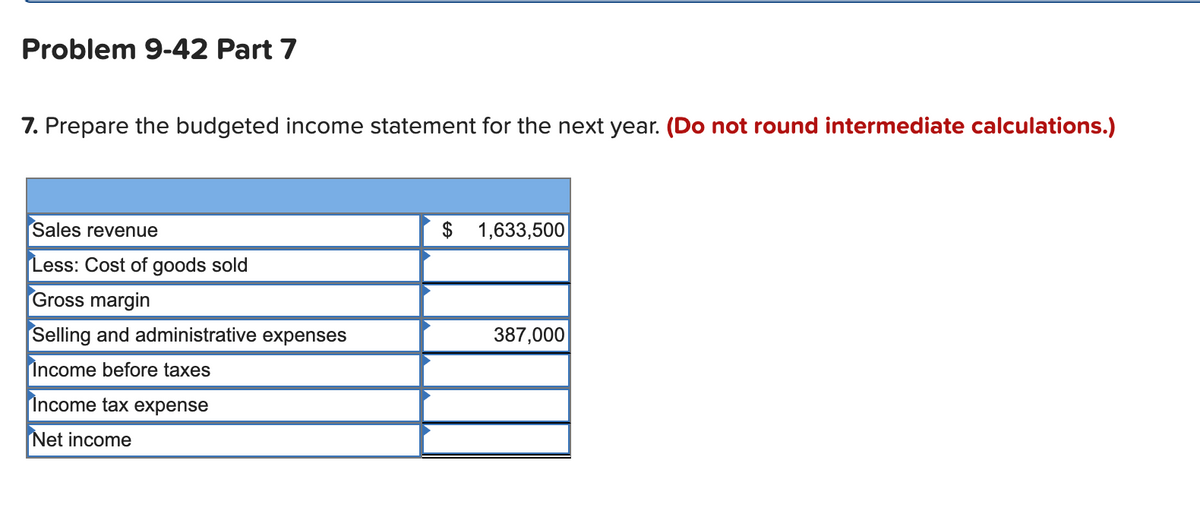

Problem 9-42 Part 7 7. Prepare the budgeted income statement for the next year. (Do not round intermediate calculations.) Sales revenue $ 1,633,500 Less: Cost of goods sold Gross margin Selling and administrative expenses 387,000 Income before taxes Income tax expense Net income

Problem 9-42 Part 7 7. Prepare the budgeted income statement for the next year. (Do not round intermediate calculations.) Sales revenue $ 1,633,500 Less: Cost of goods sold Gross margin Selling and administrative expenses 387,000 Income before taxes Income tax expense Net income

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 26E: Ingles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other...

Related questions

Question

Can you help me prepare the

Transcribed Image Text:Problem 9-42 Part 7

7. Prepare the budgeted income statement for the next year. (Do not round intermediate calculations.)

Sales revenue

$ 1,633,500

Less: Cost of goods sold

Gross margin

Selling and administrative expenses

387,000

Income before taxes

Income tax expense

Net income

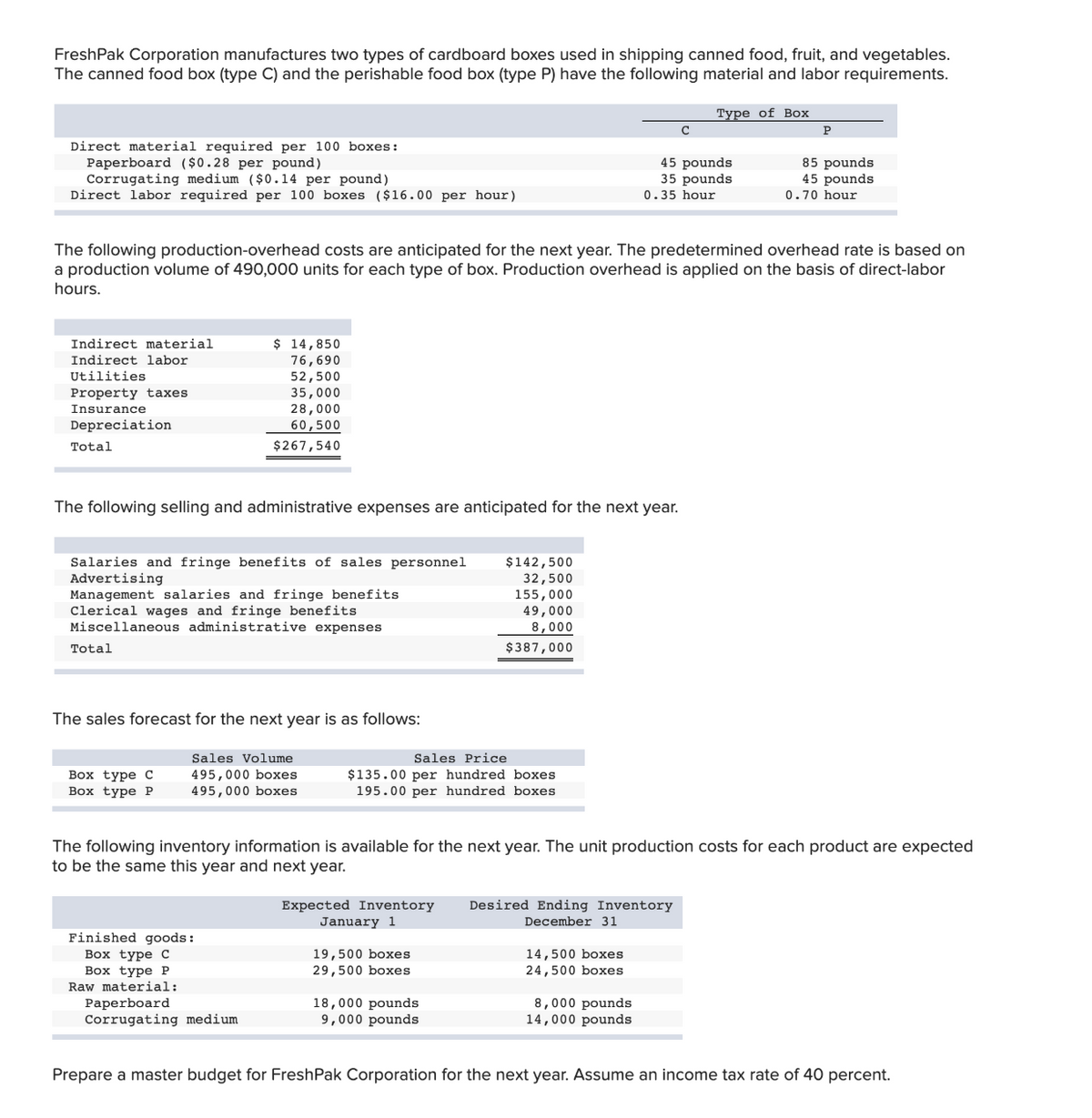

Transcribed Image Text:FreshPak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit, and vegetables.

The canned food box (type C) and the perishable food box (type P) have the following material and labor requirements.

Type of Box

C

P

Direct material required per 100 boxes:

Paperboard ($0.28 per pound)

Corrugating medium ($0.14 per pound)

Direct labor required per 100 boxes ($16.00 per hour)

45 pounds

35 pounds

0.35 hour

85 pounds

45 pounds

0.70 hour

The following production-overhead costs are anticipated for the next year. The predetermined overhead rate is based on

a production volume of 490,000 units for each type of box. Production overhead is applied on the basis of direct-labor

hours.

$ 14,850

76,690

52,500

35,000

28,000

60,500

Indirect material

Indirect labor

Utilities

Property taxes

Insurance

Depreciation

Total

$267,540

The following selling and administrative expenses are anticipated for the next year.

Salaries and fringe benefits of sales personnel

Advertising

Management salaries and fringe benefits

Clerical wages and fringe benefits

Miscellaneous administrative expenses

$142,500

32,500

155,000

49,000

8,000

Total

$387,000

The sales forecast for the next year is as follows:

Sales Volume

Sales Price

Воx type C

495,000 boxes

495,000 boxes

$135.00 per hundred boxes

195.00 per hundred boxes

Box type P

The following inventory information is available for the next year. The unit production costs for each product are expected

to be the same this year and next year.

Desired Ending Inventory

Expected Inventory

January 1

December 31

Finished goods:

Воx type C

19,500 boxes

29,500 boxes

14,500 boxes

24,500 boxes

Воx type P

Raw material:

Paperboard

Corrugating medium

18,000 pounds

9,000 pounds

8,000 pounds

14,000 pounds

Prepare a master budget for FreshPak Corporation for the next year. Assume an income tax rate of 40 percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning