Problem 9-63 and 9-64 (Static) [The following information applies to the questions displayed below] Lauder Company manufactures and distributes various fixtures used primarily in new building construction. At the company's Bayside plant, Lauder produces two models of one widely used fixture designated by model names LC-20 and LC-50. Currently, the Bayside plant uses direct labor-hours to allocate manufacturing overhead costs to products. The vice president-manufacturing (VP-M) at Lauder has recently been considering updates to the company's costing systems as a way to ensure that managers had the best information available for decision making. However, rather than update throughout the entire firm, the VP-M and CFO agreed to test an ABC system. Because of its size and focus, the Bayside plant was selected for the experiment. An ABC study team, consisting of both plant and corporate employees was formed to propose an ABC system and compare the product costs with those reported by the current system. Based on the experiment, the executives at Lauder will decide whether to roll out the new cost system to the entire company. The study team identified four cost pools into which the manufacturing overhead costs could be grouped. There was a great deal of discussion about both the pools and the cost drivers. The final system selected consisted of the following pools and drivers. The costs were based on the forecasts for the coming year. Cost Pools Costs s 396,000 Material inspection Assembly 2,210,000 Machine-hours Production runs Equipment setup 790,000 Packaging and shipping 420,000 Units shipped Data for production of the two products at the Bayside plant for the coming year of operations follows Products Activity Drivers Direct material cost LC-20 $540,000 $ 420,000 92,125 75 240,000 Total direct material casts Total direct labor costs Total machine-hours Total number of production runs Number of units produced and shipped All direct labor at the Bayside plant is paid $35 per hour LC-50 $ 180,000 $ 210,000 46,000 50 60,000

Problem 9-63 and 9-64 (Static) [The following information applies to the questions displayed below] Lauder Company manufactures and distributes various fixtures used primarily in new building construction. At the company's Bayside plant, Lauder produces two models of one widely used fixture designated by model names LC-20 and LC-50. Currently, the Bayside plant uses direct labor-hours to allocate manufacturing overhead costs to products. The vice president-manufacturing (VP-M) at Lauder has recently been considering updates to the company's costing systems as a way to ensure that managers had the best information available for decision making. However, rather than update throughout the entire firm, the VP-M and CFO agreed to test an ABC system. Because of its size and focus, the Bayside plant was selected for the experiment. An ABC study team, consisting of both plant and corporate employees was formed to propose an ABC system and compare the product costs with those reported by the current system. Based on the experiment, the executives at Lauder will decide whether to roll out the new cost system to the entire company. The study team identified four cost pools into which the manufacturing overhead costs could be grouped. There was a great deal of discussion about both the pools and the cost drivers. The final system selected consisted of the following pools and drivers. The costs were based on the forecasts for the coming year. Cost Pools Costs s 396,000 Material inspection Assembly 2,210,000 Machine-hours Production runs Equipment setup 790,000 Packaging and shipping 420,000 Units shipped Data for production of the two products at the Bayside plant for the coming year of operations follows Products Activity Drivers Direct material cost LC-20 $540,000 $ 420,000 92,125 75 240,000 Total direct material casts Total direct labor costs Total machine-hours Total number of production runs Number of units produced and shipped All direct labor at the Bayside plant is paid $35 per hour LC-50 $ 180,000 $ 210,000 46,000 50 60,000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter6: Process Costing

Section: Chapter Questions

Problem 45E: Cassien Inc. manufactures products that pass through two or more processes. During June, equivalent...

Related questions

Question

Acc

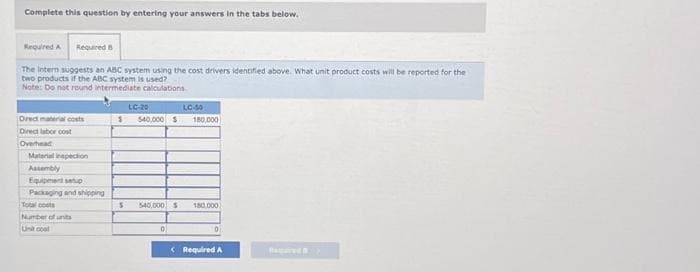

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B

The intern suggests an ABC system using the cost drivers identified above. What unit product costs will be reported for the

two products if the ABC system is used?

Note: Do not round intermediate calculations

Dredt material costs

Direct labor cost

Overhead

Material inspection

Assembly

Equipment setup

Packaging and shipping

Total costs

Number of units

Unit coal

$

5

LC-20

540,000 $

540,000 $

0

LC-50

180,000

180,000

0

< Required A

Rama

![Required information

Problem 9-63 and 9-64 (Static)

[The following information applies to the questions displayed below]

Lauder Company manufactures and distributes various fixtures used primarily in new building construction. At the

company's Bayside plant, Lauder produces two models of one widely used fixture designated by model names LC-20 and

LC-50. Currently, the Bayside plant uses direct labor-hours to allocate manufacturing overhead costs to products.

The vice president-manufacturing (VP-M) at Lauder has recently been considering updates to the company's costing

systems as a way to ensure that managers had the best information available for decision making. However, rather than

update throughout the entire firm, the VP-M and CFO agreed to test an ABC system. Because of its size and focus, the

Bayside plant was selected for the experiment. An ABC study team, consisting of both plant and corporate employees was

formed to propose an ABC system and compare the product costs with those reported by the current system. Based on

the experiment, the executives at Lauder will decide whether to roll out the new cost system to the entire company.

The study team identified four cost pools into which the manufacturing overhead costs could be grouped. There was a

great deal of discussion about both the pools and the cost drivers. The final system selected consisted of the following

pools and drivers. The costs were based on the forecasts for the coming year.

Cost Pools

Material inspection

Assembly

Equipment setup

Packaging and shipping

Data for production of the two products at the Bayside plant for the coming year of operations follows:

Products

Total direct material costs

Total direct labor costs

Total machine-hours

Costs

$ 396,000

2,210,000

790,000

420,000

Activity Drivers

Direct material cost

Machine-hours

Production runs

Units shipped

$540,000

$ 420,000

92,125

75

240,000

Total number of production runs.

Number of units produced and shipped i

All direct labor at the Bayside plant is paid $35 per hour.

LC-50

$ 180,000

$ 210,000

46,000

50

60,000](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fdd1e6fb3-a3bb-45a5-8140-9e7ea4ef5a8e%2F53403372-cb91-4eed-abd2-2ddee54ff3ec%2F28ivit_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

Problem 9-63 and 9-64 (Static)

[The following information applies to the questions displayed below]

Lauder Company manufactures and distributes various fixtures used primarily in new building construction. At the

company's Bayside plant, Lauder produces two models of one widely used fixture designated by model names LC-20 and

LC-50. Currently, the Bayside plant uses direct labor-hours to allocate manufacturing overhead costs to products.

The vice president-manufacturing (VP-M) at Lauder has recently been considering updates to the company's costing

systems as a way to ensure that managers had the best information available for decision making. However, rather than

update throughout the entire firm, the VP-M and CFO agreed to test an ABC system. Because of its size and focus, the

Bayside plant was selected for the experiment. An ABC study team, consisting of both plant and corporate employees was

formed to propose an ABC system and compare the product costs with those reported by the current system. Based on

the experiment, the executives at Lauder will decide whether to roll out the new cost system to the entire company.

The study team identified four cost pools into which the manufacturing overhead costs could be grouped. There was a

great deal of discussion about both the pools and the cost drivers. The final system selected consisted of the following

pools and drivers. The costs were based on the forecasts for the coming year.

Cost Pools

Material inspection

Assembly

Equipment setup

Packaging and shipping

Data for production of the two products at the Bayside plant for the coming year of operations follows:

Products

Total direct material costs

Total direct labor costs

Total machine-hours

Costs

$ 396,000

2,210,000

790,000

420,000

Activity Drivers

Direct material cost

Machine-hours

Production runs

Units shipped

$540,000

$ 420,000

92,125

75

240,000

Total number of production runs.

Number of units produced and shipped i

All direct labor at the Bayside plant is paid $35 per hour.

LC-50

$ 180,000

$ 210,000

46,000

50

60,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning