Prompt Truck Company is a large trucking company that operates throughout the United States. Prompt Truck Company uses the units-of-production (UOP) method to depreciate its trucks. Prompt Truck Compeny trades in truckS often to keep driver morale high and to maximize fuel economy. Consider these facts about one Mack truck in the company's fleet. When acquired in 20X6, the tractor-trailer rig cost $390,000 and was expected to remain in service for 10 years or 1,000,000 miles. Estimated residual value was $100,000 During 20X6, the truck was driven 78,000 miles, during 20X7, 118,000 miles and during 20XB, 156,000 miles. After 38 000 miles in 20X9, the company traded in the Mack truck for a loss expensive Freightliner with a sticker price of S300,000, Prompt Truck Company paid cash of $27 000 Requirements 1. Determine Prompt's gain or loss on the transaction 2 Prepare the journal entry to record the trade-in of the old truck for the new one. Requirement 1. Determine Prompt's gain or loss on the transaction Begin by determining the formula needed to calculate the gain or loss and then complete the calculation to determine the amount. (Use a minus sign or parentheses for a loss Round depreciation per unit to the nearest cent.) Gain (Loss) on oxchango

Prompt Truck Company is a large trucking company that operates throughout the United States. Prompt Truck Company uses the units-of-production (UOP) method to depreciate its trucks. Prompt Truck Compeny trades in truckS often to keep driver morale high and to maximize fuel economy. Consider these facts about one Mack truck in the company's fleet. When acquired in 20X6, the tractor-trailer rig cost $390,000 and was expected to remain in service for 10 years or 1,000,000 miles. Estimated residual value was $100,000 During 20X6, the truck was driven 78,000 miles, during 20X7, 118,000 miles and during 20XB, 156,000 miles. After 38 000 miles in 20X9, the company traded in the Mack truck for a loss expensive Freightliner with a sticker price of S300,000, Prompt Truck Company paid cash of $27 000 Requirements 1. Determine Prompt's gain or loss on the transaction 2 Prepare the journal entry to record the trade-in of the old truck for the new one. Requirement 1. Determine Prompt's gain or loss on the transaction Begin by determining the formula needed to calculate the gain or loss and then complete the calculation to determine the amount. (Use a minus sign or parentheses for a loss Round depreciation per unit to the nearest cent.) Gain (Loss) on oxchango

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: St. Johns River Shipyards welding machine is 15 years old, fully depreciated, and has no salvage...

Related questions

Question

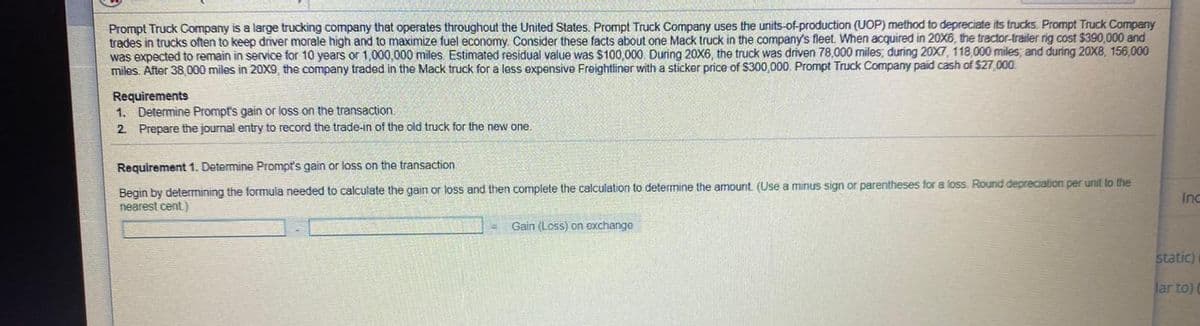

Transcribed Image Text:Prompt Truck Company is a large trucking company that operates throughout the United States. Prompt Truck Company uses the units-of-production (UOP) method to depreciate its trucks. Prompt Truck Company

trades in trucks often to keep driver morale high and to maximize fuel economy. Consider these facts about one Mack truck in the company's fleet, When acquired in 20X6, the tractor-trailer rig cost $390,000 and

was expected to remain in service for 10 years or 1,000,000 miles. Estimated residual value was $100,000. During 20X6, the truck was driven 78,000 miles, during 20X7, 118,000 miles; and during 20X8, 156,000

miles. After 38 000 miles in 20X9, the company traded in the Mack truck for a less expensive Freightliner with a sticker price of S300,000. Prompt Truck Company paid cash of $27,000

Requirements

1. Determine Prompt's gain or loss on the transaction.

2. Prepare the journal entry to record the trade-in of the old truck for the new one.

Requirement 1. Determine Prompt's gain or loss on the transaction

Begin by determining the formula needed to calculate the gain or loss and then complete the calculation to determine the amount. (Use a minus sign or parentheses for a loss. Round depreciation per unit to the

nearest cent)

Inc

Gain (Loss) on exchange

static)

Jar to) (

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning