Question 10 James has an opportunity to buy shares in a start-up company. The shares have a 0.5 chance of being worth 10 and a 0.5 chance of being worth 70 in one year. His utility function is illustrated in the diagram. LAWealth) LAST0) - 140 0.1ASIO)+ 0.BLAST0)- 133 LS40) - 120 0.SUSIO) - 0.SASTO)- LAS26)- 105 LASI0)= 70 10 64 70 Wealtn, $ 26 40 Risk premium Which of the following statements is true? O The risk premium shows that James would buy at any price below 40. O The risk premium shows that James would have negative expected utility if he buys the stock at a price of 40. O At a price of 28 James would be risk neutral O No other answer given here is correct.

Question 10 James has an opportunity to buy shares in a start-up company. The shares have a 0.5 chance of being worth 10 and a 0.5 chance of being worth 70 in one year. His utility function is illustrated in the diagram. LAWealth) LAST0) - 140 0.1ASIO)+ 0.BLAST0)- 133 LS40) - 120 0.SUSIO) - 0.SASTO)- LAS26)- 105 LASI0)= 70 10 64 70 Wealtn, $ 26 40 Risk premium Which of the following statements is true? O The risk premium shows that James would buy at any price below 40. O The risk premium shows that James would have negative expected utility if he buys the stock at a price of 40. O At a price of 28 James would be risk neutral O No other answer given here is correct.

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.7P

Related questions

Question

Pls help with this homework.

Transcribed Image Text:Question 10

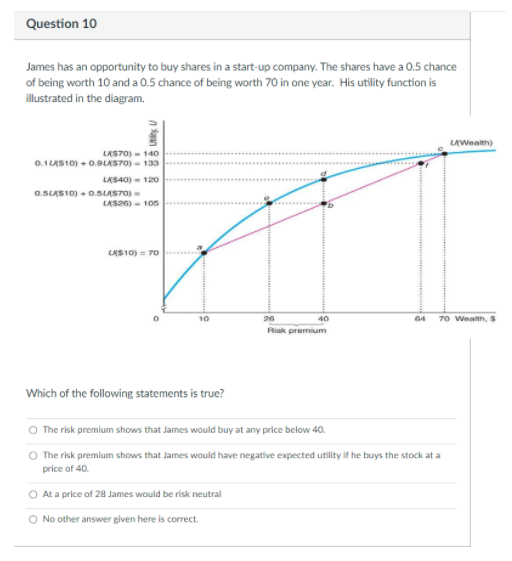

James has an opportunity to buy shares in a start-up company. The shares have a 0.5 chance

of being worth 10 and a 0.5 chance of being worth 70 in one year. His utility function is

illustrated in the diagram.

AWealth)

LAS70) - 140

0.1 USI0) + 0.9LAST0) - 133

LAS40) - 120

0.SUSI0) + 0.5USTO) =

LAS26) - 105

LKS10) = 70

64

70 Wealth, S

10

26

Risk premium

40

Which of the following statements is true?

O The risk premium shows that James would buy at any price below 40.

O The risk premium shows that James would have negative expected utility if he buys the stock at a

price of 40.

O At a price of 28 James would be risk neutral

O No other answer given here is correct.

n an 9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you