Question 14 Blue Haven Computers' sales volume is below its production volume for the month. How will profit margin differ on an absorption costing income statement from profit margin on a variable costing Income statement? Profit margin will be higher on a variable costing income statement. O Profit will be higher on an absorption costing income statement. O Both amounts will be the same. The costs are just located in different sections of the two statements. O It depends on the number of cost pools the company uses to allocate capacity costs.

Question 14 Blue Haven Computers' sales volume is below its production volume for the month. How will profit margin differ on an absorption costing income statement from profit margin on a variable costing Income statement? Profit margin will be higher on a variable costing income statement. O Profit will be higher on an absorption costing income statement. O Both amounts will be the same. The costs are just located in different sections of the two statements. O It depends on the number of cost pools the company uses to allocate capacity costs.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 4CE: Refer to Cornerstone Exercise 18.3. Required: 1. Calculate the cost of each unit using variable...

Related questions

Question

Show your work.

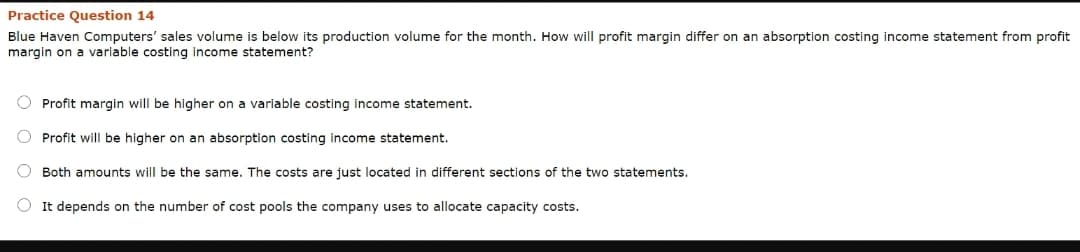

Transcribed Image Text:Practice Question 14

Blue Haven Computers' sales volume is below its production volume for the month. How will profit margin differ on an absorption costing income statement from profit

margin on a variable costing income statement?

O Profit margin will be higher on a variable costing income statement.

Profit will be higher on an absorption costing income statement.

O Both amounts will be the same. The costs are just located in different sections of the two statements.

O It depends on the number of cost pools the company uses to allocate capacity costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning