Concept explainers

Segment variable costing income statement and effect on income of change in operations

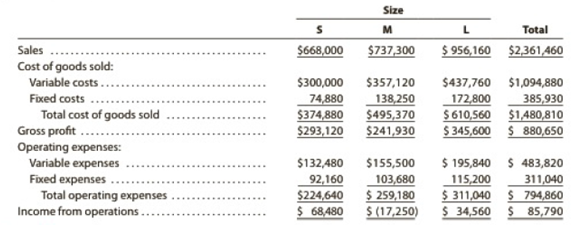

Valdespin Company manufactures three sizes of camping tents—small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used.

If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $46,080 and 532,240. respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of $34,560 for the rental of additional warehouse space would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M.

The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended June 30, 20Y9, is as follows:

Instructions

- 1. Prepare an income statement for the past year in the variable costing: format. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the “Total” column, to determine income from operations.

- 2. Based on the income statement prepared in (1) and the other data presented, determine the amount by which total annual income from operations would be reduced below its present level if Proposal 2 is accepted.

- 3. Prepare an income statement in the variable costing format, indicating the projected annual income from operations if Proposal 3 is accepted. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the “Total” column. For purposes of this problem, the expenditure of $34,560 for the rental of additional warehouse space can be added to the fixed operating expenses.

- 4. By how much would total annual income increase above its present level if Proposal 3 is accepted? Explain.

Trending nowThis is a popular solution!

Chapter 20 Solutions

Financial & Managerial Accounting

- Variable-Costing and Absorption-Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: During the year, Borques produced 200,000 wooden pallets and sold 204,300 at 9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borquess balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? 2. Calculate absorption-costing operating income. 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why? 4. Calculate variable-costing operating income. 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?arrow_forwardEstimated income statements, using absorption and variable costing Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 50,000 units instead of 40,000 units, thus creating an ending inventory of 10,000 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. Prepare an estimated income statement, comparing operating results if 40,000 and 50,000 units are manufactured in (1) the absorption costing format and (2) the variable costing format. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement?arrow_forwardFunctional-Based versus Activity-Based Costing For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermined plantwide rate based on units produced.) Surprisingly, after the addition of the duffel-bag line and the switch to departmental rates, the costs to produce the backpacks increased, and their profitability dropped. Josie, the marketing manager, and Steve, the production manager, both complained about the increase in the production cost of backpacks. Josie was concerned because the increase in unit costs led to pressure to increase the unit price of backpacks. She was resisting this pressure because she was certain that the increase would harm the companys market share. Steve was receiving pressure to cut costs also, yet he was convinced that nothing different was being done in the way the backpacks were produced. After some discussion, the two managers decided that the problem had to be connected to the addition of the duffel-bag line. Upon investigation, they were informed that the only real change in product-costing procedures was in the way overhead costs are assigned. A two-stage procedure was now in use. First, overhead costs are assigned to the two producing departments, Patterns and Finishing. Second, the costs accumulated in the producing departments are assigned to the two products by using direct labor hours as a driver (the rate in each department is based on direct labor hours). The managers were assured that great care was taken to associate overhead costs with individual products. So that they could construct their own example of overhead cost assignment, the controller provided them with the information necessary to show how accounting costs are assigned to products: The controller remarked that the cost of operating the accounting department had doubled with the addition of the new product line. The increase came because of the need to process additional transactions, which had also doubled in number. During the first year of producing duffel bags, the company produced and sold 100,000 backpacks and 25,000 duffel bags. The 100,000 backpacks matched the prior years output for that product. Required: (Note: Round rates and unit cost to the nearest cent.) 1. CONCEPTUAL CONNECTION Compute the amount of accounting cost assigned to a backpack before the duffel-bag line was added by using a plantwide rate approach based on units produced. Is this assignment accurate? Explain. 2. Suppose that the company decided to assign the accounting costs directly to the product lines by using the number of transactions as the activity driver. What is the accounting cost per unit of backpacks? Per unit of duffel bags? 3. Compute the amount of accounting cost assigned to each backpack and duffel bag by using departmental rates based on direct labor hours. 4. CONCEPTUAL CONNECTION Which way of assigning overhead does the best jobthe functional-based approach by using departmental rates or the activity-based approach by using transactions processed for each product? Explain. Discuss the value of ABC before the duffel-bag line was added.arrow_forward

- Grand Canyon Manufacturing Inc. produces and sells a product with a price of 100 per unit. The following cost data have been prepared for its estimated upper and lower limits of activity: Overhead: Selling and administrative expenses: Required: 1. Classify each cost element as either variable, fixed, or semi-variable. (Hint: Recall that variable expenses must go up in direct proportion to changes in the volume of activity.) 2. Calculate the break-even point in units and dollars. (Hint: First use the high-low method illustrated in Chapter 4 to separate costs into their fixed and variable components.) 3. Prepare a break-even chart. 4. Prepare a contribution income statement, similar in format to the statement appearing on page 540, assuming sales of 5,000 units. 5. Recompute the break-even point in units, assuming that variable costs increase by 20% and fixed costs are reduced by 50,000.arrow_forwardVariable and Fixed Costs, Cost Formula, High-Low Method Li Ming Yuan and Tiffany Shaden are the department heads for the accounting department and human resources department, respectively, at a large textile firm in the southern United States. They have just returned from an executive meeting at which the necessity of cutting costs and gaining efficiency has been stressed. After talking with Tiffany and some of her staff members, as well as his own staff members, Li Ming discovered that there were a number of costs associated with the claims processing activity. These costs included the salaries of the two paralegals who worked full time on claims processing, the salary of the accountant who cut the checks, the cost of claims forms, checks, envelopes, and postage, and depreciation on the office equipment dedicated to the processing. Some of the paralegals time appears to vary with the routine processing of uncontested claims, but considerable time also appears to be spent on the claims that have incomplete documentation or are contested. The accountants time appears to vary with the number of claims processed. Li Ming was able to separate the costs of processing claims from the costs of running the departments of accounting and human resources. He gathered the data on claims processing cost and the number of claims processed per month for the past 6 months. These data are as follows: Required: 1. Classify the claims processing costs that Li Ming identified as variable and fixed. 2. What is the independent variable? The dependent variable? 3. Use the high-low method to find the fixed cost per month and the variable rate. What is the cost formula? 4. CONCEPTUAL CONNECTION Suppose that an outside company bids on the claims processing business. The bid price is 4.60 per claim. If Tiffany expects 75,600 claims next year, should she outsource the claims processing or continue to do it in-house?arrow_forwardCost-Volume-Profit, Margin of Safety Victoria Company produces a single product. Last years income statement is as follows: Required: 1. Compute the break-even point in units and sales dollars calculated using the break-even units. 2. What was the margin of safety for Victoria last year in sales dollars? 3. Suppose that Victoria is considering an investment in new technology that will increase fixed cost by 250,000 per year but will lower variable costs to 45% of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming that Victoria makes this investment. What is the new break-even point in sales dollars, assuming that the investment is made?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning