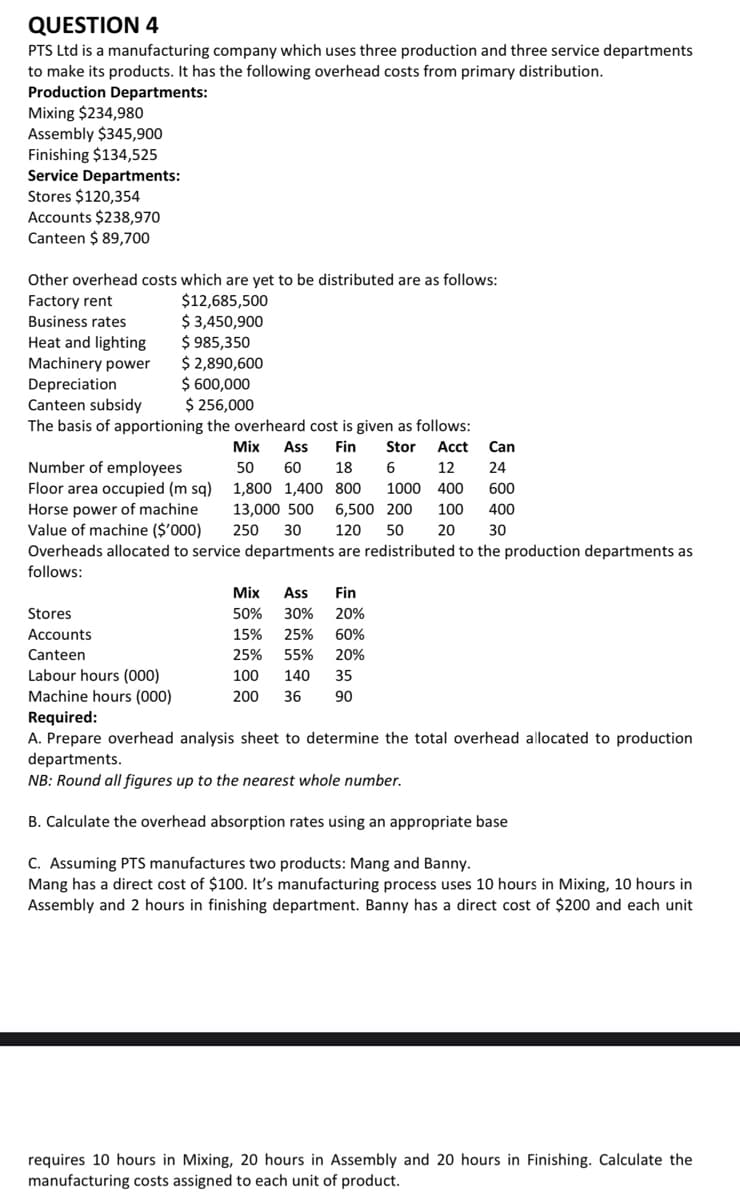

QUESTION 4 PTS Ltd is a manufacturing company which uses three production and three service departments to make its products. It has the following overhead costs from primary distribution. Production Departments: Mixing $234,980 Assembly $345,900 Finishing $134,525 Service Departments: Stores $120,354 Accounts $238,970 Canteen $ 89,700 Other overhead costs which are yet to be distributed are as follows: $12,685,500 $ 3,450,900 $ 985,350 $ 2,890,600 $ 600,000 $ 256,000 The basis of apportioning the overheard cost is given as follows: Factory rent Business rates Heat and lighting Machinery power Depreciation Canteen subsidy Mix Ass Fin Stor Acct Can Number of employees 50 60 18 6. 12 24 Floor area occupied (m sq) 1,800 1,400 800 1000 400 600 Horse power of machine Value of machine ($'000) Overheads allocated to service departments are redistributed to the production departments as 13,000 500 6,500 200 100 400 250 30 120 50 20 30 follows: Мix Ass Fin Stores 50% 30% 20% Accounts 15% 25% 60% Canteen 25% 55% 20% Labour hours (000) Machine hours (000) Required: A. Prepare overhead analysis sheet to determine the total overhead allocated to production departments. NB: Round all figures up to the nearest whole number. 100 140 35 200 36 90 B. Calculate the overhead absorption rates using an appropriate base C. Assuming PTS manufactures two products: Mang and Banny. Mang has Assembly and 2 hours in finishing department. Banny has a direct cost of $200 and each unit direct cost of $100. It's ma uring process uses 10 hours ixing, 10 hours in requires 10 hours in Mixing, 20 hours in Assembly and 20 hours in Finishing. Calculate the manufacturing costs assigned to each unit of product.

QUESTION 4 PTS Ltd is a manufacturing company which uses three production and three service departments to make its products. It has the following overhead costs from primary distribution. Production Departments: Mixing $234,980 Assembly $345,900 Finishing $134,525 Service Departments: Stores $120,354 Accounts $238,970 Canteen $ 89,700 Other overhead costs which are yet to be distributed are as follows: $12,685,500 $ 3,450,900 $ 985,350 $ 2,890,600 $ 600,000 $ 256,000 The basis of apportioning the overheard cost is given as follows: Factory rent Business rates Heat and lighting Machinery power Depreciation Canteen subsidy Mix Ass Fin Stor Acct Can Number of employees 50 60 18 6. 12 24 Floor area occupied (m sq) 1,800 1,400 800 1000 400 600 Horse power of machine Value of machine ($'000) Overheads allocated to service departments are redistributed to the production departments as 13,000 500 6,500 200 100 400 250 30 120 50 20 30 follows: Мix Ass Fin Stores 50% 30% 20% Accounts 15% 25% 60% Canteen 25% 55% 20% Labour hours (000) Machine hours (000) Required: A. Prepare overhead analysis sheet to determine the total overhead allocated to production departments. NB: Round all figures up to the nearest whole number. 100 140 35 200 36 90 B. Calculate the overhead absorption rates using an appropriate base C. Assuming PTS manufactures two products: Mang and Banny. Mang has Assembly and 2 hours in finishing department. Banny has a direct cost of $200 and each unit direct cost of $100. It's ma uring process uses 10 hours ixing, 10 hours in requires 10 hours in Mixing, 20 hours in Assembly and 20 hours in Finishing. Calculate the manufacturing costs assigned to each unit of product.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter10: Accounting Systems For Manufacturing Operations

Section: Chapter Questions

Problem 10.4.3C: Factory overhead rate Fabricator Inc., a specialized equipment manufacturer, uses a job order cost...

Related questions

Question

100%

Transcribed Image Text:QUESTION 4

PTS Ltd is a manufacturing company which uses three production and three service departments

to make its products. It has the following overhead costs from primary distribution.

Production Departments:

Mixing $234,980

Assembly $345,900

Finishing $134,525

Service Departments:

Stores $120,354

Accounts $238,970

Canteen $ 89,700

Other overhead costs which are yet to be distributed are as follows:

$12,685,500

$ 3,450,900

$ 985,350

$ 2,890,600

$ 600,000

$ 256,000

The basis of apportioning the overheard cost is given as follows:

Factory rent

Business rates

Heat and lighting

Machinery power

Depreciation

Canteen subsidy

Mix

Ass

Fin

Stor

Acct

Can

Number of employees

Floor area occupied (m sq) 1,800 1,400 800

50

60

18

6.

12

24

1000

400

600

Horse power of machine

Value of machine ($'000)

13,000 500

6,500 200

100

400

250

30

120

50

20

30

Overheads allocated to service departments are redistributed to the production departments as

follows:

Мix

Ass

Fin

Stores

50%

30%

20%

Accounts

15%

25%

60%

Canteen

25%

55%

20%

Labour hours (000)

Machine hours (000)

100

140

35

200

36

90

Required:

A. Prepare overhead analysis sheet to determine the total overhead allocated to production

departments.

NB: Round all figures up to the nearest whole number.

B. Calculate the overhead absorption rates using an appropriate base

C. Assuming PTS manufactures two products: Mang and Banny.

Mang has a direct cost of $100. It's manufacturing process uses 10 hours in Mixing, 10 hours in

Assembly and 2 hours in finishing department. Banny has a direct cost of $200 and each unit

requires 10 hours in Mixing, 20 hours in Assembly and 20 hours in Finishing. Calculate the

manufacturing costs assigned to each unit of product.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning