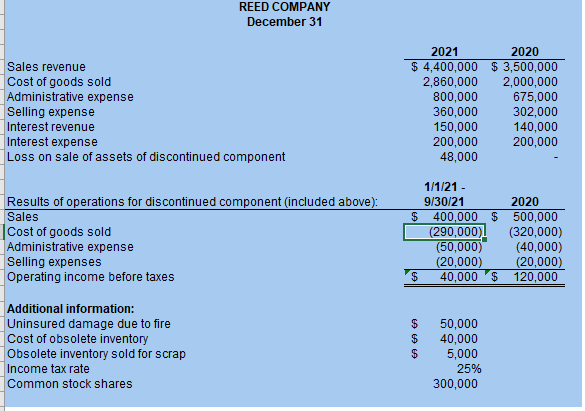

REED COMPANY December 31 2021 $ 4,400,000 $ 3,500,000 2,860,000 800,000 360,000 150,000 200,000 48,000 2020 Sales revenue Cost of goods sold Administrative expense Selling expense nterest revenue nterest expense Loss on sale of assets of discontinued component 2,000,000 675,000 302,000 140,000 200,000 Results of operations for discontinued component (included above): Sales Cost of goods sold Administrative expense Selling expenses Operating income before taxes 1/1/21 - 9/30/21 400,000 $ 500,000 (290,000) (50,000) (20,000) s. 2020 (320,000) (40,000) (20,000) 40,000 's 120,000 Additional information: Uninsured damage due to fire Cost of obsolete inventory Obsolete inventory sold for scrap ncome tax rate Common stock shares 50,000 40,000 5,000 25% 300,000 SSS

REED COMPANY December 31 2021 $ 4,400,000 $ 3,500,000 2,860,000 800,000 360,000 150,000 200,000 48,000 2020 Sales revenue Cost of goods sold Administrative expense Selling expense nterest revenue nterest expense Loss on sale of assets of discontinued component 2,000,000 675,000 302,000 140,000 200,000 Results of operations for discontinued component (included above): Sales Cost of goods sold Administrative expense Selling expenses Operating income before taxes 1/1/21 - 9/30/21 400,000 $ 500,000 (290,000) (50,000) (20,000) s. 2020 (320,000) (40,000) (20,000) 40,000 's 120,000 Additional information: Uninsured damage due to fire Cost of obsolete inventory Obsolete inventory sold for scrap ncome tax rate Common stock shares 50,000 40,000 5,000 25% 300,000 SSS

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

I need the comparative income statement, it is incomplete but that is the format.

Transcribed Image Text:REED COMPANY

December 31

2021

2020

$ 4,400,000 S$ 3,500,000

2,000,000

675,000

302,000

140,000

200,000

Sales revenue

Cost of goods sold

Administrative expense

Selling expense

Interest revenue

|Interest expense

|Loss on sale of assets of discontinued component

2,860,000

800,000

360,000

150,000

200,000

48,000

1/1/21 -

Results of operations for discontinued component (included above):

Sales

9/30/21

2020

Cost of goods sold

Administrative expense

Selling expenses

Operating income before taxes

400,000 $ 500,000

(290,000)

(50,000)

(20,000)

$.

(320,000)

(40,000)

(20,000)

40,000 '$ 120,000

Additional information:

Uninsured damage due to fire

Cost of obsolete inventory

Obsolete inventory sold for scrap

50,000

40,000

5,000

Income tax rate

Common stock shares

25%

300,000

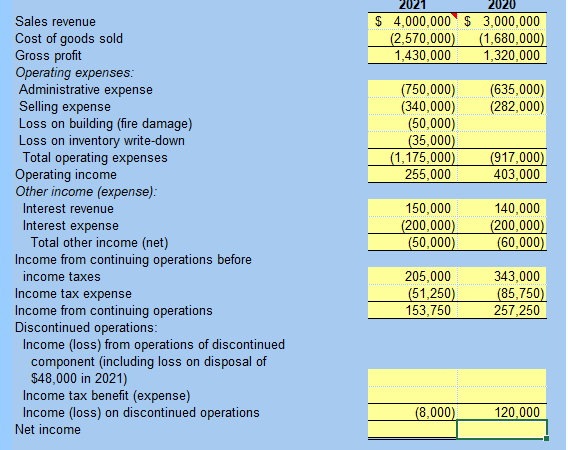

Transcribed Image Text:2021

2020

$ 4,000,000 S 3,000,000

(2,570,000)

1,430,000

Sales revenue

Cost of goods sold

Gross profit

Operating expenses:

Administrative expense

Selling expense

Loss on building (fire damage)

Loss on inventory write-down

Total operating expenses

Operating income

Other income (expense):

(1,680,000)

1,320,000

(635,000)

(282,000)

(750,000)

(340,000)

(50,000)

(35,000)

(1,175,000)

255,000

(917,000)

403,000

Interest revenue

150,000

140,000

Interest expense

Total other income (net)

Income from continuing operations before

(200,000)

(50,000)

(200,000)

(60,000)

343,000

(85,750)

257,250

income taxes

205,000

Income tax expense

Income from continuing operations

Discontinued operations:

Income (loss) from operations of discontinued

component (including loss on disposal of

$48,000 in 2021)

Income tax benefit (expense)

Income (loss) on discontinued operations

(51,250)

153,750

(8,000)

120,000

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning