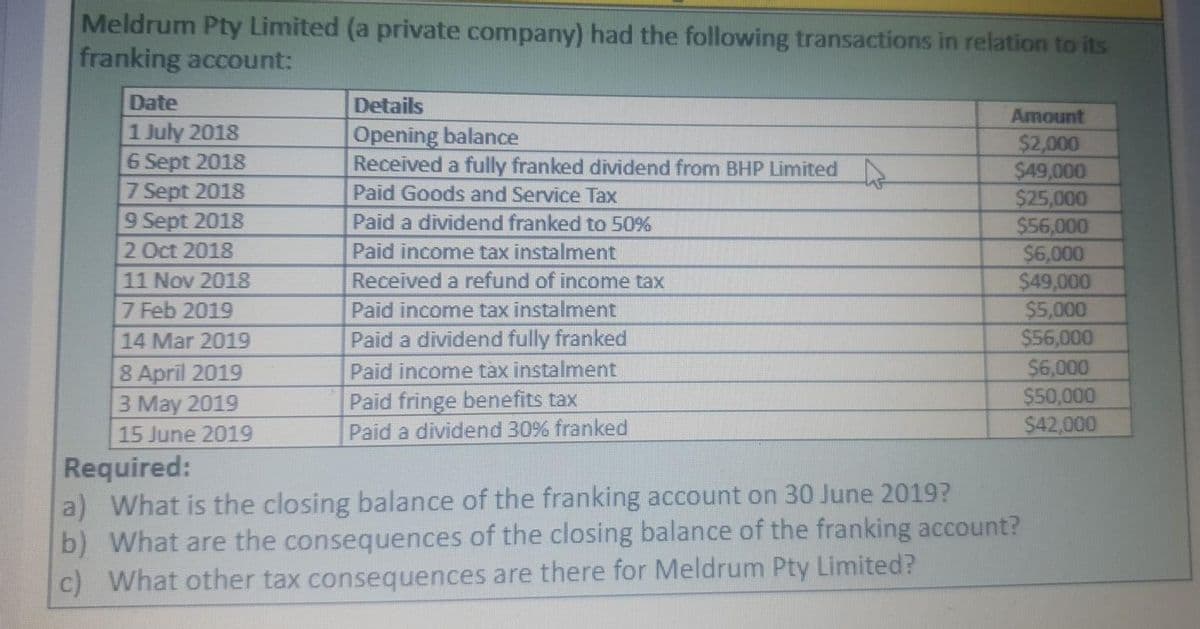

Required: a) What is the closing balance of the franking account on 30 June 2019? 5) What are the consequences of the closing balance of the franking account? -- What other tax consequences are there for Meldrum Pty Limited?

Q: Denmark Torralba did not file his income tax return for the calendar year 2022 which was due for…

A: A tax is generally defined as a mandatory expense that is imposed on the income of particular…

Q: Explain to Daniel how the date of commencement of his business is determined and what tax…

A: Here given the details of commencement of business which can be influence in taxation affairs and…

Q: The differences between the book basis and tax basis of the assets and liabilities of Castle…

A: Requirement a: Prepare the journal entry to record income tax expense, deferred income taxes, and…

Q: X wishes to file his 2019 income tax return. To avoid penalty, he must file his return on or before:…

A: For individuals, income tax return filing due date when their financial year ends on December 31 is…

Q: Compute the total income tax due on the income of Carding in 2021.

A: It has been given in the question that Carding has opted at the beginning of the year to use 8% tax…

Q: Required Compute the tax payable by Mr Bo Kau Looi for the year of assessment 2021.

A: Introduction: Your tax obligation refers to the amount of money you owe to taxing authorities such…

Q: In 2021, a company performed service for the customers. It will receive payments from the customers…

A: Deferred tax refers to the tax on the timing difference arrives due to difference in carrying amount…

Q: a) Explain what a temporary difference is and why it attracts deferred tax

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: How are payments of alimony and separate maintenance under agreements and modifications finalized…

A: Alimony Payment - It is a payment between current or former spouses as the result of a marriage…

Q: GYV Ltd has the following deferred tax balances as at 30 June 2019. Deferred tax asset $900000…

A: Deferred Tax asset: Deferred tax asset is an assets that results from overpayment or advance payment…

Q: What would be the balance of the deferred tax asset or deferred tax liability as at 30 June 2022

A:

Q: ____________ is the return filing deadline for an individual taxpayer who has no self-employment or…

A: Every Taxpayer should submit the details of its income through filling the return and should also…

Q: What are the tax ramifications if section 179 is used to depreciate the total amount of an asset…

A: Introduction Section 179 allows immediate expense deduction businesses for purchase of depreciable…

Q: Based on Problem 3, assuming Nelia was promoted on June 2018, and starting the same month was given…

A: In the given question, Nelia was promoted in June 2018 and she has given a raise and thereby she…

Q: If a taxable temporary difference originates in 2020, it will cause taxable income for 2020 to be…

A: ●(D.) If a taxable temporary difference originates in 2020, it will cause taxable income for 2020 to…

Q: Larkspur Corporation has one temporary difference at the end of 2020 that will reverse and cause…

A: Deferred tax Assets/liability: A deferred tax asset is created from overpayment or advance payment…

Q: ! Required information [The following information applies to the questions displayed below.] Henrich…

A: The following points need to be calculated: Income Tax Net Investment Income Tax Total Tax

Q: For each item listed below, indicate whether it involves a: a. permanent…

A: PLEASE LIKE THE ANSWER, YOUR RESPONSE MATTERS The items should be matched as follows: b 1…

Q: 27. Mr. Gusion filed his 2019 income tax return and paid the tax shown thereon in the amount of…

A: Income tax: Tax collected by the central government of the country on the income generated by the…

Q: On a 2021 tax return, how, if at all, would you recover the cost you pay for a noncompete agreement…

A: Sec 179 deals with provisions relating to the immediate deduction of business expenses related to…

Q: Compute for the Income Tax Due and Payable for taxable year ended December 31, 2020 assuming that…

A: Income tax: Fees charged on the taxable income of the individual and the corporates by the…

Q: Complete the following statements by filling in the blanks. A. In a period in which a taxable…

A: As per the guidelines, only three subparts are allowed to be solved. Please resubmit the remaining…

Q: What is the amount of income tax payable for 2019? What is the company's financial income subject…

A: Solution Concept Financial income is the income as per the income statement prepared by the company…

Q: What is the deadline by which a c corporation must file a tax return

A: Generally, an organization must file its tax return by the 15th day of the fourth month after the…

Q: ABC SAOG is a taxable entity in Oman. The business incurred General expense of OMR 12,500 during the…

A: Deductible expenses are the expenses which are allowed as deduction from gross income. It reduces…

Q: Which of the following statements is/are correct? A. A minimum corporate income tax (MCIT) of 1% of…

A: Gross Pay- Gross pay is the total amount paid to employees by an employer before any deductions. In…

Q: d. If a taxable temporary difference originates in 2022, it will cause taxable income for 2022 to…

A: Disclaimer:- Hence it is a multipart question we can answer only first three part. If you want…

Q: A taxpayer has unutilized or excess Creditable Withholding Taxes (CWT) for the taxable year 2019.…

A: Withhold taxes The term withhold taxes which can be described as portion of amount which can be…

Q: Which of the following is not correct regarding the NOLCO? NOLCO is allowed as deduction from…

A: Income Tax- The federal, state, and local governments levy taxes on the gross income of individuals…

Q: Required: For the taxation year ending December 31, 2020, calculate the maximum CCA that can be…

A: CCA- The capital cost allowance, that is the deduction allowed by the taxation authorities of Canada…

Q: In 2021, a company accrued salaries expense. It will make the payment in 2022. At the end of 2021,…

A: A company accrued salaries expenses therefore they are liable to pay it in the future.

Q: At December 31, 2018 PT ABC reported a deferred tax liability of Rp90.000 which was attributable to…

A: please like the answer your resp[onse matters Income tax expense = Rp300,000 * (0.4-0.3) =Rp30,000

Q: Which of the following statements regarding the home mortgage interest expense deduction is false…

A: The question is related home mortgage interest expenses deduction. As per Internal Revenue Service…

Q: i and Ali to apply for the tax return of three months. Is it correct? If not, then sp

A: A tax deduction is declared by the taxable assessee for which the tax is being determined and he…

Q: Required (a) Calculate the current and deferred tax of Bright Star Ltd for each year, 2018 and 2019…

A:

Q: . A taxpayer forgot to file and pay his annual income tax return for the year 2019. He only recalled…

A: For computing interest the days of delinquency begin from the date when the tax return is to be…

Q: (a) Calculate the current and deferred tax of Bright Star Ltd for each year, 2018 and 2019 (b)…

A: (a) Formulation Computation

Q: At December 31, 2018 AP Corporation had a deferred tax liability of P250, 000. At December 31, 2019,…

A: Income tax expense is the obligation for the tax payers to pay the tax to the government authorities…

Q: Using the information from BE19.2, assume this is the only difference between Oxford's pretax…

A: Prepare journal entry to record the income tax expense, deferred income taxes, and income taxes…

Q: Question 1: A new client, Mary, is your first client. She needs to lodge his income tax for 2021/22.…

A: Many of the funds received by your organization will be taxable. Assessable income is defined as any…

Q: c. Assuming the $160,000 NOL carryover originated in 2020 and WCC elected to not carry back the…

A: NOL is an acronym of net operating loss which is the loss which has taken place in order words the…

Q: Jennings Inc. reported the following pretax income (loss) and related tax rates during the years…

A: Journal entries are the foundation of bookkeeping that helps in building a base for the preparation…

Q: Calculate the current and deferred tax of Bright Star Ltd for each year, 2018 and 2019 b. Prepare…

A: Step 1 Journal is the part of book keeping.

Q: Required: Determine the tax effect of the transactions that took place during 2020 and 2021 on Mr.…

A: At the time of exercise : When the employee has exercised the option, (agreed to buy) : the…

Q: d. If a taxable temporary difference originates in 2022, it will cause taxable income for 2022 to be…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: GYV Ltd has the following deferred tax balances as at 30 June 2019. Deferred tax asset $9 00 000…

A: Deferred tax assets and liabilities must be based on expected future tax rates - Generally, assume…

Q: December 31, 2021, ABC has earned financial income before tax of P3,240,850. The tax rate applicable…

A: Depreciation under financial accounting as per straight line method =(cost of the asset - salvage…

Q: Question No. 2: Ali and Ali enterprise filed the return on June 30th 2019. The entity applies for…

A: Ali and Ali enterprise filed a return on 30.06.2019 Entity applies for special tax year i.e., from…

Step by step

Solved in 2 steps

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Meldrum Pty Limited (a private company) had the following transactions in relation to its franking account: DateDetailsAmount1 July 2018Opening balance$2,0006 Sept 2018Received a fully franked dividend from BHP Limited$49,0007 Sept 2018Paid Goods and Service Tax$25,0009 Sept 2018Paid a dividend franked to 50%$56,0002 Oct 2018Paid income tax instalment$6,00011 Nov 2018Received a refund of income tax$49,0007 Feb 2019Paid income tax instalment$5,00014 Mar 2019Paid a dividend fully franked$56,0008 April 2019Paid income tax instalment$6,0003 May 2019Paid fringe benefits tax$50,00015 June 2019Paid a dividend 30% franked$42,000Required: (a)What is the closing balance of the franking account on 30 June 2019? (b)What are the consequences of the closing balance of the franking account? (c)What other tax consequences are there for Meldrum Pty Ltd? 3 / 3 125%

- Zoo Company began operations on January 1, 2024 with a P1,500,000 from the issuance of shares and borrowed funds of P500,000. P300,000 worth of equipment was acquired out of the initial investment. At the end of the accounting year, the company reported a net income of P400,000, and Zoo declared a P100,000 cash dividend on December 19, 2024. No additional transactions affected the owner’s equity in2024. On December 31, 2024, liabilities of the company had increased to P700,000. InZoo’s December 31, 2024 statement of financial position, how much should be reported as its total assets?Dwani Ltd acquired all the issued shares (cum div.) of Power Ltd for $653 000 on 1 January 2022. At that date, the equity of Power Ltd was recorded as follows. Share capital $ 400 000 General reserve 88 000 Retained earnings 90 000 On 1 January 2022, the records of Power Ltd showed that the company had previously recorded a goodwill at cost of $15 000. Further, Power Ltd had a dividend payable of $25 000, the dividend to be paid in March 2022. All other assets and liabilities were carried at amounts equal to their fair values at the acquisition date, except some inventories recorded at $20 000 below their fair value. Also, Dwani ltd identified at the acquisition date a patent with a fair value of $45 000 that Power Ltd has not recorded in its own accounts. Required Prepare the acquisition analysis on 1 January 2022. Prepare the consolidation worksheet entries for Dwani Ltd’s group on 1 January 2022.…Andreas Company purchased 30% of the outstanding shares of Rafif Company for $400.000 on January 2, 2023. Information relatedto Rafif's equity position and performance during 2023 is as follows: 02-Jan-23 03-Jan-23 $2.100.000 Retained Earnings $2.900.000 Rafif Company’s Total Equity $5.000.000 20-Jul Rafif Companyannounced and paid a cash dividend of $80.000 05-Oct-23 Rafif Companyannounced and paid a cash dividend of $40.000 31-Dec 2023 Rafif Company reported net income of $650.000 for the year 31-Dec 2023 Rafif Company shares have a market valueof $180 per share Required: Prepare journal entry(ies) needed by Andreas Company to record the investment in Rafif Company from the acquisition date until December 31, 2023, if: The investment has significant influence The investment has insignificant influence and classified as OCI

- Blue Horizon pty Ltd, a resident company that was formed in 2009, has a 31 March financial year-end. The company distributed the following amounts/assets to its sole shareholder, Mr. Asmal, on 1 December 2022: - A cash distribution of R1 100 000; - An in specie distribution of trading stock with a market value of R600 000 (trading stock was acquired on 1 April 2022 at a cost price of R400 000); and - An in specie distribution of a building with a market value of R1 600 000 (the building was acquired on 15 June 2015 for R1 200 000 - the building did not qualify for any capital allowances) - The applicable company tax rate and dividend tax rate is 28% and 20% respectively. REQUIRED: 1 Calculate the normal tax consequences arising from the above distributions for Blue Horizon pty Ltd’s 2023 year of assessment. 2 Calculate the amount of dividends tax that Blue Horizon Ltd. is liable for.On 1 July 2019, ABC Ltd took control of the assets and liabilities of PQR Ltd. At this date the statement of financial position of PQR Ltd was as follows:Carrying AmountFair ValueMachinery$40 000$57 000Fixtures & fittings60 00078 000Vehicles35 00045 000Current assets10 00022 000Current liabilities(16 000)(19 000)Total net assets$129 000Share capital (80 000 shares at $1.00 per share)80 000General reserve20 000Retained earnings29 000Total equity$129 000REQUIRED:Prepare the acquisition analysis in the records of ABC Ltd at 1 July 2019 in the following situations, assuming the costs of issuing the shares by ABC Ltd cost $2600:a. ABC Ltd issued 80 000 shares having a fair value of $2.50 per share in exchange for the net assets of PQR Ltdb. ABC Ltd acquired the shares of PQR Ltd. The agreement was that ABC Ltd would pay the shareholders of PQR Ltd one share in ABC Ltd for every two shares held in PQR Ltd plus $1 in cash for each share held in PQR Ltd. Shares…Agustin Company has the following transactions relating to its investments during 2022. January 5 - Acquired 10,000 shares of Abalos Company for P1,000,000 paying additional P20,000 for brokerage fee and another P5,000 for commission. Received dividends from Abalos declared January 2, 2022 to stockholders of record January 10, 2022, P20,000. How much should the investment account be debited if the shares are held for trading?

- Sehat (Pty) Ltd, a resident company that was formed in 2005, has a 31 March financial year-end. The company distributed the following amounts/assets to its sole shareholder, Mr Ahmed, on 1 July 2021: a cash distribution of R1 000 000; an in specie distribution of trading stock with a market value of R500 000 (the trading stock was acquired on 10 April 2021 at a cost price of R300 000); and an in specie distribution of a building with a market value of R1 500 000 (the building was acquired on 12 July 2008 for R1 200 000; the building did not qualify for any capital allowances). YOU ARE REQUIRED TO: 1. Calculate the normal tax consequences arising from the above distributions for Sehari (Pty) Ltd’s 2022 year of assessment. 2. Calculate the amount of dividends tax that Sehari (Pty) Ltd is obliged to pay over to SARS.Midway (Pty) Ltd, a resident company that was formed in 2005, has a 31 March financial year-end. The company distributed the following amounts/assets to its sole shareholder, Shezi, on 1 July 2021: a cash distribution of R1 000 000; an in specie distribution of trading stock with a market value of R500 000 (the trading stock was acquired on 10 April 2021 at a cost price of R300 000); and an in specie distribution of a building with a market value of R1 500 000 (the building was acquired on 12 July 2008 for R1 200 000; the building did not qualify for any capital allowances).YOU ARE REQUIRED TO:3.1. Calculate the normal tax consequences arising from the above distributions for Midway(Pty) Ltd’s 2022 year of assessment. 3.2. Calculate the amount of dividends tax that Midway (Pty) Ltd is obliged to pay over to SARS.On July 1, 2018, Brigham Corporation purchased Young Company by paying Tk.1,50,000 cash and issuing a Tk.1,00,000 note payable to Mr. Young. At July 1, 2018,the balance sheet of the company was as follows:Cash Tk.50,000 Accounts payable Tk.2,00,000Accounts Receivable Tk.90,000 Stockholders’ equity Tk.2,35,000Inventory Tk.1,00,000 Tk.4,35,000Land Tk.40,000Building Tk.75,000Equipment Tk.70,000Trademark Tk.10,000Tk.4,35,000The recorded amounts all approximate current values except for land (fair value Tk.60,000),Inventory (fair value Tk.1,25,000) and trademark (fair value Tk.15,000),Requirements:i) Prepare the July 1 entry for Brigham Corporation to record the purchase.ii) Prepare the December 31, entry for Brigham Corporation to record amortization ofintangible assets. The trademark has an estimated useful life of 5 years with a residualvalue of Tk. 5000.