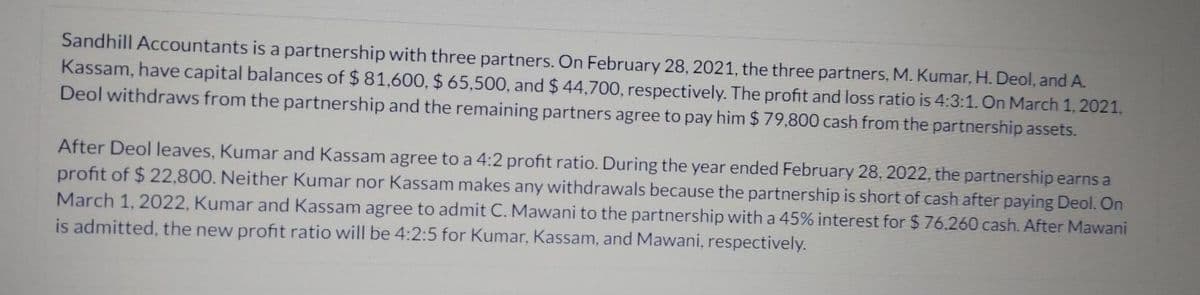

Sandhill Accountants is a partnership with three partners. On February 28, 2021, the three partners, M. Kumar, H. Deol, and A. Kassam, have capital balances of $ 81,600, $ 65,500, and $ 44,700, respectively. The profit and loss ratio is 4:3:1. On March 1, 2021, Deol withdraws from the partnership and the remaining partners agree to pay him $ 79,800 cash from the partnership assets. After Deol leaves, Kumar and Kassam agree to a 4:2 profit ratio. During the year ended February 28, 2022, the partnership earns a profit of $ 22,800. Neither Kumar nor Kassam makes any withdrawals because the partnership is short of cash after paying Deol. On March 1, 2022, Kumar and Kassam agree to admit C. Mawani to the partnership with a 45% interest for $ 76.260 cash. After Mawani is admitted, the new profit ratio will be 4:2:5 for Kumar, Kassam, and Mawani, respectively.

Sandhill Accountants is a partnership with three partners. On February 28, 2021, the three partners, M. Kumar, H. Deol, and A. Kassam, have capital balances of $ 81,600, $ 65,500, and $ 44,700, respectively. The profit and loss ratio is 4:3:1. On March 1, 2021, Deol withdraws from the partnership and the remaining partners agree to pay him $ 79,800 cash from the partnership assets. After Deol leaves, Kumar and Kassam agree to a 4:2 profit ratio. During the year ended February 28, 2022, the partnership earns a profit of $ 22,800. Neither Kumar nor Kassam makes any withdrawals because the partnership is short of cash after paying Deol. On March 1, 2022, Kumar and Kassam agree to admit C. Mawani to the partnership with a 45% interest for $ 76.260 cash. After Mawani is admitted, the new profit ratio will be 4:2:5 for Kumar, Kassam, and Mawani, respectively.

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

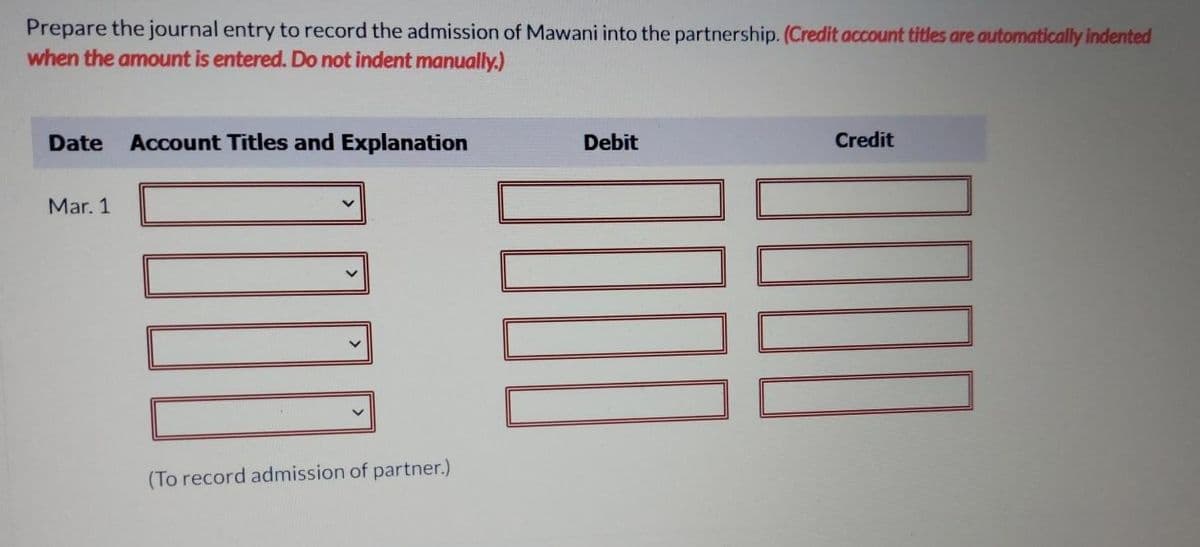

Transcribed Image Text:Prepare the journal entry to record the admission of Mawani into the partnership. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

Mar. 1

(To record admission of partner.)

Transcribed Image Text:Sandhill Accountants is a partnership with three partners. On February 28, 2021, the three partners, M. Kumar, H. Deol, and A.

Kassam, have capital balances of $ 81,600, $ 65,500, and $ 44,700, respectively. The profit and loss ratio is 4:3:1. On March 1, 2021,

Deol withdraws from the partnership and the remaining partners agree to pay him $79,800 cash from the partnership assets.

After Deol leaves, Kumar and Kassam agree to a 4:2 profit ratio. During the year ended February 28, 2022, the partnership earns a

profit of $ 22,800. Neither Kumar nor Kassam makes any withdrawals because the partnership is short of cash after paying Deol. On

March 1, 2022, Kumar and Kassam agree to admit C. Mawani to the partnership with a 45% interest for $ 76.260 cash. After Mawani

is admitted, the new profit ratio will be 4:2:5 for Kumar, Kassam, and Mawani, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you